US GDP 2022?

Imports decelerated. Current‑dollar GDP increased 7.8 percent at an annual rate, or $465.1 billion, in the second quarter to a level of $24.85 trillion.

COST OF UNIVERSAL EDUCATION?

educationdata.org

.

educationdata.org

.

A First-Dollar tuition free-program would cost $58 billion the year it is implemented. Over an 11 year time frame, a First-Dollar tuition-free program would cost a total of $800 billion. The cheapest free college program, the Last-Dollar tuition-free program would cost $28 billion the year it is implemented.

2022 US Budget?

President Joe Biden released a $6.011 trillion federal budget proposal in May 2021 for fiscal year (FY) 2022. The U.S. government estimates it will receive $4.174 trillion in revenue through Sept. 30, 2022, creating a $1.837 trillion deficit for Oct. 1, 2022.

www.thebalance.com

.

www.thebalance.com

.

US Military budget 2022?

According to the 61st NDAA bicameral agreement, the United States will spend 777.7 billion dollars on the national defense budget for the fiscal year 2022. Military spending provides the largest share of the federal budget in terms of percentage.Jun 27, 2022

https://executivegov.com › articles

U.S. Defense Budget 2022: How much does the United States ...

Imports decelerated. Current‑dollar GDP increased 7.8 percent at an annual rate, or $465.1 billion, in the second quarter to a level of $24.85 trillion.

COST OF UNIVERSAL EDUCATION?

How Much Would Free College Cost? | 2022 Cost Analysis

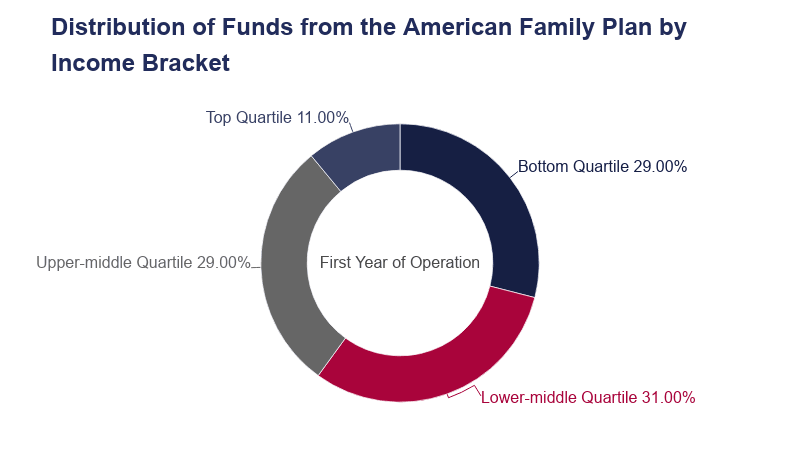

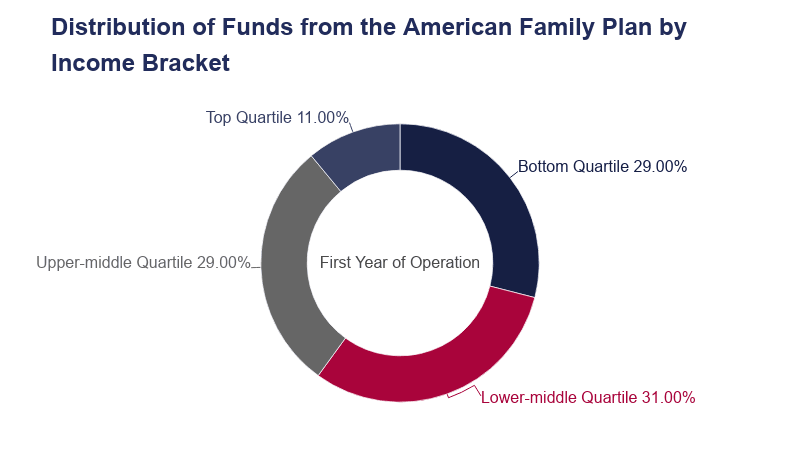

We researched the cost of nation-wide free college under several proposed programs including President Biden's American Family Plan.

A First-Dollar tuition free-program would cost $58 billion the year it is implemented. Over an 11 year time frame, a First-Dollar tuition-free program would cost a total of $800 billion. The cheapest free college program, the Last-Dollar tuition-free program would cost $28 billion the year it is implemented.

2022 US Budget?

President Joe Biden released a $6.011 trillion federal budget proposal in May 2021 for fiscal year (FY) 2022. The U.S. government estimates it will receive $4.174 trillion in revenue through Sept. 30, 2022, creating a $1.837 trillion deficit for Oct. 1, 2022.

U.S. Federal Budget Breakdown

The FY 2022 federal budget proposal was over $6 trillion, with an estimated revenue of about $4.2 trillion, creating a deficit worth about $1.9 trillion.

US Military budget 2022?

According to the 61st NDAA bicameral agreement, the United States will spend 777.7 billion dollars on the national defense budget for the fiscal year 2022. Military spending provides the largest share of the federal budget in terms of percentage.Jun 27, 2022

https://executivegov.com › articles

U.S. Defense Budget 2022: How much does the United States ...

Last edited: