Interesting , who is buying that land? Developers?Those lots ain't for sale to the common man.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

So when’s the housing bubble bursting?

- Thread starter Dr. Truth

- Start date

Yep!Interesting , who is buying that land? Developers?

Network = real net worthMeet some new friends...your friends and family holding you down..until I did that...my life was FUCKED...brah

How did you extend your circle?

Im guilty of this myself

Here in Ny people are moving far out of the city where they can stretch the NY dollar and making long commute.So here’s my question: how the hell are ordinary ninjas like myself supposed to ever get a sliver of this housing dream? My credit is great but I’m not sitting on a pile of cash. And there’s a lot of people who aren’t. How does the government expect ordinary people to get home ownership? I’m not whining or anything just curious how you guys all went about this.

Some as far p.a.

So here’s my question: how the hell are ordinary ninjas like myself supposed to ever get a sliver of this housing dream? My credit is great but I’m not sitting on a pile of cash. And there’s a lot of people who aren’t. How does the government expect ordinary people to get home ownership? I’m not whining or anything just curious how you guys all went about this.

you got to get in where you fit in...are you ready to start a family? going solo/not needing as much space/perhaps go condo?

'just buy a house' is generalized advice...it has to be right for your individual situation

i moved into my house [mine, the bank's, and uncle sam's] before 2005, after a divorce and living apartment life for a few years during the end of the last run-up in prices...bad timing.

but...it is in southern california. good timing

so...over time the prices ran up, but keep in mind...you're paying for repairs, roof, etc over that time, so that's a factor, it's not just like you move in and stack. the equity is tied up in the house until you refi or sell

there are always first time homebuyer programs, fha, naca...etc. where there is a will there's a way

make sure you're ready to take the leap...close to work? decent neighborhood? 2 incomes to make it work or just you? all factors

but be ready for the downsides too...

don't let the dream become a nightmare...

Network = real net worth

How did you extend your circle?

Im guilty of this myself

First thing...open a business... Then we can talk... brah

Thats not what he meansNot many friends going to loan people 6 figures for a down payment

Good pointThis article was funded by a mortgage lending company. They profit from optimism in the housing market. Whenever you see an article that predicts a continued rise in housing prices, look at the funding source and the group polled. Lately, either the groups polled or the sponsor of the article are mortgage lenders, Realtor Associations, builders, or housing developers. I remember seeing the same thing prior to the 2008 housing collapse.

A lot of the companies that were buying houses have stopped. Zillow stopped buying homes late last year. https://www.npr.org/2021/11/03/1051...-renovating-homes-and-cut-25-of-its-workforce

Home Flipping is declining. I actually talk to some of those House Flipping cold callers. They are way more conservative with their offers process than they were last year. They want to inspect and appraise the house now.

We are headed for a Housing downturn. Opportunity is coming if your funds are together. The most financial savy people that I am around have pulled equity lately.

Imma DM you…brahFirst thing...open a business... Then we can talk... brah

Not many friends going to loan people 6 figures for a down payment

Nah...that ain't what I meant...folks that's moving can point you In a different direction for free... brah

Where are you seeing 500k houses in Cali other than Barstow , El Centro or Bakersfield? Also I’m seeing homes listed for 800k in Oakland selling for 1.2 Million all cash offers. 80k over asking isn’t going to get it done you need to go 200k and above asking to have a shot. The suburbs are even worse. “ People “ snatching up 3 and 4 houses at a time all cash way over asking

Im in the IE famo so San Bernardino, Fontana, Rialto, Ontario, etc. You can even take it to Victorville, Hesperia, Beaumont, etc.

Interesting , who is buying that land? Developers?

That's exactly who's buying them. They are buying up lots placing warehouses on them and then selling them to Amazon...logistics...etc

In addition to that, other subdivision developers are grabbing any suburban vacant lot that can!

They're also building undersized overpriced apartments, parking decks, and storage units.That's exactly who's buying them. They are buying up lots placing warehouses on them and then selling them to Amazon...logistics...etc

In addition to that, other subdivision developers are grabbing any suburban vacant lot that can!

That's what the problem is. It's not home flipping it's corporations who siphoned money from the public through the housing and financial fallout and bailout now trying to commodify housing into rentals. The economy can't sustain the bloodsucking. Incomes aren't keeping up. Shits going to give way.It was a story in the Washington Post last week that talked about these companies with all cash offers then turning around to rent the property out. They talked about one neighborhood in Charlotte that added a rule to their HOA that home purchases in their neighborhood can't be rented out until 24 months have passed.

Fuck with me Killah I own a dessert truckFirst thing...open a business... Then we can talk... brah

They're also building undersized overpriced apartments, parking decks, and storage units.

Yup storage units are on the rise

Fuck with me Killah I own a dessert truck

You make desserts? Brah....Shit...you got bunches of clientele...huh?

Hell naw.... projects everywhere, apartments bring high crime. Immigration? What about giving free trade school for American citizens? Brah

Yep. That's one of the reasons NIMBY & zoning politics make it harder to build starter homes or affordable apartments in a lot of areas now.. And as you said immigration is an issue, there's a major labor shortage to build the homes needed..

The market is gonna be fucked up for years imo. With inflation running wild, it's a reason institutional investors are parking their money in real estate.

Even with interest rates going up, I don’t see prices going back to where they were before the pandemic.

What state they in? Inventory here is low as hell. Ain’t going to be an influx in homes here. They limited new houses being built have a waiting list and start in the millions

Nah man. SF and the Bay Area are actually shrinking. Especially when it comes to high-income earners. Alot of the SF Techies have moved to Denver, Austin, North Carolina, or East Coast. There has definitely been an increase of homes for sale in the Oakland Hills. Yes, we have laws that limit inventory, but much of the affordability of the higher prices is based on buyers selling their old home at a premium.

It was just a chart that I can't embed. It had the data points for 2018-2021 that the one below is missing including the '21 dip you pointed out:

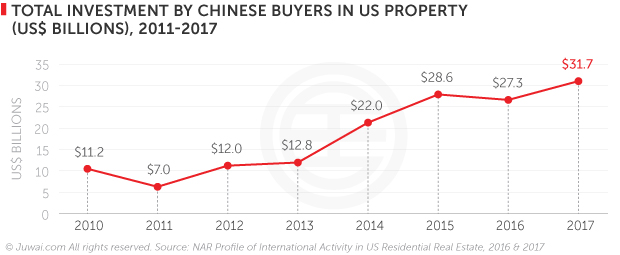

Obviously not all of that is in residential properties but you can see why this plays a factor in the rising prices.

Source= National Association of REALTORS.

I invest in Multifamily Real Estate. There are far less Chinese Investment than there was in the past.

Hell naw.... projects everywhere, apartments bring high crime. Immigration? What about giving free trade school for American citizens? Brah

That needs to happen, but it's going to take a while to put those programs in place. We need people with those skills yesterday!

That needs to happen, but it's going to take a while to put those programs in place. We need people with those skills yesterday!

We still gone need them tomorrow...brah

We still gone need them tomorrow...brah

That's why these schools are also a good idea. The immigrants are just a quick fix in the meantime.

That's why these schools are also a good idea. The immigrants are just a quick fix in the meantime.

Explain immigrants getting my brahs' money...a quick fix?

You need to cash out a 401k or you have no shot. Or win lotto.

Or if you can go VA loan. If you have an uncle, cousin or veteran in your family you can get them to get the house then take over the loan. Won’t have to pay shit down either but there will be some closing costs which ain’t shit like a down payment at all. At most no more than 4K. My buddy did this with his uncle who unfortunately passed away.

Last edited:

Ain't you a immigrant from Canada or some shit?That's why these schools are also a good idea. The immigrants are just a quick fix in the meantime.

Been at it for just a little bit but an ever growing clientele has never been a problemYou make desserts? Brah....Shit...you got bunches of clientele...huh?

https://www.bbc.com/news/business-61027374

Canada proposes foreign buyers home real estate ban

Canadian Prime Minister Justin Trudeau has proposed a two-year ban on some foreigners buying homes.

The measure comes as the country grapples with some of the worst housing affordability issues in the world.

Prices have jumped more than 20%, pushing the average home in Canada to nearly C$817,000 ($650,000; £495,000) - more than nine times household income.

But industry analysts say it's not clear a ban on foreign buyers will address the problem.

Data on purchases by foreign buyers in Canada is limited, but research suggests they amount for a small fraction of the market.

"I don't think it's going to have a huge impact," said Ben Myers, president of advisory firm Bullpenn Research & Consulting in Toronto, who found foreigners accounted for just 1% of purchases in 2020, down from 9% in 2015 and 2016.

"It's a fairly low number and let's face it, the people that really want to buy ... are going to find alternative ways to do it."

Mr Myers said the soaring housing costs reflect strong population growth and a shortage of supply, due in part to rules that restrict development.

The issues have worsened since the pandemic hit in 2020, when policymakers in Canada and elsewhere slashed interest rates to stabilise the economy, lowering borrowing costs and boosting demand even further.

The moves have fuelled the soaring housing prices seen in many markets around the world, but in Canada the disconnect between home prices and incomes is one of the most dramatic, according to OECD data.

Campaign promise

Mr Trudeau pledged to tackle housing affordability during his campaign for election last year.

In addition to the temporary ban on foreign buyers, the budget proposal his government unveiled on Thursday sets aside billions to spur new construction and proposes new programmes, such as a tax-free savings account for first-time buyers.

Mr Trudeau has also discussed banning certain bidding processes that favour investors, who by some measures have accounted for about one in five homes purchased in Canada since 2014.

The proposed ban on foreign buyers would exempt permanent residents and foreign students and workers, as well as those buying their primary residence.

The proposal builds on actions such as special taxes that some parts of Canada have already taken against out-of-town and foreign buyers.

In Ontario, for example, provincial Premier Doug Ford recently announced plans to raise an existing tax on foreign buyers from 15% to 20% and expand it beyond Toronto to the entire province.

While foreign purchases are not the driver of the affordability issues, taxing them at least captures revenue that can be re-deployed to address such problems, said Steve Pomeroy, head of Focus Consulting, a housing policy firm.

"If you ban them, you don't really have much of an impact on suppressing rising home prices and you give up the revenue," he said.

New Zealand introduced a similar measure banning foreign buyers in 2018.

"It's good politics because it's easy to blame a victim that nobody cares about," Mr Pomeroy added. "I don't think it will have much of an impact."

Paul Kershaw, professor at the University of British Columbia and founder of Generation Squeeze, also said he saw little in Mr Trudeau's proposal likely to slow price increases or significantly address affordability.

"It's not clear the housing measures will be sufficient to break Canada's addiction to high and rising home prices," he said, noting that for existing homeowners, the high prices help amass wealth.

Mr Pomeroy said he does expect price appreciation to slow in coming months, as the central bank raises interest rates. The Canadian housing market is particularly susceptible to such moves, since many buyers rely on five-year mortgages rather than the long-term ones common in the US and UK.

But higher interest rates will only make it less affordable for prospective buyers trying to break into the market, he warned.

Mr Myers said over the long-term, he expects hot markets such as Toronto and Vancouver to become dominated by renters, as regular buyers get priced out of the market, unless politicians address supply.

But Mr Pomeroy said high development costs means that adding supply will not necessarily reduce prices, unless the additions are dramatic.

"Unless you've got born into the right family ... the prospects for young buyers are quite dim," he said

Canada proposes foreign buyers home real estate ban

Canadian Prime Minister Justin Trudeau has proposed a two-year ban on some foreigners buying homes.

The measure comes as the country grapples with some of the worst housing affordability issues in the world.

Prices have jumped more than 20%, pushing the average home in Canada to nearly C$817,000 ($650,000; £495,000) - more than nine times household income.

But industry analysts say it's not clear a ban on foreign buyers will address the problem.

Data on purchases by foreign buyers in Canada is limited, but research suggests they amount for a small fraction of the market.

"I don't think it's going to have a huge impact," said Ben Myers, president of advisory firm Bullpenn Research & Consulting in Toronto, who found foreigners accounted for just 1% of purchases in 2020, down from 9% in 2015 and 2016.

"It's a fairly low number and let's face it, the people that really want to buy ... are going to find alternative ways to do it."

Mr Myers said the soaring housing costs reflect strong population growth and a shortage of supply, due in part to rules that restrict development.

The issues have worsened since the pandemic hit in 2020, when policymakers in Canada and elsewhere slashed interest rates to stabilise the economy, lowering borrowing costs and boosting demand even further.

The moves have fuelled the soaring housing prices seen in many markets around the world, but in Canada the disconnect between home prices and incomes is one of the most dramatic, according to OECD data.

Campaign promise

Mr Trudeau pledged to tackle housing affordability during his campaign for election last year.

In addition to the temporary ban on foreign buyers, the budget proposal his government unveiled on Thursday sets aside billions to spur new construction and proposes new programmes, such as a tax-free savings account for first-time buyers.

Mr Trudeau has also discussed banning certain bidding processes that favour investors, who by some measures have accounted for about one in five homes purchased in Canada since 2014.

The proposed ban on foreign buyers would exempt permanent residents and foreign students and workers, as well as those buying their primary residence.

The proposal builds on actions such as special taxes that some parts of Canada have already taken against out-of-town and foreign buyers.

In Ontario, for example, provincial Premier Doug Ford recently announced plans to raise an existing tax on foreign buyers from 15% to 20% and expand it beyond Toronto to the entire province.

While foreign purchases are not the driver of the affordability issues, taxing them at least captures revenue that can be re-deployed to address such problems, said Steve Pomeroy, head of Focus Consulting, a housing policy firm.

"If you ban them, you don't really have much of an impact on suppressing rising home prices and you give up the revenue," he said.

New Zealand introduced a similar measure banning foreign buyers in 2018.

"It's good politics because it's easy to blame a victim that nobody cares about," Mr Pomeroy added. "I don't think it will have much of an impact."

Paul Kershaw, professor at the University of British Columbia and founder of Generation Squeeze, also said he saw little in Mr Trudeau's proposal likely to slow price increases or significantly address affordability.

"It's not clear the housing measures will be sufficient to break Canada's addiction to high and rising home prices," he said, noting that for existing homeowners, the high prices help amass wealth.

Mr Pomeroy said he does expect price appreciation to slow in coming months, as the central bank raises interest rates. The Canadian housing market is particularly susceptible to such moves, since many buyers rely on five-year mortgages rather than the long-term ones common in the US and UK.

But higher interest rates will only make it less affordable for prospective buyers trying to break into the market, he warned.

Mr Myers said over the long-term, he expects hot markets such as Toronto and Vancouver to become dominated by renters, as regular buyers get priced out of the market, unless politicians address supply.

But Mr Pomeroy said high development costs means that adding supply will not necessarily reduce prices, unless the additions are dramatic.

"Unless you've got born into the right family ... the prospects for young buyers are quite dim," he said

I left SoCal some years ago. Dem house prices….for dayum. U make it seem possible. The short answer is, just get in to it. I get that. But It’s still difficult. I stopped after over a dozen offers. Everyone else just has the liquid cash to pay over askingyou got to get in where you fit in...are you ready to start a family? going solo/not needing as much space/perhaps go condo?

'just buy a house' is generalized advice...it has to be right for your individual situation

i moved into my house [mine, the bank's, and uncle sam's] before 2005, after a divorce and living apartment life for a few years during the end of the last run-up in prices...bad timing.

but...it is in southern california. good timing

so...over time the prices ran up, but keep in mind...you're paying for repairs, roof, etc over that time, so that's a factor, it's not just like you move in and stack. the equity is tied up in the house until you refi or sell

there are always first time homebuyer programs, fha, naca...etc. where there is a will there's a way

make sure you're ready to take the leap...close to work? decent neighborhood? 2 incomes to make it work or just you? all factors

but be ready for the downsides too...

don't let the dream become a nightmare...

Explain immigrants getting my brahs' money...a quick fix?

We have a severe housing shortage. Bringing in people who can make a new housing ASAP is good for everyone. Right now there's not enough American workers in this field.

That needs to happen, but it's going to take a while to put those programs in place. We need people with those skills yesterday!

We have a severe housing shortage. Bringing in people who can make a new housing ASAP is good for everyone. Right now there's not enough American workers in this field.

How does the US qualify the skills of the immigrants?

IMO we should start restricting immigration. Have a point system that leans toward immigrants with high leverage skills. The influx of low-skilled immigrants hasn't benefitted our economy because they take more from the system in form of benefits than they put in in form of value of labor. I also agree with killagram in that we should start training and providing jobs to our citizens.

Be patient and stack your money. Interest rates are increasing which reduces buying power. Inflation is increasing which reduces buying power. People are working from home and relocating outside the dense cities. The "work from home" movement is also reducing the commercial real estate market. The US actually has alot of open land. The US population is centered in urban centers with miles of vacant land in between. As the work from home movement catches on, these open land areas will become more populated. This is already happening in areas like Bastrop County outside of Austin.

DO NOT get caught up in the Frenzy and FOMO of thinking housing is just going to increase forever. That doesn't make sense. No market behaves that way, including housing. I remember the last housing downturn. The same people arguing with me about the housing market direction were asking to short sale their homes a year later. Every few years we get opportunities for wealth. The key is to prepare for them and execute then they are available. Personally, I have reduced spending, cashed out my riskier investments, and taken money out of my Real Estate holdings to prepare for the coming downturn.

DO NOT get caught up in the Frenzy and FOMO of thinking housing is just going to increase forever. That doesn't make sense. No market behaves that way, including housing. I remember the last housing downturn. The same people arguing with me about the housing market direction were asking to short sale their homes a year later. Every few years we get opportunities for wealth. The key is to prepare for them and execute then they are available. Personally, I have reduced spending, cashed out my riskier investments, and taken money out of my Real Estate holdings to prepare for the coming downturn.

How does the US qualify the skills of the immigrants?

IMO we should start restricting immigration. Have a point system that leans toward immigrants with high leverage skills. The influx of low-skilled immigrants hasn't benefitted our economy because they take more from the system in form of benefits than they put in in form of value of labor. I also agree with killagram in that we should start training and providing jobs to our citizens.

Not only is the training a good idea, it's essential! But first you have to establish the schools and hire the teachers. Then you end up with a bunch of inexperienced construction workers. Folks who are more likely to get injured, die, or change professions.

That's why we need people who have already dedicated their professional life to the trade to get things started. Right now America doesn't have enough.

There are highly skilled building trades people all over the world. Many have a hard time working in the United States because the government recognizes college degrees far more than trades. I would like to see the government change this policy for a few years.

Don't know the specifics on how you would qualify the trades people, I'll leave that to better minds than mine.

The advantage for born Americans is that once this project is successful there will be a huge availability of low cost apartments, duplexes, and retail spaces that can be purchased through a federal housing program.

Similar threads

- Replies

- 1

- Views

- 81

- Replies

- 27

- Views

- 602

- Replies

- 10

- Views

- 348

- Replies

- 0

- Views

- 167