You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Biden doesn't want to fight for 50,000 student loan relief. It's too hard

- Thread starter 850credit

- Start date

Biden needs to stop fucking around and sign an executive order

Maybe that's there next move if all else fails.

It would be funny if that occurred and the executive order goes even further with forgiveness than the original plan does

I wishMaybe that's there next move if all else fails.

It would be funny if that occurred and the executive order goes even further with forgiveness than the original plan does

Unless it's multimillionaires or billionaires who are getting the "free" money in which case they're all for it

I remember only a few years ago here in New York State they began legislation to raise the states minimum wage and also raise the pay of restaurant/fast food workers up to $15-$16 before the minimum wage was raised.

Regular, everyday average people were livid at the thought of people actually being paid more money even though they would still only be slightly above the poverty line.

So true and so stupid.

Biden needs to stop fucking around and sign an executive order

He did. That's what this plan is. And the courts have overturned it.

Biden's student loan forgiveness plan faces challenge in federal court

President Biden's executive order to cancel student debt is facing its most serious legal challenge to date. A federal judge in Missouri heard arguments from six states hoping to block the plan from taking effect. White House Correspondent Laura Barrón-López has been following it all and reports...

President Biden's executive order to cancel student debt is facing its most serious legal challenge to date.

He did. That's what this plan is. And the courts have overturned it.

Biden's student loan forgiveness plan faces challenge in federal court

President Biden's executive order to cancel student debt is facing its most serious legal challenge to date. A federal judge in Missouri heard arguments from six states hoping to block the plan from taking effect. White House Correspondent Laura Barrón-López has been following it all and reports...www.pbs.org

I think he means a far more extensive executive order which completely wipes out all debt.

I wonder if the Biden administration's attempts to do this using previous legal precedents is what is being used against them ironically.

^^^^I think he means a far more extensive executive order which completely wipes out all debt.

I wonder if the Biden administration's attempts to do this using previous legal precedents is what is being used against them ironically.

I think he means a far more extensive executive order which completely wipes out all debt.

I wonder if the Biden administration's attempts to do this using previous legal precedents is what is being used against them ironically.

^^^^

The same courts that are overturning this executive order would overturn one that goes further. I mean if the courts say an executive order that eliminates SOME debt is illegal, why would they say one that eliminates ALL debt is fine?

Wifey just got 200K worth of students loans eliminated as of today. Thank you Biden!

how... brah...

how... brah...

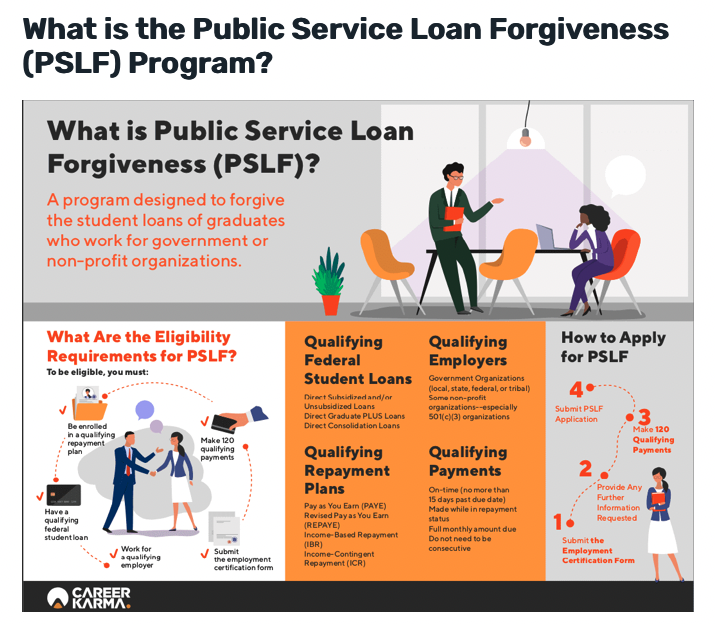

We both work for companies that are eligible for the PSLF (Public Service Loan Forgiveness program). With the extensions and the pause, my loans got cancelled in January and her's this month. 120 payments (starting in March 2020, we were all on a pause, but the months counted towards our 120 payments).

Piece of shit court.

Don't wanna see anyone else get ahead. Zero sum game muthafuckas!

Don't want to see the country they claim to love reach it's full potential.

Robots SHOULD be doing low level work because low level workers should not exist. In an evolved future everyone would have every opportunity to achieve rather than people born, living and dying in ghettos.

Education is for many people their one way out and you refuse to throw them a lifeline when they achieve a degree but not a high paying job to go with it, thus keeping them in a cycle of mediocrity.

Don't wanna see anyone else get ahead. Zero sum game muthafuckas!

Don't want to see the country they claim to love reach it's full potential.

Robots SHOULD be doing low level work because low level workers should not exist. In an evolved future everyone would have every opportunity to achieve rather than people born, living and dying in ghettos.

Education is for many people their one way out and you refuse to throw them a lifeline when they achieve a degree but not a high paying job to go with it, thus keeping them in a cycle of mediocrity.

Piece of shit court.

Don't wanna see anyone else get ahead. Zero sum game muthafuckas!

Don't want to see the country they claim to love reach it's full potential.

Robots SHOULD be doing low level work because low level workers should not exist. In an evolved future everyone would have every opportunity to achieve rather than people born, living and dying in ghettos.

Education is for many people their one way out and you refuse to throw them a lifeline when they achieve a degree but not a high paying job to go with it, thus keeping them in a cycle of mediocrity.

Naw cuz MAGA = Keep the advantage by disadvantaging others.

They should throw a lifeline simply because we bailed out the bankers time after time again after they crashed our economy.

This is what the voting doesn't matter crew doesn't get.

If 1% more people had voted for Hilary...

The Voting Rights Act would have been restored

Roe would still be law

Student loan forgiveness would nto be repealed

Affirmative action wouldn't be about to fall

But you really showed that bitch lol.

If 1% more people had voted for Hilary...

The Voting Rights Act would have been restored

Roe would still be law

Student loan forgiveness would nto be repealed

Affirmative action wouldn't be about to fall

But you really showed that bitch lol.

Last edited:

Dems are gearing up to use this as a 2024 rallying cause.

guess whos back for the another shot at the big chair!!

Marianne Williamson begins longshot 2024 challenge to Biden

The 70-year-old onetime spiritual adviser to Oprah Winfrey should provide only token primary opposition — a testament to how strongly national Democrats are united behind Biden. Still, she tweaked the president, a longtime Amtrak rider, by holding her opening rally at the ornately marble-columned presidential suite at Union Station, Washington's railway hub.

Williamson, whose red, blue and black campaign signs feature the dual slogans “A New Beginning" and “Disrupt the System,” says she'll be campaigning in early-voting states on the 2024 election calendar.

That includes New Hampshire, which has threatened to defy a Biden-backed plan by the Democratic National Committee to have South Carolina lead off the nominating contests. Democrats and Republicans in New Hampshire have warned that if Biden skips the state's unsanctioned primary and a rival wins it, that outcome could prove embarrassing for the sitting president — even if that challenger has no real shot of actually being the nominee.

Striking a defiant tone Saturday, Williamson denounced “those who feel they are the adults in the room” and aren’t taking her candidacy seriously, proclaiming, “Let me in there.”

“I have run for president before. I am not naïve about these forces which have no intention of allowing anyone into this conversation who does not align with their predetermined agenda,” she said. “I understand that, in their mind, only people who previously have been entrenched in the car that brought us into this ditch can possibly be considered qualified to bring us out of it.”

does she get your public endorsement again??

@playahaitian @mangobob79 @Coldchi @Soul On Ice @gene cisco

guess whos back for the another shot at the big chair!!

Marianne Williamson begins longshot 2024 challenge to Biden

The 70-year-old onetime spiritual adviser to Oprah Winfrey should provide only token primary opposition — a testament to how strongly national Democrats are united behind Biden. Still, she tweaked the president, a longtime Amtrak rider, by holding her opening rally at the ornately marble-columned presidential suite at Union Station, Washington's railway hub.

Williamson, whose red, blue and black campaign signs feature the dual slogans “A New Beginning" and “Disrupt the System,” says she'll be campaigning in early-voting states on the 2024 election calendar.

That includes New Hampshire, which has threatened to defy a Biden-backed plan by the Democratic National Committee to have South Carolina lead off the nominating contests. Democrats and Republicans in New Hampshire have warned that if Biden skips the state's unsanctioned primary and a rival wins it, that outcome could prove embarrassing for the sitting president — even if that challenger has no real shot of actually being the nominee.

Striking a defiant tone Saturday, Williamson denounced “those who feel they are the adults in the room” and aren’t taking her candidacy seriously, proclaiming, “Let me in there.”

“I have run for president before. I am not naïve about these forces which have no intention of allowing anyone into this conversation who does not align with their predetermined agenda,” she said. “I understand that, in their mind, only people who previously have been entrenched in the car that brought us into this ditch can possibly be considered qualified to bring us out of it.”

does she get your public endorsement again??

@playahaitian @mangobob79 @Coldchi @Soul On Ice @gene cisco

Wrong thread. Not pertinent to the student loan forgiveness issue that this thread is about.

All they needed to do is drop the IDR down to 5% from 10 % with a 10 year payback. You don't need to forgive anything, They put this poison pill in the plan knowing it would get taken out by the SC.

okWrong thread. Not pertinent to the student loan forgiveness issue that this thread is about.

Good, reliable information as usual from @DC_Dude .. thanks for all you do with these updates

Thanks bro! Yeah man one of my passion projects lol

How Repaying Student Loans Is Changing—Dramatically

Biden’s student debt forgiveness plan isn’t the only change coming for student loan borrowers. His plan also fundamentally changes how loans will be repaid, tur

What the Supreme Court Case Means for Student-Loan Forgiveness

No matter how the justices rule, the three-year pause in payments is due to end.

What the Supreme Court Case Means for Student-Loan Forgiveness

No matter how the justices rule, the three-year pause in payments is due to end

The Supreme Court took up President Biden’s student-loan forgiveness plan Tuesday, but those with education loans should be prepared to start making payments no matter how the court rules.

Under a plan released by the White House last year, millions were promised up to $20,000 in student loan forgiveness. That plan faced several legal challenges, with justices on Tuesday hearing arguments about whether the White House had the authority to grant this debt forgiveness to 40 million borrowers. Several justices questioned if the Biden administration had the power to enact such a plan, and Chief Justice John Roberts asked whether loan forgiveness was fair to those who didn’t attend college.

But no matter how the justices rule, the case marks the beginning of the end of a student-loan-payment pause that has been in effect since the early days of the pandemic. This resumption of payments and interest will hit millions more American wallets like a pay cut when rising prices on everything from eggs to rent are already crimping spending.

SUBSCRIBE

Americans who a few months ago expected to be relieved of their debt may soon find they not only owe the money, but their already-tight budgets will be even further strained, economists and financial advisers said. The time to start planning is now, they say.

“Borrowers have almost certainly seen erosion in their purchasing power, and with the resumption of payments, there’s no question those households are in a tougher economic spot,” said Brett House, an economist at Columbia University.

The Education Department estimates 40 million borrowers would qualify for forgiveness. Individuals making less than $125,000 or members of couples making less than $250,000 were eligible for up to $10,000 in forgiveness. Some borrowers could receive up to $20,000 if they had Pell Grants, a form of federal financial aid for students from low-income households.

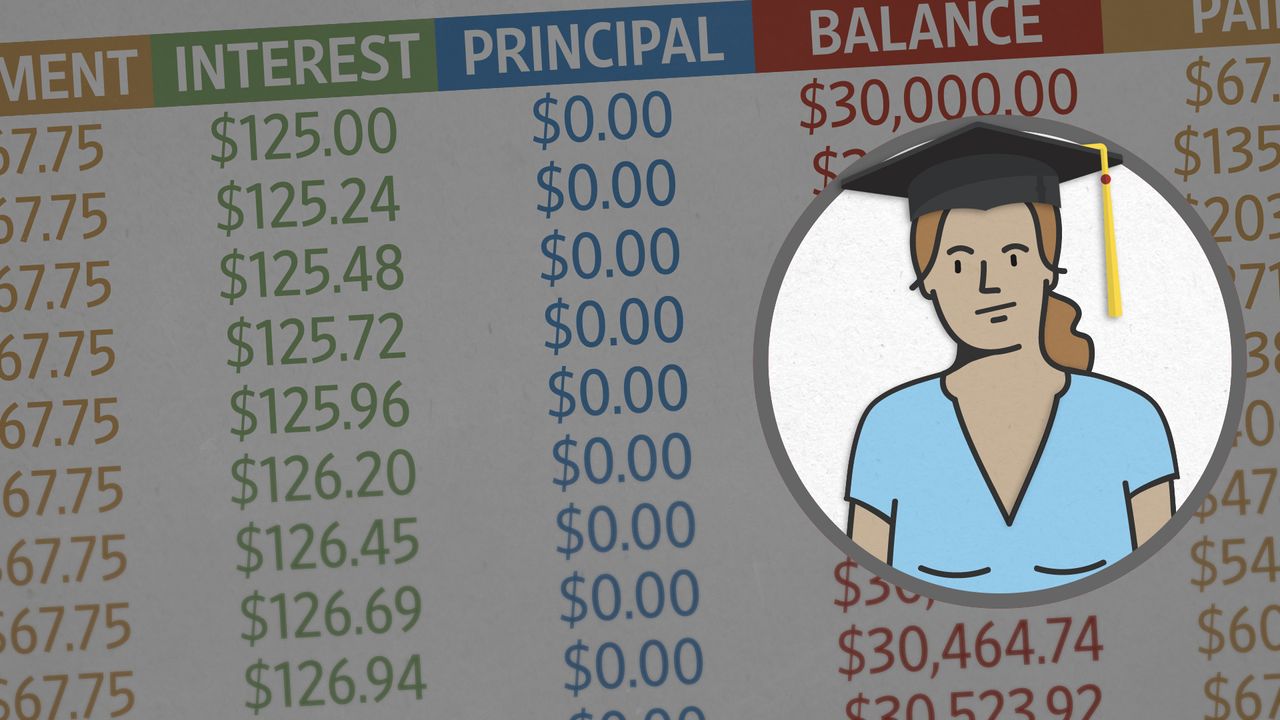

Alyssa Talacka, an outpatient oncology nurse and graduate student based in Pittsburgh, at first continued making payments on her student loans during the pause. She hoped doing so would help her finally get ahead of the interest that had been adding to the nearly $40,000 she held in undergraduate loans.

Protesters Call for Supreme Court to Uphold Student-Loan Forgiveness

YOU MAY ALSO LIKE

Protesters Call for Supreme Court to Uphold Student-Loan ForgivenessPlay video: Protesters Call for Supreme Court to Uphold Student-Loan Forgiveness

Demonstrators gathered outside the U.S. Supreme Court on Tuesday as the court debated President Biden’s plan to forgive student loans held by 40 million Americans. Conservative justices signaled skepticism on the program and questioned its fairness. Photo: Valerie Plesch/Bloomberg News

As of March 2021, she had worked her balance down to $25,000. Then, a series of unforeseen medical bills and out-of-pocket costs for her graduate school program required her to stop making payments.

“Since the pandemic, budget-wise, I was doing OK, and then as soon as gas prices skyrocketed and inflation hit, I really spiraled,” she said. “I used to be able to get two weeks’ worth of groceries for $150, and now I’m paying $100 a week or more.”

When she first learned of the Biden administration’s forgiveness plan, she said she felt “the biggest weight had been lifted.” As a Pell Grant recipient, Ms. Talacka would qualify for up to $20,000 in forgiveness.

SHARE YOUR THOUGHTS

How has the pause on student-loan payments affected your finances? Join the conversation below.

“It’s going to be life-changing, basically,” she said.

Borrowers saved as much as $5 billion a month from the suspension of interest accrual since the student-loan pause first took effect in March 2020, according to estimates from the Education Department. The pause was extended multiple times, first due to the prolonged fallout from the pandemic and then as a result of legal challenges to the forgiveness plan.

“The consequences of the pandemic have a long tail for some borrowers,” said Heather Jarvis, an attorney who trains financial professionals about student loans. “The breathing room that the student-loan-payment pause has provided people has been a critical aspect to their ability to succeed in making ends meet.”

How Repaying Student Loans Is Changing—Dramatically

YOU MAY ALSO LIKE

Biden’s student debt forgiveness plan isn’t the only change coming for student loan borrowers. His plan also fundamentally changes how loans will be repaid, turning many into, essentially, free college grants. WSJ explains.

Student-loan payments and interest will restart within 60 days of one of the following: when the Education Department is permitted to officially implement the forgiveness plan or upon resolution of the litigation. If there is movement on either by June 30, payments will resume 60 days after that, according to the Education Department.

In some cases, Kristen Euretig, certified financial planner and founder at Brooklyn Plans, said borrowers will make hard choices. For those who cannot find the room in their existing budget for student-loan payments, she said she expects to see some borrowers cutting necessary expenses, trimming back on retirement savings or ceasing payments on other debts.

“It’s been so long now—it’s been three years—and people have really put this payment out of their minds,” she said.

Borrowers who are worried about the payments could benefit from examining their current expenses, stashing money in a savings account in preparation for repayments or researching other options, such as the Biden administration’s recent revisions to income-driven repayment plans, Ms. Euretig said.

“I think there’s a lot of options and a lot of it comes down to examining and being in the right repayment plan that makes that payment doable and makes them work for you,” she said.

Ms. Talacka said she knows she should analyze her budget to find places to cut just in case forgiveness won’t happen and payments resume sooner than expected, but between her medical issues and her demanding schedule, she hasn’t yet found the time to do so.

“I feel like there’s no convenient time, between the medical bills and paying for grad school out-of-pocket and inflation in general,” she said.

Write to Julia Carpenter at julia.carpenter@wsj.com

Advertisement - Scroll to Continue

Corrections & Amplifications

Individuals making less than $125,000 or members of couples making less than $250,000 were eligible for up to $10,000 in forgiveness. An earlier version of this article incorrectly said the thresholds were $125,000 or less and $250,000 or less. (Corrected on Feb. 28)

Last edited:

I would highly recommend you watch this video to see how the new changes in payment plans will be carried, by far the most crucial part of his plan..

How Repaying Student Loans Is Changing—Dramatically

Biden’s student debt forgiveness plan isn’t the only change coming for student loan borrowers. His plan also fundamentally changes how loans will be repaid, turwww.wsj.com

What the Supreme Court Case Means for Student-Loan Forgiveness

No matter how the justices rule, the three-year pause in payments is due to end.www.wsj.com

What the Supreme Court Case Means for Student-Loan Forgiveness

No matter how the justices rule, the three-year pause in payments is due to end

The Supreme Court took up President Biden’s student-loan forgiveness plan Tuesday, but those with education loans should be prepared to start making payments no matter how the court rules.

Under a plan released by the White House last year, millions were promised up to $20,000 in student loan forgiveness. That plan faced several legal challenges, with justices on Tuesday hearing arguments about whether the White House had the authority to grant this debt forgiveness to 40 million borrowers. Several justices questioned if the Biden administration had the power to enact such a plan, and Chief Justice John Roberts asked whether loan forgiveness was fair to those who didn’t attend college.

But no matter how the justices rule, the case marks the beginning of the end of a student-loan-payment pause that has been in effect since the early days of the pandemic. This resumption of payments and interest will hit millions more American wallets like a pay cut when rising prices on everything from eggs to rent are already crimping spending.

SUBSCRIBE

Americans who a few months ago expected to be relieved of their debt may soon find they not only owe the money, but their already-tight budgets will be even further strained, economists and financial advisers said. The time to start planning is now, they say.

“Borrowers have almost certainly seen erosion in their purchasing power, and with the resumption of payments, there’s no question those households are in a tougher economic spot,” said Brett House, an economist at Columbia University.

The Education Department estimates 40 million borrowers would qualify for forgiveness. Individuals making less than $125,000 or members of couples making less than $250,000 were eligible for up to $10,000 in forgiveness. Some borrowers could receive up to $20,000 if they had Pell Grants, a form of federal financial aid for students from low-income households.

Alyssa Talacka, an outpatient oncology nurse and graduate student based in Pittsburgh, at first continued making payments on her student loans during the pause. She hoped doing so would help her finally get ahead of the interest that had been adding to the nearly $40,000 she held in undergraduate loans.

Protesters Call for Supreme Court to Uphold Student-Loan Forgiveness

YOU MAY ALSO LIKE

Protesters Call for Supreme Court to Uphold Student-Loan ForgivenessPlay video: Protesters Call for Supreme Court to Uphold Student-Loan Forgiveness

Demonstrators gathered outside the U.S. Supreme Court on Tuesday as the court debated President Biden’s plan to forgive student loans held by 40 million Americans. Conservative justices signaled skepticism on the program and questioned its fairness. Photo: Valerie Plesch/Bloomberg News

As of March 2021, she had worked her balance down to $25,000. Then, a series of unforeseen medical bills and out-of-pocket costs for her graduate school program required her to stop making payments.

“Since the pandemic, budget-wise, I was doing OK, and then as soon as gas prices skyrocketed and inflation hit, I really spiraled,” she said. “I used to be able to get two weeks’ worth of groceries for $150, and now I’m paying $100 a week or more.”

When she first learned of the Biden administration’s forgiveness plan, she said she felt “the biggest weight had been lifted.” As a Pell Grant recipient, Ms. Talacka would qualify for up to $20,000 in forgiveness.

SHARE YOUR THOUGHTS

How has the pause on student-loan payments affected your finances? Join the conversation below.

“It’s going to be life-changing, basically,” she said.

Borrowers saved as much as $5 billion a month from the suspension of interest accrual since the student-loan pause first took effect in March 2020, according to estimates from the Education Department. The pause was extended multiple times, first due to the prolonged fallout from the pandemic and then as a result of legal challenges to the forgiveness plan.

“The consequences of the pandemic have a long tail for some borrowers,” said Heather Jarvis, an attorney who trains financial professionals about student loans. “The breathing room that the student-loan-payment pause has provided people has been a critical aspect to their ability to succeed in making ends meet.”

How Repaying Student Loans Is Changing—Dramatically

YOU MAY ALSO LIKE

Biden’s student debt forgiveness plan isn’t the only change coming for student loan borrowers. His plan also fundamentally changes how loans will be repaid, turning many into, essentially, free college grants. WSJ explains.

Student-loan payments and interest will restart within 60 days of one of the following: when the Education Department is permitted to officially implement the forgiveness plan or upon resolution of the litigation. If there is movement on either by June 30, payments will resume 60 days after that, according to the Education Department.

In some cases, Kristen Euretig, certified financial planner and founder at Brooklyn Plans, said borrowers will make hard choices. For those who cannot find the room in their existing budget for student-loan payments, she said she expects to see some borrowers cutting necessary expenses, trimming back on retirement savings or ceasing payments on other debts.

“It’s been so long now—it’s been three years—and people have really put this payment out of their minds,” she said.

Borrowers who are worried about the payments could benefit from examining their current expenses, stashing money in a savings account in preparation for repayments or researching other options, such as the Biden administration’s recent revisions to income-driven repayment plans, Ms. Euretig said.

“I think there’s a lot of options and a lot of it comes down to examining and being in the right repayment plan that makes that payment doable and makes them work for you,” she said.

Ms. Talacka said she knows she should analyze her budget to find places to cut just in case forgiveness won’t happen and payments resume sooner than expected, but between her medical issues and her demanding schedule, she hasn’t yet found the time to do so.

“I feel like there’s no convenient time, between the medical bills and paying for grad school out-of-pocket and inflation in general,” she said.

Write to Julia Carpenter at julia.carpenter@wsj.com

Advertisement - Scroll to Continue

Corrections & Amplifications

Individuals making less than $125,000 or members of couples making less than $250,000 were eligible for up to $10,000 in forgiveness. An earlier version of this article incorrectly said the thresholds were $125,000 or less and $250,000 or less. (Corrected on Feb. 28)

If you voted for him… STFU

Similar threads

- Replies

- 1

- Views

- 169

- Replies

- 25

- Views

- 1K

- Replies

- 2

- Views

- 256

- Replies

- 0

- Views

- 88