Not yet, but the premiums look good for covered calls.Anyone playing BITO, the new BTC ETF?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anyone investing heavily this year??

- Thread starter rph2005

- Start date

Not yet, but the premiums look good for covered calls.

Haven't looked at the options chain yet. Weirdly, it's not available for trade or lookup on TD Ameritrade.

There may be a huge money making opportunity if BTC continues to the upside and premiums stay low.

$SOFI

I'm on ToS, I see both the ETF and option chain.Haven't looked at the options chain yet. Weirdly, it's not available for trade or lookup on TD Ameritrade.

There may be a huge money making opportunity if BTC continues to the upside and premiums stay low.

*Full disclosure: I hold positions in $AMD*

Really looking forward to earnings from ASML, Netflix and Intel this week.

ASML just because they are the 'One Above all' in the Marvel Semiconductor Universe. Always good to get information on how many machines they're shipping out (and where).

Netflix simply because they're using AMD server parts, and I have a small percentage here. Maybe an AMD shout-out on how their server chip helped double bandwidth...

Intel's earning will be interesting. They're rolling out a new architecture with Alder Lake soon. Leaks on performance seem like the chip is legit. Definitely exciting for next quarter, but my focus will be on the server CPU revenue. Can AMD carve out more marketshare? I hope like hell they can.

$ASML

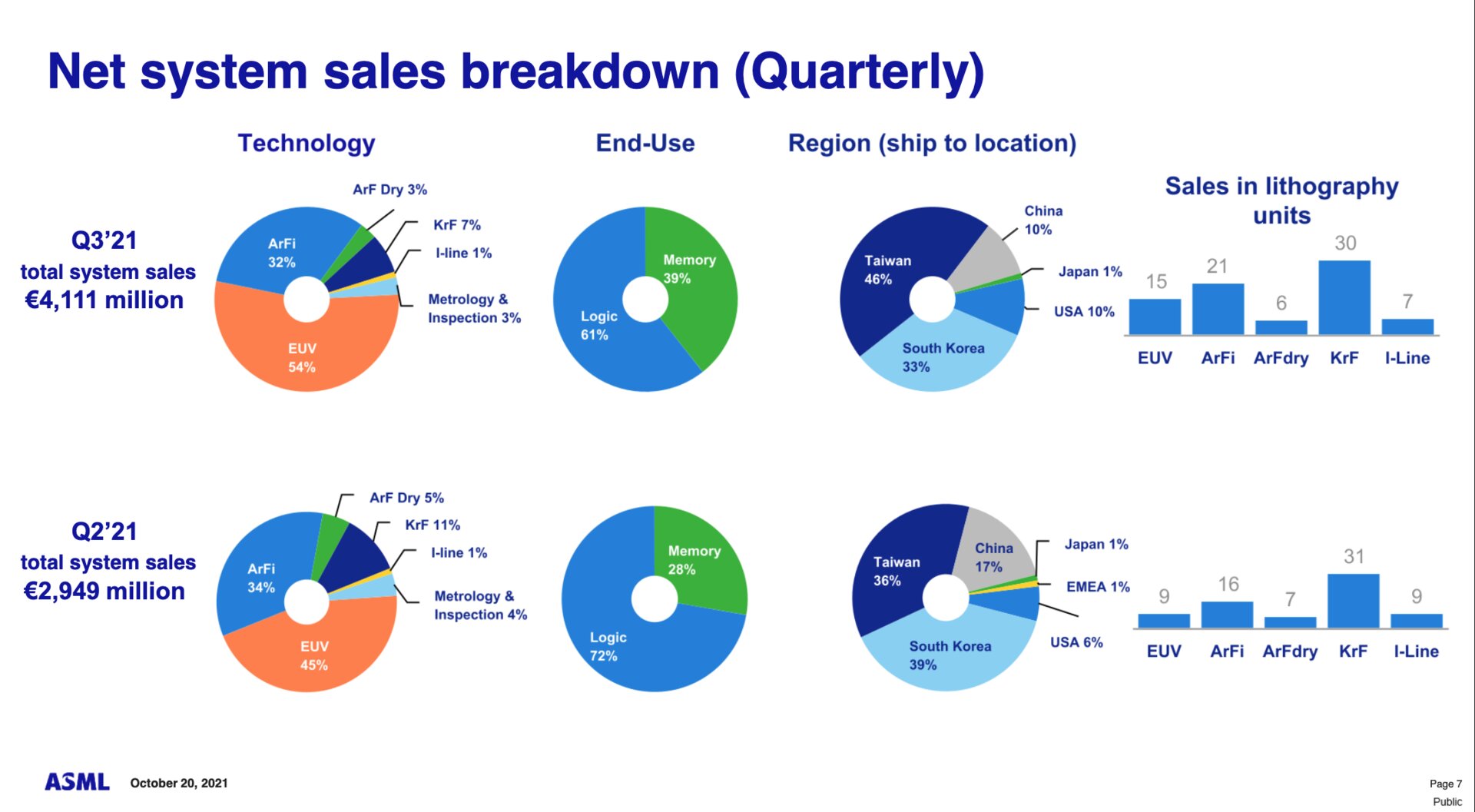

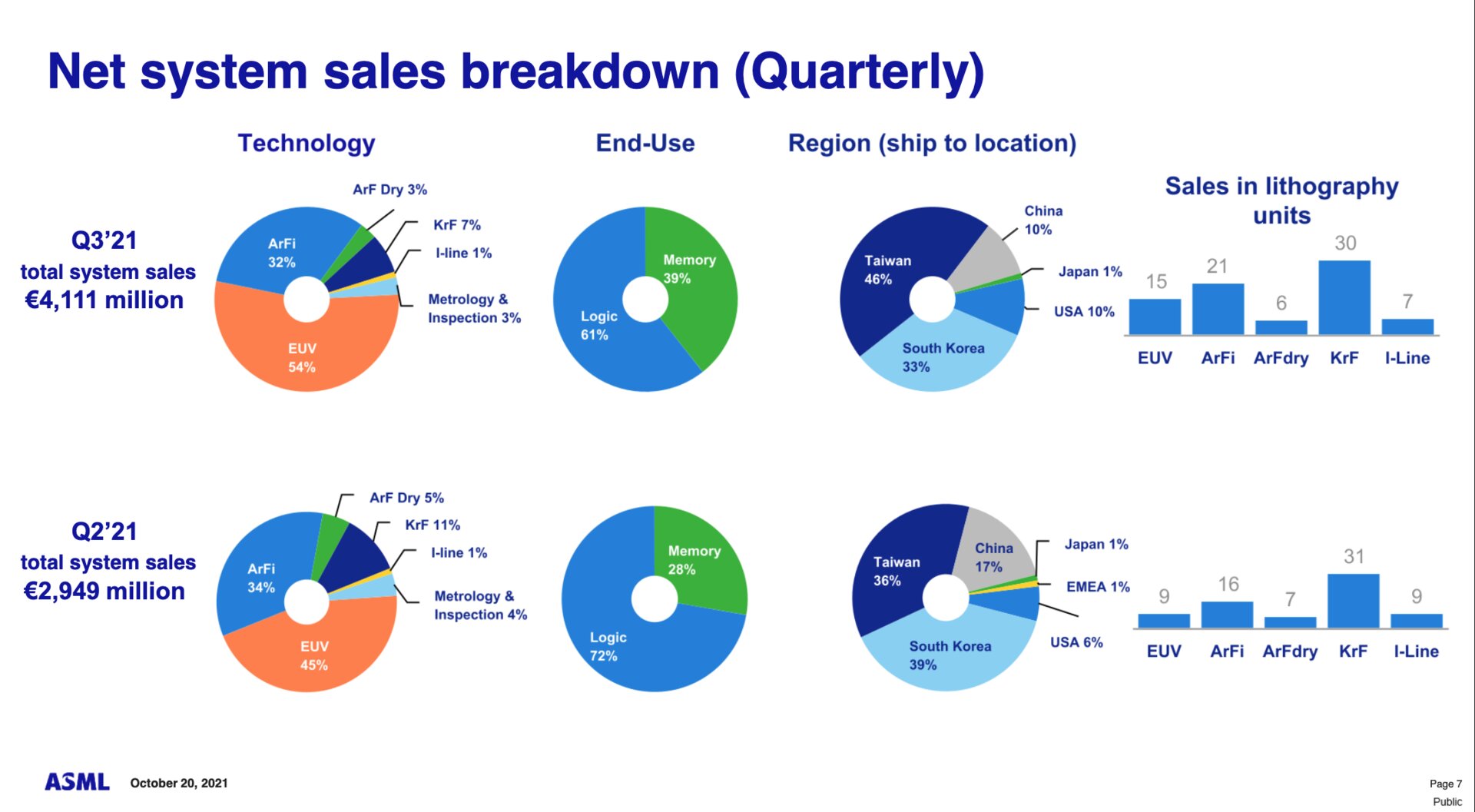

Expects to ship 55 EUV machines in 2022. EUV machines are needed to produce silicon wafers for chips and $ASML basically has a Monopoly. Quarterly sales by region is always interesting ($TSM, $INTC, Samsung, Global Foundries):

$ASML

Expects to ship 55 EUV machines in 2022. EUV machines are needed to produce silicon wafers for chips and $ASML basically has a Monopoly. Quarterly sales by region is always interesting ($TSM, $INTC, Samsung, Global Foundries):

This one and NVAX were massive shorts.

Anyone playing BITO, the new BTC ETF?

you lose money buying into the etf

just buy Bitcoin direct

I'm on ToS, I see both the ETF and option chain.

I see the problem, their web interface: https://trade.thinkorswim.com/?symbol=BITOF

doesn't display it, but the above stock is what is displayed.

When I logged into TOS, I was able to pull it up.

you lose money buying into the etf

just buy Bitcoin direct

Yeah, I'm well aware.

My BTC/Crypto portfolio is stacked.

I invest in both stocks and crypto and play them differently (and against) each other.

Looks like Johnson and Johnson and moderna are good plays for tomorrow. Their Corona-hoax booster shot just got FDA approval.

FDA authorizes booster doses of Moderna and Johnson & Johnson vaccines, says mix and match OK (msn.com)

FDA authorizes booster doses of Moderna and Johnson & Johnson vaccines, says mix and match OK (msn.com)

My brother made a grip on this today.Any one investing in trump deserves to get got

So is that dating app Match. I had no idea so many people used that shit.Square and Nike are running today!

*Full disclosure: I hold positions in $AMD*

Really looking forward to earnings from ASML, Netflix and Intel this week.

ASML just because they are the 'One Above all' in the Marvel Semiconductor Universe. Always good to get information on how many machines they're shipping out (and where).

Netflix simply because they're using AMD server parts, and I have a small percentage here. Maybe an AMD shout-out on how their server chip helped double bandwidth...

Intel's earning will be interesting. They're rolling out a new architecture with Alder Lake soon. Leaks on performance seem like the chip is legit. Definitely exciting for next quarter, but my focus will be on the server CPU revenue. Can AMD carve out more marketshare? I hope like hell they can.

$ASML

Expects to ship 55 EUV machines in 2022. EUV machines are needed to produce silicon wafers for chips and $ASML basically has a Monopoly. Quarterly sales by region is always interesting ($TSM, $INTC, Samsung, Global Foundries):

$INTC

Bought a few of cheap $INTC puts@0.89 with a 55 strike expiring tomorrow. SP dropped big time after hours. Hope it holds...

All I need now is a strong beat by $AMD and some $AMD- $XLNX merger news.

Last edited:

I’ll take that 2,000% gain in a day anytime. That is a decade + worth of ROI in 8 hours. Ain’t no emotion in this game.Any one investing in trump deserves to get got

$INTC

Bought a few of cheap $INTC puts@0.89 with a 55 strike expiring tomorrow. SP dropped big time after hours. Hope it holds...

All I need now is a strong beat by $AMD and some $AMD- $XLNX merger news.

$INTC getting that work, might be back up tomorrow though.

If you call that running then this must have been on one of Bezos’s rockets:Square and Nike are running today!

Digital World Acquisition Corp. (DWACW) Stock Price, News, Quote & History - Yahoo Finance

Find the latest Digital World Acquisition Corp. (DWACW) stock quote, history, news and other vital information to help you with your stock trading and investing.

Did you see the Apple processor? I think you may need to differently approach this situation.$INTC getting that work, might be back up tomorrow though.

do you think theres still room for it to run? Its ran up alot todayIf you call that running then this must have been on one of Bezos’s rockets:

Digital World Acquisition Corp. (DWACW) Stock Price, News, Quote & History - Yahoo Finance

Find the latest Digital World Acquisition Corp. (DWACW) stock quote, history, news and other vital information to help you with your stock trading and investing.finance.yahoo.com

Did you see the Apple processor? I think you may need to differently approach this situation.

$AAPL is doing amazing things. They're still a walled-garden though. I guess when you can optimize the CPU to the OS to the nth power you get those results. Probably the reason why it would make some sense for $MSFT... But I don't have that kinda faith.

$INTC ain't gotta worry yet as $AAPL doesn't have a server chip. Their issues are multifaceted though: lost manufacturing leadership, had a damn near monopoly in the server space so shareholders expect them to hold ground & now competition eating into marketshare, and competition eating into their gross margins... Can't sell their chips at a premium like the old days.

I'm worried about Intel. They have to hit on all of their manufacturing /design targets for the next 3 years. The CEO is thumping this chest that they'll be in the lead again in 2025.

Life changing moves happening out here.

PHUN is just as bananas

1200% today.

Frozed it.

$INTC

Bought a few of cheap $INTC puts@0.89 with a 55 strike expiring tomorrow. SP dropped big time after hours. Hope it holds...

Didn't waste any time here. Sold my 5 INTC20211022P55 @ around 5.40.

A quick $2200+ come up for 15 mins of work. $INTC could go lower but fuck it. Might as well get some tickets to the Wizards game today.

I had one, sold for +$299.Didn't waste any time here. Sold my 5 INTC20211022P55 @ around 5.40.

A quick $2200+ come up for 15 mins of work. $INTC could go lower but fuck it. Might as well get some tickets to the Wizards game today.

Contemplating?DWAC makes no damn sense.

Contemplating shorting it

SALMRunning with DWAC and the CACs right now APIDTMH

Contemplating?

Gotta come down at some point.

Momentum stocks crash hard.

I expect a 30% pullback.

I think only a commie wouldn’t engage in shorting them. Then again if the former president becomes president again maybe he will ban all other social media platforms.Gotta come down at some point.

Momentum stocks crash hard.

I expect a 30% pullback.

I think only a commie wouldn’t engage in shorting them. Then again if the former president becomes president again maybe he will ban all other social media platforms.

I don't put that past him.

He's only got a few years before dying.

Similar threads

- Replies

- 14

- Views

- 316

- Replies

- 38

- Views

- 2K

- Replies

- 34

- Views

- 1K