I could write a book of all the stupid shit in this post. Kind of incredible...No. Not really. I really don't think any ADOS should anything for college. Zero. Zlitch!! We can speak on reparations later but college education should be part of it. Native Americans don't have to pay for school then why should we. Same for reservations with our own law enforcement laws and judges. But I'm not going to focus on that.

The most of the debts tied to college education are connected to highly inflated debt schemes used to benefit white liberals.

If you wonder why the average housing project doesn't have money to meet basic maintenance needs is because low income housing money is being sucked up for "low" income whites in the form of college students.

Your typical new big city college dormitories are built of off mix of low income housing funding that used to go towards family housing. Between section 8 sucking up money and developers scheming ain't shit low cost about most of the "projects". If I have to paid college tuition to live there, how is it low cost and accessible to most when you have to be admitted to a school?

Anyone can damn near be considered low income once they initially moved from their parents home. It's a lot of middle upper class and up people in "low income housing". Just look at what's consider low in NYC/California and see how much money it drains from real low cost housing where it could be directed towards family growth.

The DNC rather have low cost immigrants who don't pay taxes sucking up more money that could go towards building family units could actually make cities for affordable. Now they are begging the Feds to print more money so they can get low cost day care and construction workers for their flip and gentrification games they play with the banks that wont give blacks that live in the same neighborhoods a loan.

The facts are showing that the "liberals" ain't shit but shady ass whites/teathers who have driven up the cost of essentials like health care and education in the cities. While subscribing to globalism that have destroyed the manufacturing base of America.

The schools are straight shit while you pay high ass taxes to liberal whites and incompetent sista girl/teachers politicians.

Health care is higher than ever while 55% of todays kids are obese, the birth rate has decreased,50% of all Americans are fat as fuck, and the average age of Americans at death is going down. Why are we paying these people more money to die sooner.

Why are we paying people more for education when the kids are dumber?? I will tell you why. Your DNC ran cities that are shitty as fuck right now and the future are ran by incompetent white men and women along with their handpicked niggas.

Lastly, Nobody from gentrified places like California and DC should tell her other black people how to conduct political business.

They got schemed out of their neighborhoods now they want to give you same the bad advice that got them gentrified out of their own neighborhoods. Now white people live in the same places they used to stay and have better access to better resources now that they kicked their black asses out of California and DC.

I'm glad the people in Chicago are waking up faster than most. They see the game plan is the same as aways. Infiltrate us take down our leaders and insert theirs. Lori Lightfoot and Brandon Johnson are showing how many black politicians have sold and are more concerned about self-interest than the people who vote for them.

Just listen to the beta in the niggas. "If we don't vote for them and they win they won't listen to us in the future"

Anybody with any mathematical knowledge knows that's not true and understand that somebody's lying about something. It's part of the scheme it's part of the deception and it's part of the fear mongering.

But fears is all you have other than results. The point the conversation is pretty much over with. They're losing the election and if there's very little they can do about it at this point. Inflation alone gets most guys kicked out the white house. Biden is involved in two wars with a third on the horizon. Kennedy probably is the best choice but Biden is not an option. He's not even physically fit for the job.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

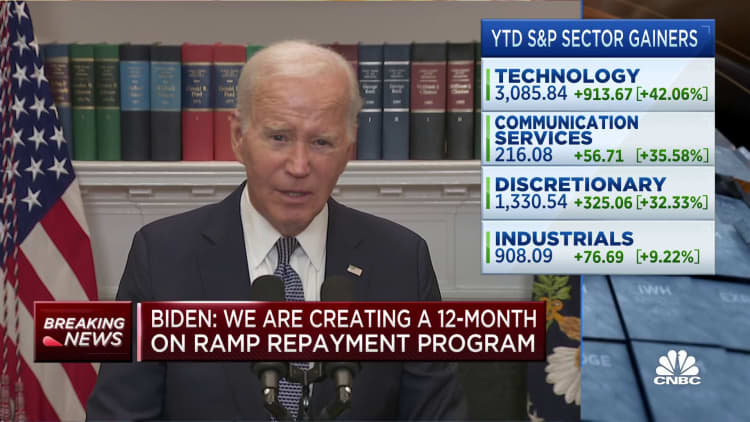

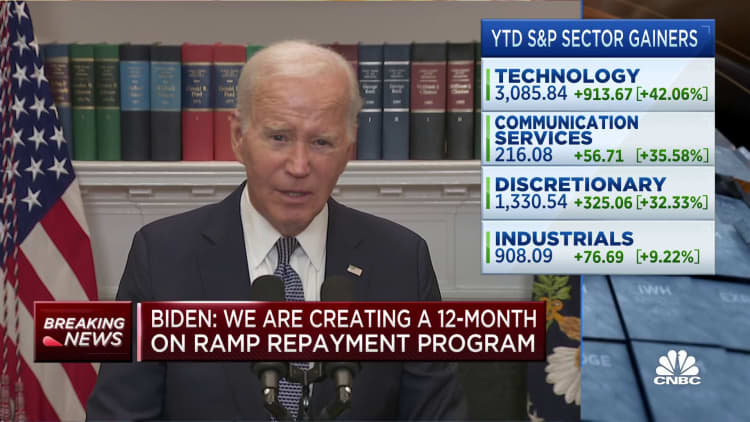

Biden doesn't want to fight for 50,000 student loan relief. It's too hard

- Thread starter 850credit

- Start date

You are from Chicago ? Do like whats happening with your education system and the gentrification?I could write a book of all the stupid shit in this post. Kind of incredible...

Do you really think you are getting bang for you buck from the white municipal workers that are supposed to serve your black communities?

Are the black politicians serious about service to black Chicago beyond collecting votes and making promises that they take little action on?

You like the facts that migrants are getting kids kicked out of their community centers?

You have homeless and migrants living in your critical public transportation facilities such as your airport. Is that normal for to you?

Do you understand how much pension debt you guys have and how much of that money is going towards the the coffers of Republican states?

You guys are going to need a federal government bail out soon and having a senile old man to scheme money from like Biden would save your assess right now. So I can see why you want the old bastard in there.

But you will never get rid of the built in corruption of your city unions and politicians unless you're going to bring in people who will make them accountable.

Do you think Harold Washington will go for any of the current mess that's going on in your city?

Nigga, you guys are a pure joke right now. You last two Mayors have made Kwame Klpatrick look competent and I don't see any local government willing to pick up the slack. Detroit bankruptcy was regulated by the state Republican party and they actually had the balls to tell some of these municipal unions no and cut pork jobs attached to city government.

I wish you guys the best but Chicago is in for some very dark times. The sad part is that I know the Republicans are going to have to come in and make the adult decisions the Democrats refuse to make. Only then will things get better from an economical physical standpoint.

I'm just telling you what I've seen personally work. Its not easy to really to have to confront the hard truths. But our cites are dying because of very bad policy. If you don't believe me then please understand demographics drive economics. You probably need to take a look at this lecture first and then let's discuss how these numbers impacted the black community.

It has nothing to do directly with African Americans but if you look at the numbers you can understand why blacks are pissed right now..

You look at these numbers and you will start to understand the policy. DM me if you want details.

Last edited:

“What I’ve come to learn in my long life is that ignorance is not bliss; it is time consuming and costly as hell.”

— Dick Gregory

— Dick Gregory

Draft rules for the forgiveness proposal are out

I'll be doing a summary later today. Please hold off on questions until I do. And remember..these are draft rules. Things can change and be challenged.

From politico

The Education Department unveiled a draft proposal on Tuesday of President Joe Biden’s latest plan to broadly cancel swaths of student loan debt for millions of borrowers.

His plan seeks to forgive unpaid interest for some 25 million Americans who now owe more on their loans than they originally borrowed. It would also help more than 2 million borrowers who’ve carried their debts for decades and another 2 million borrowers who would have qualified for existing federal programs but failed to enroll. Borrowers who attended “low-value programs” could see relief as well.

If implemented, the administration said the plan, along with its other student debt relief efforts, would apply to roughly 30 million borrowers as early as this fall.

“These distinct forms of debt relief are designed for borrowers struggling with their loans — and that’s a lot of people,” Education Undersecretary James Kvaal said in a statement. “There are 25 million borrowers whose interest is growing faster than they can pay it down. That fact alone shows how badly President Biden’s student loan relief is needed.”

Biden first announced the plan last week at a community college in Madison, Wisconsin, while other top administration officials went to other swing states to push his pitch.

The proposal, which provides targeted relief for the majority of student loan borrowers, comes as Biden looks to deliver on his campaign promise to cancel some student loan debt after his more sweeping plan was thwarted by the Supreme Court last year.

Senior administration officials have previously told reporters they’re “confident” that Biden’s new attempt is sufficiently different to pass muster before the court. The plan hinges on the Education secretary’s legal authority under the Higher Education Act, rather than the Covid-related emergency powers that were the basis for the administration’s first plan.

While Democrats and groups in support of debt relief have lauded the Biden administration’s efforts, Rep. Virginia Foxx (R-N.C.), who helms the House education panel, slammed the proposal as a “reckless and fiscally irresponsible" action.

“Mr. President, you have no legal ground to stand upon,” Foxx said. “Your scheme is not steeped in benevolence or goodwill. It is mired in utter contempt for the Supreme Court and every student, family and hardworking taxpayer in this country.”

The proposed rule will be published in the Federal Register on Wednesday with a 30-day comment period, and the department said it is still aiming to finalize its rules by the fall.

A separate draft rule focused on relief for borrowers experiencing hardship is slated for the coming months. It is expected to include proposals to grant automatic forgiveness of loans for borrowers at a high risk of default and others who “show hardship due to other indicators” like high medical and caregiving expenses.

“As President Biden said last week, our Administration is working as quickly as possible to deliver relief to as many borrowers as possible,” a department spokesperson said about the hardship proposal. “As we vigorously continue to develop the NPRM related to hardship for release in the coming months, we also are moving forward with these proposed rules today so we can begin delivering relief to borrowers as early as this fall.”

Link to the undrafted rule

Student Debt Relief for the William D. Ford Federal Direct Loan Program, the Federal Family Education Loan Program, the Federal Perkins Loan Program, and the Health Education Assistance Loan Program

An unpublished Proposed Rule by the Education Department on 04/17/2024Federal Register :: Request Access

Draft rules for the forgiveness proposal are out

I'll be doing a summary later today. Please hold off on questions until I do. And remember..these are draft rules. Things can change and be challenged.

From politico

The Education Department unveiled a draft proposal on Tuesday of President Joe Biden’s latest plan to broadly cancel swaths of student loan debt for millions of borrowers.

His plan seeks to forgive unpaid interest for some 25 million Americans who now owe more on their loans than they originally borrowed. It would also help more than 2 million borrowers who’ve carried their debts for decades and another 2 million borrowers who would have qualified for existing federal programs but failed to enroll. Borrowers who attended “low-value programs” could see relief as well.

If implemented, the administration said the plan, along with its other student debt relief efforts, would apply to roughly 30 million borrowers as early as this fall.

“These distinct forms of debt relief are designed for borrowers struggling with their loans — and that’s a lot of people,” Education Undersecretary James Kvaal said in a statement. “There are 25 million borrowers whose interest is growing faster than they can pay it down. That fact alone shows how badly President Biden’s student loan relief is needed.”

Biden first announced the plan last week at a community college in Madison, Wisconsin, while other top administration officials went to other swing states to push his pitch.

The proposal, which provides targeted relief for the majority of student loan borrowers, comes as Biden looks to deliver on his campaign promise to cancel some student loan debt after his more sweeping plan was thwarted by the Supreme Court last year.

Senior administration officials have previously told reporters they’re “confident” that Biden’s new attempt is sufficiently different to pass muster before the court. The plan hinges on the Education secretary’s legal authority under the Higher Education Act, rather than the Covid-related emergency powers that were the basis for the administration’s first plan.

While Democrats and groups in support of debt relief have lauded the Biden administration’s efforts, Rep. Virginia Foxx (R-N.C.), who helms the House education panel, slammed the proposal as a “reckless and fiscally irresponsible" action.

“Mr. President, you have no legal ground to stand upon,” Foxx said. “Your scheme is not steeped in benevolence or goodwill. It is mired in utter contempt for the Supreme Court and every student, family and hardworking taxpayer in this country.”

The proposed rule will be published in the Federal Register on Wednesday with a 30-day comment period, and the department said it is still aiming to finalize its rules by the fall.

A separate draft rule focused on relief for borrowers experiencing hardship is slated for the coming months. It is expected to include proposals to grant automatic forgiveness of loans for borrowers at a high risk of default and others who “show hardship due to other indicators” like high medical and caregiving expenses.

“As President Biden said last week, our Administration is working as quickly as possible to deliver relief to as many borrowers as possible,” a department spokesperson said about the hardship proposal. “As we vigorously continue to develop the NPRM related to hardship for release in the coming months, we also are moving forward with these proposed rules today so we can begin delivering relief to borrowers as early as this fall.”

Link to the undrafted rule

Student Debt Relief for the William D. Ford Federal Direct Loan Program, the Federal Family Education Loan Program, the Federal Perkins Loan Program, and the Health Education Assistance Loan Program

An unpublished Proposed Rule by the Education Department on 04/17/2024

Federal Register :: Request Access

www.federalregister.gov

Thanks for the update, this would def be a welcome move

You gotta be super evil n greedy to be in such STRONG opposition to cutting interest off of decades old student loan balances under these circumstances. What type of person or why would one even care enough to fight so vehemently against this, unless they are just a true blue greedy piece of shit? Especially considering all the other bs this country promotes and has the nerve to waste money on? It's baffling.

On a separate but related note: I called Aidvantage yesterday and these fools are dumb as rocks

I was able to confirm the new certification date, but I still need to get in touch with Fed Aid directly for a full list of my past payments. I don't think they are giving me credit for a few years of payments I made in the past.

THIS! That interest is some BSThanks for the update, this would def be a welcome move

You gotta be super evil n greedy to be in such STRONG opposition to cutting interest off of decades old student loan balances under these circumstances. What type of person or why would one even care enough to fight so vehemently against this, unless they are just a true blue greedy piece of shit? Especially considering all the other bs this country promotes and has the nerve to waste money on? It's baffling.

On a separate but related note: I called Aidvantage yesterday and these fools are dumb as rocks

I was able to confirm the new certification date, but I still need to get in touch with Fed Aid directly for a full list of my past payments. I don't think they are giving me credit for a few years of payments I made in the past.

I think Fed Aid has a live online chat if you don’t want to call. You should be able to log in also and pull up all of your payments. If you know the original loan folks, you can try and log in there also.

I can still pull up all my payments I made to Sallie Mae and Moehela before I switched over to FedLoans.

THIS! That interest is some BS

I think Fed Aid has a live online chat if you don’t want to call. You should be able to log in also and pull up all of your payments. If you know the original loan folks, you can try and log in there also.

I can still pull up all my payments I made to Sallie Mae and Moehela before I switched over to FedLoans.

I think I was Sallie Mae way back when, then FedLoan for most of my payment history, now Aidvantage post-pandemic.

I went on the site a few months back but got frustrated and left. I'ma give it another shot though. I plan on calling them or chatting if I can't find what I need on the site.

I went back on the other day and noticed that they appear to have a few options to file a complaint. Which I also might do just to have something logged in writing and see what they say.

Thanks man.

HELL YEAH my G!!!!HELL YEAH BIDEN!!

i just got the email.. my shit bout to be gone!!!!!!

Damn that’s some great news!

We need stats bro! How much????? Lol

HELL YEAH my G!!!!

Damn that’s some great news!

We need stats bro! How much????? Lol

only had about 20 grand left... i work in government so mine was going to be forgiven in a few years anyway

but now its gone totally in may

Damn that’s what’s up!only had about 20 grand left... i work in government so mine was going to be forgiven in a few years anyway

but now its gone totally in may

Taking a shot of Uncle nearest for you bro when I get off lol

only had about 20 grand left... i work in government so mine was going to be forgiven in a few years anyway

but now its gone totally in may

I just got one too and I'm not on the IDR plan. Mohela just put my account on an administrative hold until June. Fingers crossed.

On April 19, 2022, the Biden-Harris Administration announced several changes that will help borrowers get closer to or achieve forgiveness under income-driven repayment (IDR) regardless of whether or not you have ever participated in an IDR plan. With these changes, you are now eligible to have some or all of your student loans forgiven because you have reached the necessary 240- or 300-months' of payments under IDR.

I just got one too and I'm not on the IDR plan. Mohela just put my account on an administrative hold until June. Fingers crossed.

On April 19, 2022, the Biden-Harris Administration announced several changes that will help borrowers get closer to or achieve forgiveness under income-driven repayment (IDR) regardless of whether or not you have ever participated in an IDR plan. With these changes, you are now eligible to have some or all of your student loans forgiven because you have reached the necessary 240- or 300-months' of payments under IDR.

Good info....Fingers cross but we claiming that shit is going to get discharged....

Interest rates gonna sink Biden, not this. A damn 30k car costs $500 a month with a 750 credit score.

Interest rates gonna sink Biden, not this. A damn 30k car costs $500 a month with a 750 credit score.

Your math ain't mathing homie. That's a 0% interest loan.

$500 x 60 month $30000

You sure? I have a high credit score and got a car loan on a new car from navy federal at about 3% in 2016. It’s 4.5% now on there website. Might even be lower if you have good credit.Interest rates gonna sink Biden, not this. A damn 30k car costs $500 a month with a 750 credit score.

Your math ain't mathing homie. That's a 0% interest loan.

$500 x 60 month $30000

You haven't bought many cars if you think a 30k car with a 500 monthly payment is ok. I bought a loaded Yukon Denali in 21 & my note is $1,006.36 a month & it was 88K

Your math ain't mathing homie. That's a 0% interest loan.

$500 x 60 month $30000

Not actually correct brother... (I said car, not loan cost)

Plus I am a GM employee, so incentives are added in

I was just talking to a broker to locate a car for my 15 year old....

Last edited:

You sure? I have a high credit score and got a car loan on a new car from navy federal at about 3% in 2016. It’s 4.5% now on there website. Might even be lower if you have good credit.

I got a rate today as of 4.9% ( I got excellent credit)

My payment for an Encore GX ST would be $494.13

Be careful if you get any emails saying it’s from Moeahla. Wife just got a phishing email saying she owed money even though her loans were discharged last year

The US Department of Education sign hangs over the entrance to the federal building housing the agency’s headquarters on February 9, 2024, in Washington, DC.

J. David Ake | Getty Images

If your current federal student loan servicer is Mohela, or the Missouri Higher Education Loan Authority, the U.S. Department of Education saidit will soon transfer some student loan borrowers to different servicers.

Here’s what you should know about the change.

More than 1 million borrowers may be impacted.

“A different servicer will begin managing these loans and assisting these borrowers,” the department said.

The Education Department contracts with different companies to service its federal student loans, including Mohela, Nelnet and EdFinancial. It pays the servicers more than $1 billion a year to do so, according to higher education expert Mark Kantrowitz.

At the end of October 2023, the government accused the servicer of failing to send timely billing statements to 2.5 million borrowers when the Covid-era pause on payments expired, resulting in more than 800,000 borrowers becoming delinquent.

The Education Department withheld $7.2 million in payment to Mohela for its error.

“The disruption to Mohela’s servicing last fall may have been caused by capacity issues,” Kantrowitz said.

More from Personal Finance:

Advice about 401(k) rollovers is poised for a big change. Here’s why

IRS free filing pilot processed more than 140,000 returns, commissioner says

Here’s why new home sales inch higher despite 7% mortgage rates

In February, the Student Borrower Protection Center and the American Federation of Teachers published a joint report titled, “The Mohela Papers,” finding that four in 10 student loan borrowers in repayment serviced by Mohela “experienced a servicing failure since loan payments resumed in September 2023.”

On April 10, the U.S. Senate Committee on Banking, Housing and Urban Affairs Subcommittee on Economic Policy held a hearing about Mohela’s performance as a student loan servicer.

“Today, Mohela surrendered more than 10 percent of its total loan servicing business, showing that its executives now recognize what borrowers have long understood: Mohela’s position as a leader in the student loan industry was a mistake,” Mike Pierce, the executive director of the Student Borrower Protection Center, said in a statement.

Officials at Mohela did not immediately respond to a request for comment.

Pierce added that he hopes Education Secretary Miguel Cardona “builds on this progress and continues to protect borrowers by stripping the scandal-plagued firm of its remaining business.”

After the transfers, Mohela will still service the federal student loans of at least 6 million borrowers, Kantrowitz estimates.

They will then need to establish an online account with their new servicer.

If you were enrolled in automatic payments with your servicer, which usually leads to a small discount on your interest rate, you may need to reenroll, Kantrowitz said.

If a borrower has a problem with their servicer, they can submit a complaint to the Department of Education’s Federal Student Aid unit.

The Education Department will transfer some student loan borrowers to a different servicer. Here’s what you need to know

The US Department of Education sign hangs over the entrance to the federal building housing the agency’s headquarters on February 9, 2024, in Washington, DC.

J. David Ake | Getty Images

If your current federal student loan servicer is Mohela, or the Missouri Higher Education Loan Authority, the U.S. Department of Education saidit will soon transfer some student loan borrowers to different servicers.

Here’s what you should know about the change.

Change impacts Mohela borrowers

The Education Department began transferring a portion of Mohela’s borrowers this week to different companies, it said in an April 29 blog post.More than 1 million borrowers may be impacted.

“A different servicer will begin managing these loans and assisting these borrowers,” the department said.

The Education Department contracts with different companies to service its federal student loans, including Mohela, Nelnet and EdFinancial. It pays the servicers more than $1 billion a year to do so, according to higher education expert Mark Kantrowitz.

Why the transfer is happening

Mohela requested the transfers, the Education Department said, but the company has also been a magnet for controversy of late.At the end of October 2023, the government accused the servicer of failing to send timely billing statements to 2.5 million borrowers when the Covid-era pause on payments expired, resulting in more than 800,000 borrowers becoming delinquent.

The Education Department withheld $7.2 million in payment to Mohela for its error.

“The disruption to Mohela’s servicing last fall may have been caused by capacity issues,” Kantrowitz said.

More from Personal Finance:

Advice about 401(k) rollovers is poised for a big change. Here’s why

IRS free filing pilot processed more than 140,000 returns, commissioner says

Here’s why new home sales inch higher despite 7% mortgage rates

In February, the Student Borrower Protection Center and the American Federation of Teachers published a joint report titled, “The Mohela Papers,” finding that four in 10 student loan borrowers in repayment serviced by Mohela “experienced a servicing failure since loan payments resumed in September 2023.”

On April 10, the U.S. Senate Committee on Banking, Housing and Urban Affairs Subcommittee on Economic Policy held a hearing about Mohela’s performance as a student loan servicer.

“Today, Mohela surrendered more than 10 percent of its total loan servicing business, showing that its executives now recognize what borrowers have long understood: Mohela’s position as a leader in the student loan industry was a mistake,” Mike Pierce, the executive director of the Student Borrower Protection Center, said in a statement.

Officials at Mohela did not immediately respond to a request for comment.

Pierce added that he hopes Education Secretary Miguel Cardona “builds on this progress and continues to protect borrowers by stripping the scandal-plagued firm of its remaining business.”

After the transfers, Mohela will still service the federal student loans of at least 6 million borrowers, Kantrowitz estimates.

What borrowers should do amid transition

Borrowers who are being transferred to a different servicer should receive alerts from Mohela and their new servicer, the Education Department explained.They will then need to establish an online account with their new servicer.

If you were enrolled in automatic payments with your servicer, which usually leads to a small discount on your interest rate, you may need to reenroll, Kantrowitz said.

If a borrower has a problem with their servicer, they can submit a complaint to the Department of Education’s Federal Student Aid unit.

Last edited:

I can't remember what my last update was, but a about a month ago I got an e-mail from my servicer (Aidvantage) saying that I didn't need to recertify until Summer 2025.

Then I got a letter saying my loan terms had changed,

then another saying to disregard a previous letter,

then another letter recently saying that they put me on Administrative Forbearance for 2 months (until June).

..so I called my servicer to ask what was up, but they weren't much help as usual. They asked me if I applied for any other programs recently (I'm already Consolidated and in S.A.V.E., so nah) and just told me that my next payment isn't due until June and it looks like my account was flagged for review.

Then I finally called StudentAid.gov and they weren't much help either. They told me more of the same and said that I'll eventually get a letter (presumably before my next payment due date) updating me on my account status. They said if I wanted to reach out to get specifics, I could file a complaint letter with the Dept. of Ed so I'ma do that just to see what they say and so that something is officially logged in writing.

Then I got a letter saying my loan terms had changed,

then another saying to disregard a previous letter,

then another letter recently saying that they put me on Administrative Forbearance for 2 months (until June).

..so I called my servicer to ask what was up, but they weren't much help as usual. They asked me if I applied for any other programs recently (I'm already Consolidated and in S.A.V.E., so nah) and just told me that my next payment isn't due until June and it looks like my account was flagged for review.

Then I finally called StudentAid.gov and they weren't much help either. They told me more of the same and said that I'll eventually get a letter (presumably before my next payment due date) updating me on my account status. They said if I wanted to reach out to get specifics, I could file a complaint letter with the Dept. of Ed so I'ma do that just to see what they say and so that something is officially logged in writing.

Graduation season is upon us. Where are you headed for law school in the fall?If you needed any more proof that the American dream was never intended for us, here it is.

But there's always another way.

I may look at Germany or Canada for law school depending on how things shake out.

I'm a splitter. My GPA won't finish out great but I track to score high on the LSAT. AA might have helped me get into a more well known program. It's all good though, I'll make it happen.

Guys like me might have to do a year at a smaller school and transfer in to a higher program to finish with that name.

Where there's a will there's a way.

I can't remember what my last update was, but a about a month ago I got an e-mail from my servicer (Aidvantage) saying that I didn't need to recertify until Summer 2025.

Then I got a letter saying my loan terms had changed,

then another saying to disregard a previous letter,

then another letter recently saying that they put me on Administrative Forbearance for 2 months (until June).

..so I called my servicer to ask what was up, but they weren't much help as usual. They asked me if I applied for any other programs recently (I'm already Consolidated and in S.A.V.E., so nah) and just told me that my next payment isn't due until June and it looks like my account was flagged for review.

Then I finally called StudentAid.gov and they weren't much help either. They told me more of the same and said that I'll eventually get a letter (presumably before my next payment due date) updating me on my account status. They said if I wanted to reach out to get specifics, I could file a complaint letter with the Dept. of Ed so I'ma do that just to see what they say and so that something is officially logged in writing.

YO... my servicer sent a letter saying they forgave my joints. I almost don't want to say shit until I can call them tomorrow to confirm. Unbelievable if true:

Congratulations! The Biden-Harris Administration has forgiven your federal student loan(s) listed below with Aidvantage in full. This debt relief was processed as part of the Biden-Harris Administration’s one-time account adjustment because your student loan(s) have been in repayment of at least 20 or 25 years. An adjustment to your account updated the number of payments that qualify towards income driven repayment (IDR) forgiveness. This forgiveness is effective as of 02/29/24.

WHAT YOU NEED TO KNOW

Here are some important points on this IDR forgiveness:

· Due to the American Rescue Plan Act of 2021 the balance of your loans that were forgiven is not considered taxable income for federal income tax purposes. Since state and local tax implications will vary, we recommend you contact a tax advisor for more information.

· Not all your federal student loans may be represented in the table above as you may have begun repaying each loan on a different date. If you have federal student loans that are not included in the table, please continue to make payments on them. Payments are not required until after the payment pause ends at the end of August. Your first payment will be due in October 2023. To find options to help with repayment, visit studentaid.gov.

· We have notified, or will notify by the end of the month, all national credit bureaus of your student loan forgiveness.

Date Mail Subject Correspondence Download 05/05/2024 Your Student Loans Have Been Forgiven Your Student Loans Have Been Forgiven

Account Summary As of 05/05/2024 (ET)

Chat

Unavailable

$0 Balance Loans

Loan Date Status 1-01 DL Consolidated - Subsidized 02/29/2024 Paid by discharge and/or write off 1-02 DL Consolidated - Unsubsidized 02/29/2024 Paid by discharge and/or write off

..does this sound like what ya'll have heard happens when they get the forgiveness?

Ahh shit my nigga. HELL FUCKInG YEAH!!YO... my servicer sent a letter saying they forgave my joints. I almost don't want to say shit until I can call them tomorrow to confirm. Unbelievable if true:

..does this sound like what ya'll have heard happens when they get the forgiveness?

Taking a shot for the good news my fellow Comrade received!!!

You’re showing an 84 month loan. Show the price of a 30k car with a 48 or 60 month loan at a 7.3% Apr which is what most people get. You’ve never been able to get a 30k car for $500 a month unless you had a 0% APR and stretched the payments out to over 7 years which 0% APR won’t allow anyway and even with taxes title and fee’s you going over that. Here I’ll show you.You haven't bought many cars if you think a 30k car with a 500 monthly payment is ok. I bought a loaded Yukon Denali in 21 & my note is $1,006.36 a month & it was 88K

Not actually correct brother... (I said car, not loan cost)

Plus I am a GM employee, so incentives are added in

I was just talking to a broker to locate a car for my 15 year old....

Your estimated monthly payment on a $30,000 new car loan at 7.3% is

$598

YO... my servicer sent a letter saying they forgave my joints. I almost don't want to say shit until I can call them tomorrow to confirm. Unbelievable if true:

..does this sound like what ya'll have heard happens when they get the forgiveness?

Ahh shit my nigga. HELL FUCKInG YEAH!!

Taking a shot for the good news my fellow Comrade received!!!

Maaan. I'll be doing the same tomorrow after I hear the words from the horse's mouth. I need absolute confirmation before I relax and take the next steps... if this is some scam somehow I'm a be heated.

I'll keep y'all posted.

Hell fucking YEAH!!!Got the email today. Forgiven in full. My Mohela balance shows -$350 they owe me for payments since January. I had a message waiting saying all good on my account.

Yall niggas about to get me fucked up taking shots today!

Happy for you my G!!!

And you about to get a REFUND! Hahahahahaha

No I'm not showing a 84 month loan, that's what's defaulted on the screen. Above it has $506 at 60 months.You’re showing an 84 month loan. Show the price of a 30k car with a 48 or 60 month loan at a 7.3% Apr which is what most people get. You’ve never been able to get a 30k car for $500 a month unless you had a 0% APR and stretched the payments out to over 7 years which 0% APR won’t allow anyway and even with taxes title and fee’s you going over that. Here I’ll show you.

Your estimated monthly payment on a $30,000 new car loan at 7.3% is

$598

I* know what my credit union told me, it was less, but not by much

That is amazing. Cheers!only had about 20 grand left... i work in government so mine was going to be forgiven in a few years anyway

but now its gone totally in may

Actually got another email todayThat is amazing. Cheers!

Zero balance!

Similar threads

- Replies

- 1

- Views

- 171

- Replies

- 25

- Views

- 1K

- Replies

- 2

- Views

- 262

- Replies

- 0

- Views

- 89