I I see a lot of guys have the 41K and it's good and all but understand A401K is not An instrument you can really use to retire on.

If you read exactly what it says it's an executive retirement plan it's for people ( ie executives ) who make a lot of money who want to offset their tax liability and lower thier income by saying they are " saving".

The real.deal is this - you'd need to have your home paid off - cars paid off - and kids all done and paid off

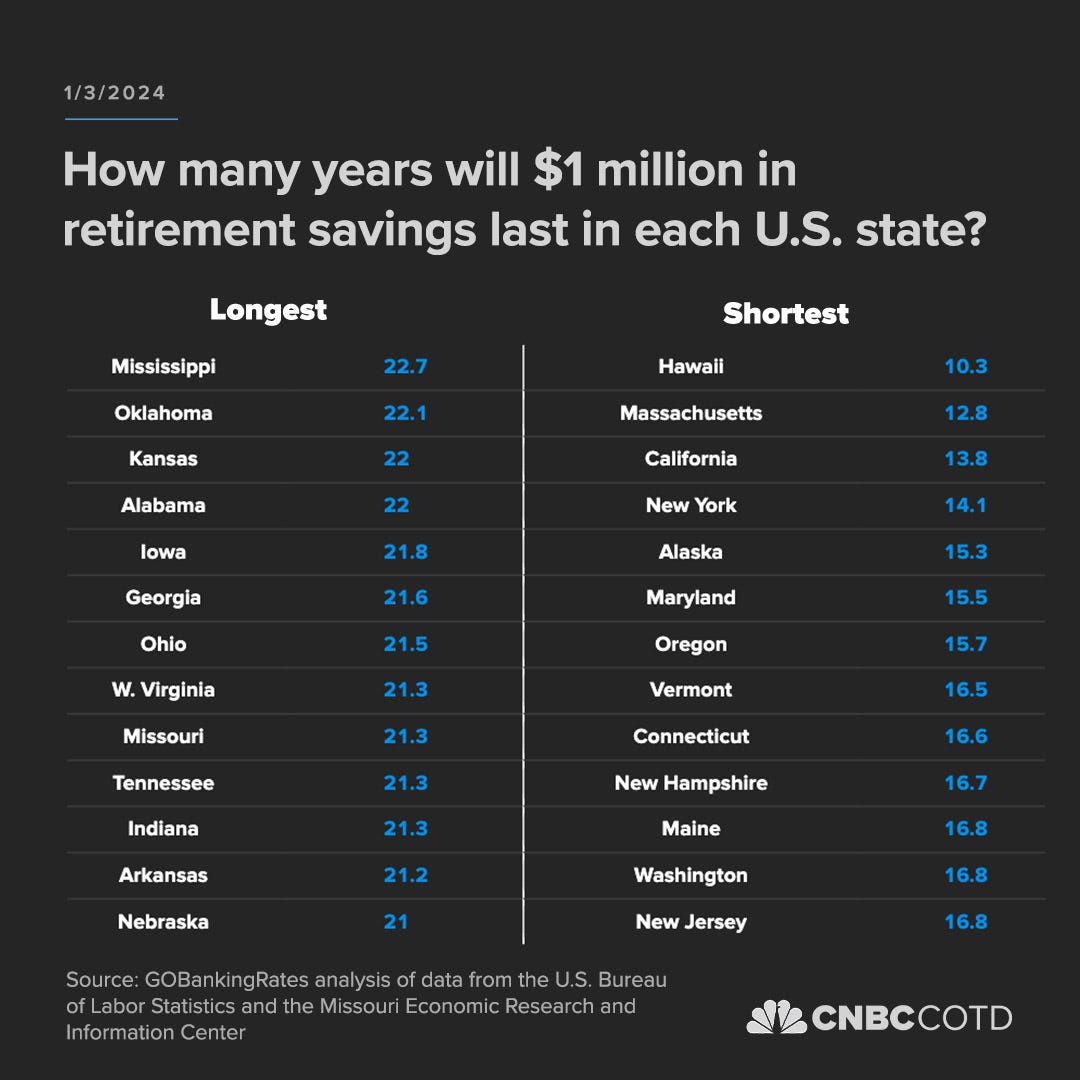

THEN you need to have enough money that will supplant your living an extra 20 to 30 years -

That's a LOT of money-

Think about how in the last 20 years the cost of living has risen - what you have saved needs to account for that rise ....a 401k even if you have 200 or 300k saved in it will probably only carry you about 10 years realistically speaking if you are relying on a 401k to be the majority of what you will rely on the most you could stack is 25k or 27k a year

Over 10 years thats only 250k but let's say 300k .

300k over 10 years is 30k a year and thats not a lot of dough if you still have a mortgage or car payment....or both.

So if your expenses are 30KA year and you plan on living another 25 to 30 years you're looking at almost $900000

AND...

Homes cost money. for property taxes and upkeep ( roof windows and siding will easily cost you almost 80 to 100k over 10 years ) ....

And of course the biggie is health - even if you're reasonably healthy now and you do some kind of retirement job to bring in some 30 or 40k that ends once you get sick.

And everyone will get sick

This is pretty much for the US

Once you are sick AND you can't keep up with expenses if you need govt help you can't have any assets.

if you need medicaid or Medicare esp for something like a stroke / heart attack or cancer... You can't work and you've got nothing but expenses

The government here says you have to be dirt poor so you'd have to somehow "hide" that you own a. Home or any accounts that have $$$ ....and mind you often what doctors recommend for treatment is not covered by your insurance so you have to.make up the diff .

Retirement is not something that anyone in the last 20 or 30 years is even remotely prepared for

If you read exactly what it says it's an executive retirement plan it's for people ( ie executives ) who make a lot of money who want to offset their tax liability and lower thier income by saying they are " saving".

The real.deal is this - you'd need to have your home paid off - cars paid off - and kids all done and paid off

THEN you need to have enough money that will supplant your living an extra 20 to 30 years -

That's a LOT of money-

Think about how in the last 20 years the cost of living has risen - what you have saved needs to account for that rise ....a 401k even if you have 200 or 300k saved in it will probably only carry you about 10 years realistically speaking if you are relying on a 401k to be the majority of what you will rely on the most you could stack is 25k or 27k a year

Over 10 years thats only 250k but let's say 300k .

300k over 10 years is 30k a year and thats not a lot of dough if you still have a mortgage or car payment....or both.

So if your expenses are 30KA year and you plan on living another 25 to 30 years you're looking at almost $900000

AND...

Homes cost money. for property taxes and upkeep ( roof windows and siding will easily cost you almost 80 to 100k over 10 years ) ....

And of course the biggie is health - even if you're reasonably healthy now and you do some kind of retirement job to bring in some 30 or 40k that ends once you get sick.

And everyone will get sick

This is pretty much for the US

Once you are sick AND you can't keep up with expenses if you need govt help you can't have any assets.

if you need medicaid or Medicare esp for something like a stroke / heart attack or cancer... You can't work and you've got nothing but expenses

The government here says you have to be dirt poor so you'd have to somehow "hide" that you own a. Home or any accounts that have $$$ ....and mind you often what doctors recommend for treatment is not covered by your insurance so you have to.make up the diff .

Retirement is not something that anyone in the last 20 or 30 years is even remotely prepared for