BGOL IS GIVING YOU THE GOODS, HUH? BETTER THAN A PAID COURSE, HUH? BUMP THIS THREAD ONE YEAR FROM TODAY AND POST

A SCREENSHOT OF YOUR GAINS. AND FUCKING WITH OPTIONS? TELL US HOW OFTEN YOU BLEW UP YOUR ACCOUNT BEFORE

YOU STARTED MAKING BANK.

Each to their own, bro. If you seriously think you can do it on your own, and established traders won't capitalize on their craft by selling the game, that's on you.

Some of us can read a cookbook and thrive, others need a cooking class. I take courses and read books. I like how reading and listening and applying methods complement each other. After all, until you hone on your style of trading, you're basically copying the other man's handwriting. If you sincerely think you will prosper from unverified no names

from a porn site where we can't even get a sticky, I feel for you. Not to HALO this thread, why not share and POST DEM BOOKS for the fam to cover.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anyone investing heavily this year??

- Thread starter rph2005

- Start date

You're right. They are hustlers and scam artists abound. And no, I can't claim the 1000 a day circle because I didn't hit a grand a day

on their terms. But that's on me. I did hit back to back on 1,000 a day at one time. But that wasn't consistent and I got got. Come to find out

later, I was cautioned by the course. That's the game. What I'm not doing is relying solely on books that can't pinpoint how I need to move.

So far, I'm enjoying the journey. I'm ebbing away from popular stocks and hot shock tips. I envision a hefty account this year, and see

myself adding more methods from putting in my screen time. I can't chase a hook up anymore. I waste time on a 100 DIY approach either.

This here... I have a professionally managed portfolio at Edward Jones, I got some money back after a property deal that went south. I met this white cat at a lounge, he was a former nurse now Financial Advisor and I was a former Counselor now entrepreneur. Long story short I was like I like dude and he had 20% returns for his clients that year. Started meeting with him monthly and learning. I invested enough money with him to make it worthwhile for him and me, but since Ive started doing my own investing, I paid fo some courses that like you said was a waste. It was pretty much same info out here but I was looking for the shortcut and or 'the way'. Ive realized you have to have a relationship with your expectation and your style. Last year I got back about 40% return, I know almost everybody had good years, but I got way more then the 7-10% average which Im good with.

I did options maybe 3-4 months... Had some great gains but seem to lose every single time I thought I knew what I was doing. Sobered me up back into my lane. Now? I invest into my ETFs, good growth stocks, and I take a couple educated swings at the fence that have been good (ie. Draftkings, Celh)

The biggest take away for me and my style is.... time.... If you invest in good companies, in 3-7-10-20 years you will outperform the bank and the markets. I got in Sq, Shop, Apple, Disney, QQQ, years ago...... They have all have had AMAZING returns.

I heard a trader say, "If a real trader is selling you a course, he's full of shit. Because a real trader who is currently trading won't have time to put a course together. He'll be too busy making money." I believe that.

Yes and No. If you're trading and you are making great returns, then other people will throw money at you literally to teach them.

Instead of teaching them one by one you make a course and sell it everybody. If you're really good you start your own hedgefund.

On the other hand if the course seller is claiming things without any evidence, then it is probably wise to ignore them.

Nowadays people suffer too much from FOMO and instant gratification.

This here... I have a professionally managed portfolio at Edward Jones, I got some money back after a property deal that went south. I met this white cat at a lounge, he was a former nurse now Financial Advisor and I was a former Counselor now entrepreneur. Long story short I was like I like dude and he had 20% returns for his clients that year. Started meeting with him monthly and learning. I invested enough money with him to make it worthwhile for him and me, but since Ive started doing my own investing, I paid for some courses that like you said was a waste. It was pretty much same info out here but I was looking for the shortcut and or 'the way'. Ive realized you have to have a relationship with your expectation and your style. Last year I got back about 40% return, I know almost everybody had good years, but I got way more then the 7-10% average which Im good with.

I did options maybe 3-4 months... Had some great gains but seem to lose every single time I thought I knew what I was doing. Sobered me up back into my lane. Now? I invest into my ETFs, good growth stocks, and I take a couple educated swings at the fence that have been good (ie. Draftkings, Celh)

The biggest take away for me and my style is.... time.... If you invest in good companies, in 3-7-10-20 years you will outperform the bank and the markets. I got in Sq, Shop, Apple, Disney, QQQ, years ago...... They have all have had AMAZING returns.

Sounds right. Took me a year to ponder the course thing. Got lucky with the corona virus and copped discounted stocks. Had a

20 percent gain until last week but it will bounce. Can't retire from impulse stock buying. Time is a big factor. Realized I need to sell most of last years

gains and come through with hella cash for trading. I'm testing scanning methods and scalping for profit. And studying order flow but those hot stock pics and fomo will hem you up as I'm bagholding on two stocks.

You're right. They are hustlers and scam artists abound. And no, I can't claim the 1000 a day circle because I didn't hit a grand a day

on their terms. But that's on me. I did hit back to back on 1,000 a day at one time. But that wasn't consistent and I got got. Come to find out

later, I was cautioned by the course. That's the game. What I'm not doing is relying solely on books that can't pinpoint how I need to move.

So far, I'm enjoying the journey. I'm ebbing away from popular stocks and hot shock tips. I envision a hefty account this year, and see

myself adding more methods from putting in my screen time. I can't chase a hook up anymore. I waste time on a 100 DIY approach either.

I've found, personally, and i'd bet its universally the same across the board. The thing that kills most trader is "money management." This is the market so you're going to lose. Anyone that tells you they win all their trades and never take a loss you need to get as far away from them as possible.

They're are lots of trading strategies and style out there and many of them can win for you. It's a matter of finding them and seeing which molds to your natural tendencies.

Money management is what kills folks. Taking a conservative position over an aggressive one. Reinvesting portions of positive gains into longer "investing" positions. Avoiding revenge and impuse trading etc.

That stuff takes time, imo.

But money managment is the #1 killer in this game.

1) Options As A Strategic Investment- By Lawrence McMillianEach to their own, bro. If you seriously think you can do it on your own, and established traders won't capitalize on their craft by selling the game, that's on you.

Some of us can read a cookbook and thrive, others need a cooking class. I take courses and read books. I like how reading and listening and applying methods complement each other. After all, until you hone on your style of trading, you're basically copying the other man's handwriting. If you sincerely think you will prosper from unverified no names

from a porn site where we can't even get a sticky, I feel for you. Not to HALO this thread, why not share and POST DEM BOOKS for the fam to cover.

2) Option Markets- By John Cox

3) How To Make Money In Stocks- By William J. O'Niell

4) Reading Price Charts Bar By Bar- By Al Brooks

Don't miss understand me, Bro. Not only do I read, but I've taken several courses on Udemy.com. I'm serious about this, not to say that you aren't. But I'm saying that we can share information and make money together.

There are places in this game where I am strong. There are are also places where my game is weak. That's where the sharing of knowledge comes into play.

I don't have to copy what anyone is saying, because I'm learning how to fish. I'm not taking fish from someone. I use my own scans, and I have my own methods because I've read and I've studied.

This is a Porn Board, no argument there. But, I know for a fact that there are Attorneys, Doctors, and Real Estate Brokers whom are a part of this Board. This really is a special place. Take advantage of what's offered here. I don't give a shit if the moderators can't see that this is probably the most important thread on the site. I see it, and I visit it everyday; because someone is going to say something profound and it's going to be added to my arsenal.

But hey, you do you. It's all to the good.

Perfect buying opportunity after the dippossible puts on sq and tesla for tomorrow

they are too connected to bitcoin

nah id just buy more and average down..you have plenty of time

more calls?

scouring the www to see how rolling down and backward on calendar effects the option delta and theta.

possible puts on sq and tesla for tomorrow

they are too connected to bitcoin

Goodluck! #BTC is a beast i don't understand and don't play with. Whenever i think it's going down or up it does the opposite. Point being it's so volatile that options is the last thing i'd play on #BTC.

I try to play options when i'm as sure as i can be on a move.

Doesn't always work ofcourse! But that's all i got for now.

Personally, I'd be shocked if the trend is bearish monday.

I'd guess alot of people are buying this dip and it's going to rally!

Price and volume is all u need. That will tell u everythingNow with that said what are we predicting for $SPY and the market overall come Monday? A rebound or continued downward spiral?

Price and volume is all u need. That will tell u everything

Elaborate further..

Meaning price action and volume determine where we go. All the indicators amd everything else is based on price and volume. You can look at a naked chart and see the trends and base ya plays on that actionElaborate further..

I'm in BFT March calls but I like the idea of the business long term. PaysafeI'm done with SPACs

but BFT looks like a good flip

15 before the merger

still very early

I might throw something small at it

This is from the weekly catalyst article I posted yesterday, but wanted to highlight it just in case folks missed it ...and think they may have any corresponding recovery plays:

..I'm still holding AMC, so hoping for the best

Also.. I noticed mad folks were out and about again in these streets this past Friday night with indoor dining capacity being boosted here in NYC. Eager to see if any of this moves the needle..

Friday - March 5

- All day - New York City movie theaters can open their doors again at 25% capacity. The exhibitor sector is looking for some normalization into the summer season with a backlog of blockbusters for AMC Entertainment (NYSE:AMC), Cineworld (OTCPK:CNNWF), IMAX (NYSE:IMAX), Marcus (NYSE:MCS), Reading International (NASDAQ:RDI), National CineMedia (NASDAQ:NCMI) and Cineplex (OTCPK:CPXGF).

..I'm still holding AMC, so hoping for the best

Also.. I noticed mad folks were out and about again in these streets this past Friday night with indoor dining capacity being boosted here in NYC. Eager to see if any of this moves the needle..

You know how we can post pics with tinypic or imgur an shit like that, what do we use to post books? I got some that will help this thread.

Meaning price action and volume determine where we go. All the indicators amd everything else is based on price and volume. You can look at a naked chart and see the trends and base ya plays on that action

Gotcha you and that's how we normally trade. I thought you had something specific in mind..Thanks!

You know how we can post pics with tinypic or imgur an shit like that, what do we use to post books? I got some that will help this thread.

You got dough for tesla options?

possible puts on sq and tesla for tomorrow

they are too connected to bitcoin

I disagree with the bold statements, speaking from my own experiences as well as my business partners with our own fund(s). Most new people want information for free AND even if people do give money to join a fund, they typically won’t have enough with the larger ones that do extremely well. (When you have to give a minimum of $100k or $1M)

the people online that teach classes make more money through selling than trading and the majority of them rarely trade real money AT ALL. I know this for a fact. Check Nathan Michaud’s case for example. Some of them can’t legally invest anyway because of boiler room style tactics and fraud that they’ve been charged with and convicted by the SEC. Remember Martin Shkreli? He will likely be banned from trading for life.

I don’t have time to teach people one on one because of my intense research schedule but I do take contract with people to build a financial plan for them based on a variety of factors. Most so-called black people have little knowledge about investing and even less about the money and banking system which is the only reason I’ve participated in this thread to drop some nuggets every now and then to help us out but it takes too much time to teach all facets.

People like Warrior Day Trading, Investorslive, Timothy Sykes, the tiktok/fintok, the Twitter furus are just modern day pump and dump shops. Then you have the shills like Jim Cramer on CNBC.

I do agree with you about FOMO and instant gratification which is what I have posted about in this thread many times because people do not have the patience or a sound plan or strategy to make the money needed for great returns. Most inexperienced investors and new traders think 100% gains are normal when that is hall of fame skill level and not sustainable for a long period of time. Last year was historic for my fund due to some penny stock plays, cryptocurrencies and the COVID bubble but that won’t happen this year. The best skills to have are information(inside or outside), research, patience and risk management (which all come with a PLAN)

the people online that teach classes make more money through selling than trading and the majority of them rarely trade real money AT ALL. I know this for a fact. Check Nathan Michaud’s case for example. Some of them can’t legally invest anyway because of boiler room style tactics and fraud that they’ve been charged with and convicted by the SEC. Remember Martin Shkreli? He will likely be banned from trading for life.

I don’t have time to teach people one on one because of my intense research schedule but I do take contract with people to build a financial plan for them based on a variety of factors. Most so-called black people have little knowledge about investing and even less about the money and banking system which is the only reason I’ve participated in this thread to drop some nuggets every now and then to help us out but it takes too much time to teach all facets.

People like Warrior Day Trading, Investorslive, Timothy Sykes, the tiktok/fintok, the Twitter furus are just modern day pump and dump shops. Then you have the shills like Jim Cramer on CNBC.

I do agree with you about FOMO and instant gratification which is what I have posted about in this thread many times because people do not have the patience or a sound plan or strategy to make the money needed for great returns. Most inexperienced investors and new traders think 100% gains are normal when that is hall of fame skill level and not sustainable for a long period of time. Last year was historic for my fund due to some penny stock plays, cryptocurrencies and the COVID bubble but that won’t happen this year. The best skills to have are information(inside or outside), research, patience and risk management (which all come with a PLAN)

Yes and No. If you're trading and you are making great returns, then other people will throw money at you literally to teach them.

Instead of teaching them one by one you make a course and sell it everybody. If you're really good you start your own hedgefund.

On the other hand if the course seller is claiming things without any evidence, then it is probably wise to ignore them.

Nowadays people suffer too much from FOMO and instant gratification.

The futures are ripping up on Bloomberg TV. Is that shit right?

too early, might mean a red day

lets see what asia does

YeaYou got dough for tesla options?

Yep futures don't matter till like 3amtoo early, might mean a red day

lets see what asia does

The futures are ripping up on Bloomberg TV. Is that shit right?

10Yr...

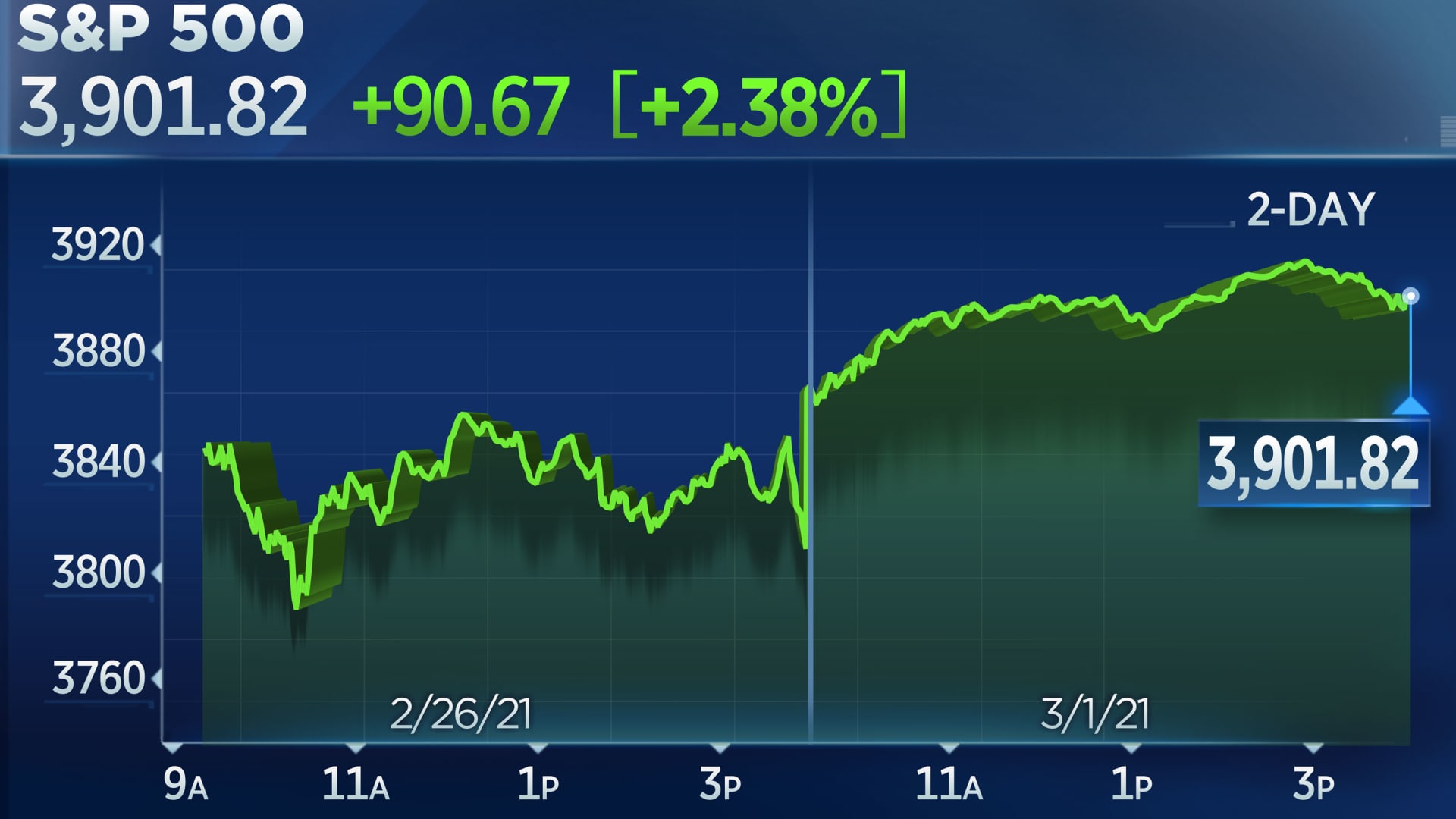

Stocks rocket higher in broad rally to start March, S&P 500 jumps 2% for best day since June

Yields appeared to be stabilizing and the 10-year rate was off its high from last week, which encouraged investors that the rapid rise in rates was slowing.

Right. Do you use RSI to determine that?‘The time to buy stocks is when they are on sale, and not when they are high priced because everyone wants to own them"

yea rsi is a good tool but i watch support and resistance as wellRight. Do you use RSI to determine that?

inflation is a huge concern. People have moved to cryptocurrency and land instead of precious metals. In theory, he is correct about the bond yields but this is not a typical situation we are in. The rise in bond yields is the 2nd to last step of destroying the middle class, the stimulus will be the last, then you’ll see another Great Depression.

puru is a good follow

And VolatilityMeaning price action and volume determine where we go. All the indicators amd everything else is based on price and volume. You can look at a naked chart and see the trends and base ya plays on that action

Similar threads

- Replies

- 5

- Views

- 143

- Replies

- 5

- Views

- 182

- Replies

- 2

- Views

- 98