by

UrbanTurf Staff

A home in Palisades that is under contract.

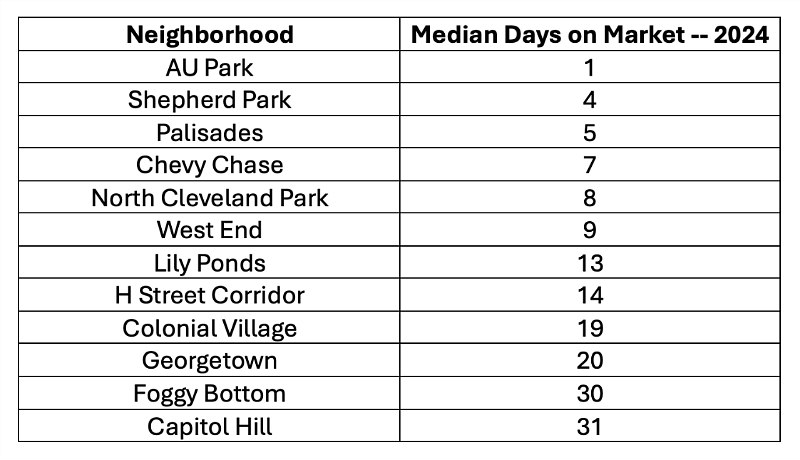

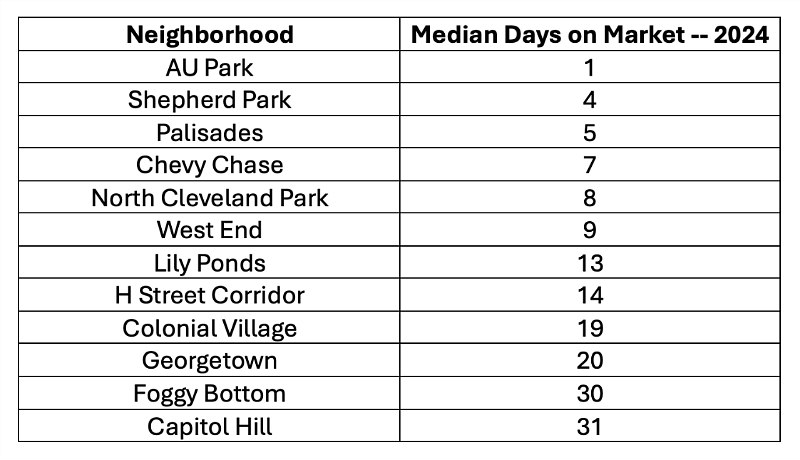

As the spring market gets going, UrbanTurf is taking a look around DC to see how long homes are taking to sell in various neighborhoods.

Using median days on market data for advertised subdivisions, we highlighted areas where homes are selling quickly, as well as where listings are taking a bit longer to sell.

Click to enlarge.

American University Park, an upper NW DC neighborhood where homes sell in the blink of an eye, is seeing listings move at the quickest pace, spending just a day on the market. In other neighborhoods, like Shepherd Park along 16th Street as well as Chevy Chase DC, homes are selling in a week or less, on median.

While we are still only a couple months into the year, homes are spending a bit longer on the market in places like Georgetown and Capitol Hill. The median days on market statistic is two to three weeks for these neighborhoods, but that is much lower than at this time last year.

www.zdnet.com

www.zdnet.com