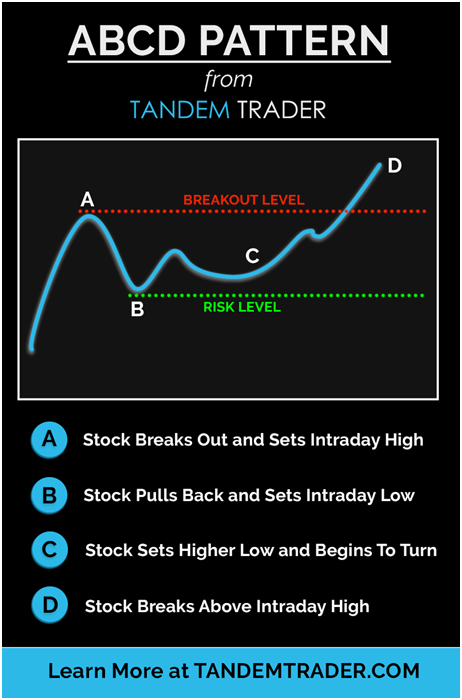

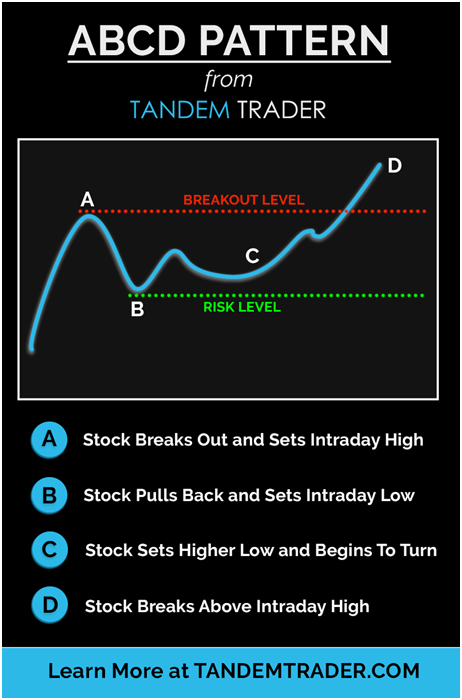

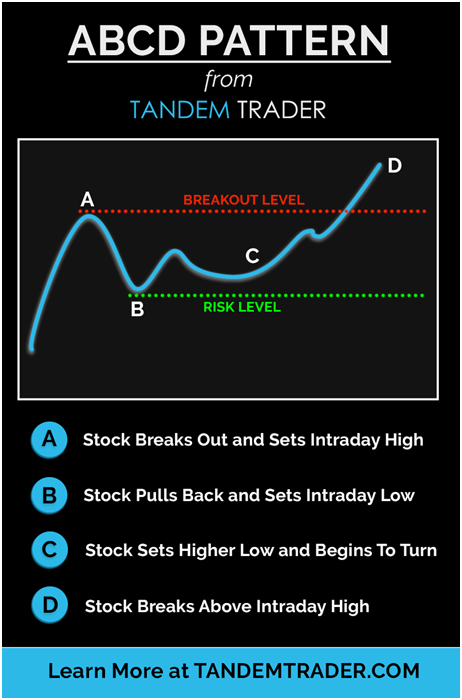

classic ABCD pattern for the breakout.....

Missed opportunity today. I was watching NNDM in this channel, but missed it about to break out yesterday.

ie:

classic ABCD pattern for the breakout.....

Missed opportunity today. I was watching NNDM in this channel, but missed it about to break out yesterday.

$HOME was $1 last year - and guess who picked it up then?47% Here.... Thanks Chris Sain...

KonnichiwaWhat you know about ichimoku?

Props on posting the charts and what they mean. That is a key that is going to help brothas pick this shit up quick because we are already smarter than the Neanderthal , we just are too ignorant (unaware of what we can do).classic ABCD pattern for the breakout.....

ie:

Still learning:

How many of you use position size as a rule? I am learning to be disciplined and factor out emotions in my trades got burnt both ways, too much or too little. Again thanks to all the contributors.

Money at Risk ÷ Cents at Risk = Ideal Position Size

ADMP with a major push in AH.........KODK slowly grinding...had a busy today with work......

swings for tomorrow....i'd say jump in now while there's still time.

MDGS, ZSAN, CLSN, ADMP, & KODK

Oh wise one, what do the charts reveal to us about ARWR? I don’t know how to read charts. Never bothered. But since you’re the chart whisperer up in here, please run arwr and cvs thru your thingamagiga and let’s see what it says

Watching WKHS to see if it breaks below the channel, if so might go back to $20 for another swing up. If it bounces in the channel, I might be able to get ~$5 out of it.

ADMP Open @ 2.34 90% gain for me. Sudden dip triggered my stop loss. Cant be mad $681 while sleeping.ADMP with a major push in AH.........KODK slowly grinding...

yeah the support level for it is at 1.81.......as long as it stays above....you're good. normally i gauge my stop losses and not wait til it gets so close to the support level before i sell. but for those that may be still in ADMP....if it reaches that mark (1.81)....sell....if not....it has the potential to keep rising thru the day.ADMP Open @ 2.34 90% gain for me. Sudden dip triggered my stop loss. Cant be mad $681 while sleeping.

Thanks again "Coldchi", respect.

How many spacs this nigga gonna make at one time lol

This transaction is a PIPE. Thats where he invests money into a SPAC thats needs more money to close the deal.How many spacs this nigga gonna make at one time lol

Oh wise one, what do the charts reveal to us about ARWR? I don’t know how to read charts. Never bothered. But since you’re the chart whisperer up in here, please run arwr and cvs thru your thingamagiga and let’s see what it says

Thanks, I was reading up last night like wtf is a PIPE!This transaction is a PIPE. Thats where he invests money into a SPAC thats needs more money to close the deal.

How’s that webull free stock thing ?Webull

$AMD eating off Intel's poor earnings reaction.

Gonna see how these $INTC February puts feel. May bite if the price is right. ER on Jan 21. Very curious as to their 2021 outlook.

.

.OPTT still going.......called OPTT as a swing 2 days ago...........off to the races

The stocks I've gotten for referrals have all been pretty cheap ones. Let me know if you need a referral link.How’s that webull free stock thing ?

You already missed it. There may still be room for it to shoot up higher however. Im buying puts to be safe.So when does the GME short start?

I picked up a few Feb 19 $30 puts (Lots of volume for it). Lets see what happens.You already missed it. There may still be room for it to shoot up higher however. Im buying puts to be safe.

So when does the GME short start?

Craziness! The shorts are covering their positions. They've essentially bought all their position to minimize losses which artificially increased the $GME price within a matter of minutes. The IV on $GME is unreal...like 350%

Fuck that! Not touching any of that drama