You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Unemployment Rate Falls Below 8 Percent. Game Changer?

- Thread starter thoughtone

- Start date

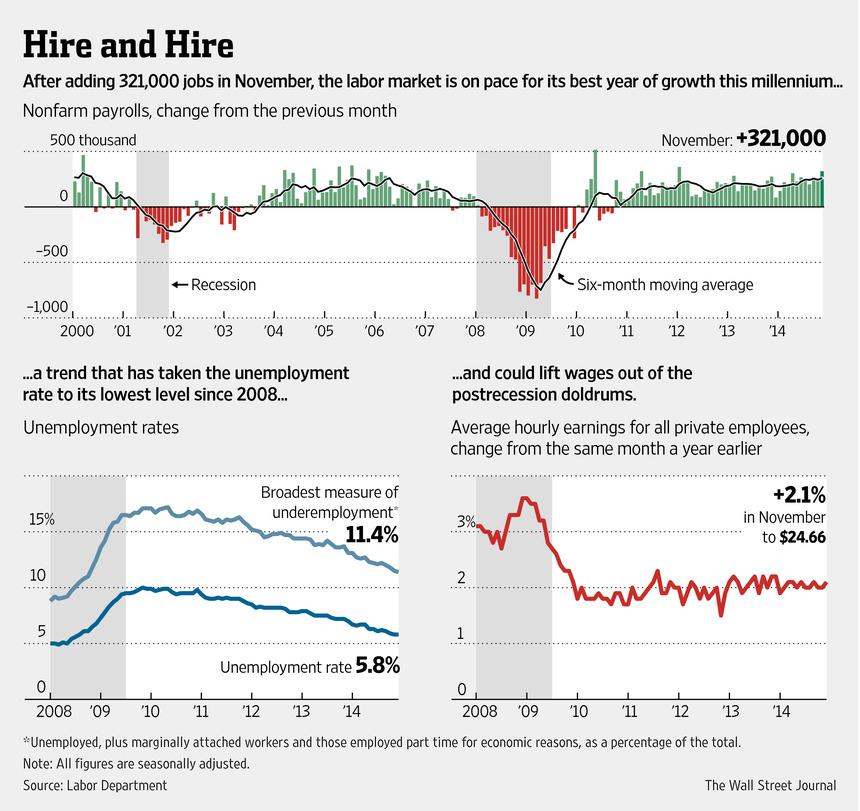

U.S. Payrolls in November Grew 321,000; Jobless Rate 5.8%

Economy on Track to Record Strongest Year of Job Creation in 15 Years

Wall Street Journal

December 5, 2014

WASHINGTON—U.S. employers ramped up hiring last month, continuing a stretch of robust payroll gains and keeping the economy on track to record its strongest year of job creation in 15 years.

Nonfarm payrolls rose a seasonally adjusted 321,000 last month, the strongest month of hiring since January 2012, the Labor Department said Friday. Hiring was broad across the economy, led by gains in the professional and business-services sector.

Revisions showed employers added 44,000 more jobs in September and October than previously estimated. October’s payroll gain was revised up to 243,000 from 214,000 and September’s growth was revised up to 271,000 from 256,000.

The unemployment rate, which is obtained from a separate survey of U.S. households, was 5.8% in November, unchanged from the prior month and remaining at its lowest level since mid-2008.

December 5, 2014

WASHINGTON—U.S. employers ramped up hiring last month, continuing a stretch of robust payroll gains and keeping the economy on track to record its strongest year of job creation in 15 years.

Nonfarm payrolls rose a seasonally adjusted 321,000 last month, the strongest month of hiring since January 2012, the Labor Department said Friday. Hiring was broad across the economy, led by gains in the professional and business-services sector.

Revisions showed employers added 44,000 more jobs in September and October than previously estimated. October’s payroll gain was revised up to 243,000 from 214,000 and September’s growth was revised up to 271,000 from 256,000.

The unemployment rate, which is obtained from a separate survey of U.S. households, was 5.8% in November, unchanged from the prior month and remaining at its lowest level since mid-2008.

The Rest of the Story: http://online.wsj.com/articles/u-s-payrolls-in-november-grew-321-000-jobless-rate-5-8-1417786322

The Most Encouraging, Least Noticed Economic News of 2014

The Most Encouraging, Least Noticed Economic News of 2014

By Danny Vinik

December 22, 2014

This year was a pretty good one for the U.S. economy. Employers have added more than 2.5 million jobs through November. Growth picked up substantially in the second half of the year, after a nasty first quarter in which bad weather caused the economy to contract. The price of oil has plummeted nearly 50 percent in the past six months, giving Americans an effective tax cut during the holiday season.

But one of the most important, positive developments of the year has received little attention: the stabilization of the labor force participation rate.

It not as complicated as it sounds. The labor force participation rate is the percentage of Americans who are either employed or looking for work—i.e. the percentage of people in the labor force. When the Great Recession struck, the participation rate was around 66 percent, slightly down from its peak of 67.3 percent in 2000. Since then, though, the rate continued to decline even after the recession ended and the recovery began—until this year, that is. The labor force participation rate, at 62.8 percent, is the same now as it was in December 2013.

There a few factors that contributed to the fall in the participation rate from 2007 through 2013. The population is getting older as Baby Boomers retire, meaning a smaller percentage of the country is working. This is a structural factor—it was going to happen regardless of the underlying economic conditions. That’s why the Congressional Budget Office forecasted in 2007 that the participation rate would decline to approximately 65 percent by 2014.

But demographics alone cannot explain the decline in the participation rate. Cyclical factors also play a key role. After the Great Recession, millions of workers dropped out of the labor force, discouraged that they could not find work. That drove the participation rate down. The clearest way to see the economy’s effect on the labor force is through the labor force participation rate of prime-age workers—those aged 25-54. This statistic won’t be affected by aging demographics or younger Americans choosing to stay in school instead of entering a weak job market.

The participation rate for prime-age workers has been slowly declining since the mid-1990s, with the exception of the mid-2000s. It’s not clear why that is. In separate articles the New York Times recently, Binyamin Appelbaum and Clain Cain Miller and Liz Alderman looked for an explanation for the respective falls in employment rates of men and women, although none of them came to a definitive answer. Regardless, the financial crisis clearly accelerated that long-term trend, causing American workers in their prime to drop out of the labor force—until it also stabilized in 2014.

Economists have forecasted—and hoped—that an improving economy would cause some, or even most, of these workers to reenter the labor force. But up until this year, there were few signs of that. Of course, the participation rate hasn’t started increasing yet—and based on the pre-crisis long-term trend, it may never return to its previous level. But the stabilization of the participation rate is a welcome development.

It’s also important for the U.S. economy. The most frightening consequence of the Great Recession is that millions of prime-age Americans may never return to work. Instead of contributing to the economy, they may instead rely on the government. At this point, it’s clear that this has happened to some Americans. Those who have started collecting Social Security Disability Insurance, for instance, are unlikely to return to work.

But right now we are entering a key moment in the recovery. As the economy shows signs of life, will the millions of discouraged workers reenter the labor market? Or has the Great Recession, and the subsequent policy failures, permanently disconnected them from it? On those questions, the news was good in 2014. Let’s hope it’s even better in 2015.

http://www.newrepublic.com/article/120626/labor-force-participation-rate-stabilized-2014-few-noticed

The Most Encouraging, Least Noticed Economic News of 2014

By Danny Vinik

December 22, 2014

This year was a pretty good one for the U.S. economy. Employers have added more than 2.5 million jobs through November. Growth picked up substantially in the second half of the year, after a nasty first quarter in which bad weather caused the economy to contract. The price of oil has plummeted nearly 50 percent in the past six months, giving Americans an effective tax cut during the holiday season.

But one of the most important, positive developments of the year has received little attention: the stabilization of the labor force participation rate.

It not as complicated as it sounds. The labor force participation rate is the percentage of Americans who are either employed or looking for work—i.e. the percentage of people in the labor force. When the Great Recession struck, the participation rate was around 66 percent, slightly down from its peak of 67.3 percent in 2000. Since then, though, the rate continued to decline even after the recession ended and the recovery began—until this year, that is. The labor force participation rate, at 62.8 percent, is the same now as it was in December 2013.

There a few factors that contributed to the fall in the participation rate from 2007 through 2013. The population is getting older as Baby Boomers retire, meaning a smaller percentage of the country is working. This is a structural factor—it was going to happen regardless of the underlying economic conditions. That’s why the Congressional Budget Office forecasted in 2007 that the participation rate would decline to approximately 65 percent by 2014.

But demographics alone cannot explain the decline in the participation rate. Cyclical factors also play a key role. After the Great Recession, millions of workers dropped out of the labor force, discouraged that they could not find work. That drove the participation rate down. The clearest way to see the economy’s effect on the labor force is through the labor force participation rate of prime-age workers—those aged 25-54. This statistic won’t be affected by aging demographics or younger Americans choosing to stay in school instead of entering a weak job market.

The participation rate for prime-age workers has been slowly declining since the mid-1990s, with the exception of the mid-2000s. It’s not clear why that is. In separate articles the New York Times recently, Binyamin Appelbaum and Clain Cain Miller and Liz Alderman looked for an explanation for the respective falls in employment rates of men and women, although none of them came to a definitive answer. Regardless, the financial crisis clearly accelerated that long-term trend, causing American workers in their prime to drop out of the labor force—until it also stabilized in 2014.

Economists have forecasted—and hoped—that an improving economy would cause some, or even most, of these workers to reenter the labor force. But up until this year, there were few signs of that. Of course, the participation rate hasn’t started increasing yet—and based on the pre-crisis long-term trend, it may never return to its previous level. But the stabilization of the participation rate is a welcome development.

It’s also important for the U.S. economy. The most frightening consequence of the Great Recession is that millions of prime-age Americans may never return to work. Instead of contributing to the economy, they may instead rely on the government. At this point, it’s clear that this has happened to some Americans. Those who have started collecting Social Security Disability Insurance, for instance, are unlikely to return to work.

But right now we are entering a key moment in the recovery. As the economy shows signs of life, will the millions of discouraged workers reenter the labor market? Or has the Great Recession, and the subsequent policy failures, permanently disconnected them from it? On those questions, the news was good in 2014. Let’s hope it’s even better in 2015.

http://www.newrepublic.com/article/120626/labor-force-participation-rate-stabilized-2014-few-noticed

Re: The Most Encouraging, Least Noticed Economic News of 2014

December hiring brings best year since 1999

WASHINGTON — Employers added a solid 252,000 jobs in December and the unemployment rate ticked down to 5.6 percent, the government said Friday in a good report that capped a great year.

For all of 2014, employers added about 2.952 million jobs, the strongest annual showing since 1999.

Hiring gains in December were reflected across all sectors of the economy, and government statisticians revised upwards the October and November numbers by a combined 50,000.

That means that November’s first-blush estimate of 321,000 jobs was actually a sizzling 353,000.

The combined strong showing over the final two months of 2014 help explain the two-tenths of a percentage point drop in the jobless rate.

On a down note, wages actually dipped slightly in December. That puzzles economists, who expect the strong hiring to lead to a tighter labor market, allowing workers to demand higher salaries.

Read more here: http://www.mcclatchydc.com/2015/01/...ring-brings-best-year.html?rh=1#storylink=cpy

December hiring brings best year since 1999

unemployment rate ticked down to 5.6 percent

WASHINGTON — Employers added a solid 252,000 jobs in December and the unemployment rate ticked down to 5.6 percent, the government said Friday in a good report that capped a great year.

For all of 2014, employers added about 2.952 million jobs, the strongest annual showing since 1999.

Hiring gains in December were reflected across all sectors of the economy, and government statisticians revised upwards the October and November numbers by a combined 50,000.

That means that November’s first-blush estimate of 321,000 jobs was actually a sizzling 353,000.

The combined strong showing over the final two months of 2014 help explain the two-tenths of a percentage point drop in the jobless rate.

On a down note, wages actually dipped slightly in December. That puzzles economists, who expect the strong hiring to lead to a tighter labor market, allowing workers to demand higher salaries.

Read more here: http://www.mcclatchydc.com/2015/01/...ring-brings-best-year.html?rh=1#storylink=cpy

Re: The Most Encouraging, Least Noticed Economic News of 2014

February hiring blows past expectations,

jobless rate falls

Read more here: http://www.mcclatchydc.com/2015/03/06/258897/feb-hiring-scorches-jobless-rate.html#storylink=cpy

February hiring blows past expectations,

jobless rate falls

McClatchy Washington

By Kevin G. Hall

BureauMarch 6, 2015

WASHINGTON — Hiring picked up steadily in February as employers added a better-than-expected 295,000 jobs and the unemployment rate fell to 5.5 percent, the government said Friday.

Mainstream economic forecasters expected a number below 200,000 because of the tough winter weather last month across much of the nation. Instead, Friday’s report showed hiring blew past expectations and the jobless rate fell by two-tenths of a percentage point.

“The job market is in full swing. Despite bad weather, a refinery strike, and energy layoffs, job gains were boom-like,” said Mark Zandi, chief economist for forecaster Moody’s Analytics. “At this pace of job (growth), the labor market is tightening quickly. Wage growth has yet to pick-up, but that's coming soon.”

Average hourly earnings ticked up just a tenth of a percentage point, suggesting workers still aren’t yet taking more pay home even as more people are finding work. And the labor force participation rate also ticked down a tenth of a percentage point to a historically low 62.8 percent, suggesting workers who exited the labor force aren’t yet coming back.

That may be soon changing, suggested Zandi.

“With the number of job openings at record highs, prospects are good for continued strong gains,” he said. “The gains will moderate from the torrid pace of recent months, but we should see another year of 3 million jobs. This is about as good as it ever gets.”

In a good sign, the so-called unofficial unemployment rate fell sharply from 11.3 percent to 11 percent. This alternative measure of unemployment includes the unemployed as well as people working part-time but wanting full-time jobs and workers who haven’t looked for work recently but want to come back.

The White House welcomed the strong February report.

“With another strong employment report, we have now seen twelve straight months of private-sector job gains above 200,000 -- the first time that has happened since 1977,” said Jason Furman, head of the White House Council of Economic Advisers. “Moreover, 2014 was the best year for job growth since the late 1990s and 2015 has continued at this pace.”

Job gains were broad, across all sectors of economy. Leisure and hospitality jobs led the pack, adding 66,000 positions, suggesting that Americans are opening their wallets to eat out and stay at hotels. The white-collar, higher-paying business and professional services sector added a solid 51,000 jobs.

The hard-hit construction sector continues its steady rebound, adding another 29,000 jobs last month.

“Despite challenging weather conditions in much of the country, both the number of workers and their average weekly hours rose last month to the highest levels since the recession," said Ken Simonson, chief economist of Associated General Contractors of America. "There are lots of good-paying, full-time jobs available in construction, with more work on the way.”

Retailers added a robust 32,000 positions last month, even as the holidays are in the rear-view mirror.

“The strength in the February jobs report bodes well for the next few months in terms of expectations for retail sales and even more job growth in the industry,” said Jack Kleinhenz, chief economist for the National Retail Federation. “As we approach spring there's good reason to believe that the optimism that we've seen thus far from businesses will continue, though wage growth remains a big question mark, potentially impacting how Americans will continue to spend their discretionary budgets.”

Manufacturers continued to add jobs, although a modest 8,000 last month month.

“Overall, these jobs numbers were mostly positive, with the labor market continuing to see progress in the right direction,” Chad Moutray, chief economist for the National Association of Manufacturers, wrote in his blog Shopfloor.org. “Still, the February employment data also show softness in the manufacturing sector as we begin 2015. There have been several headwinds that have negatively impacted demand and output, and this has led to an easing in hiring in February in the sector.”

Private-sector job growth was 288,000 last month, with 7,000 government jobs pushing up the overall number to 295,000 last month. Labor Department statisticians revised downwards January’s hiring number of 257,000, determining that with more complete incoming data the number was actually 239,000.

NOTE: An earlier version of this story incorrectly said January’s numbers were revised up. They were revised down.

Email: khall@mcclatchydc.com; Twitter: @KevinGHall.

By Kevin G. Hall

BureauMarch 6, 2015

WASHINGTON — Hiring picked up steadily in February as employers added a better-than-expected 295,000 jobs and the unemployment rate fell to 5.5 percent, the government said Friday.

Mainstream economic forecasters expected a number below 200,000 because of the tough winter weather last month across much of the nation. Instead, Friday’s report showed hiring blew past expectations and the jobless rate fell by two-tenths of a percentage point.

“The job market is in full swing. Despite bad weather, a refinery strike, and energy layoffs, job gains were boom-like,” said Mark Zandi, chief economist for forecaster Moody’s Analytics. “At this pace of job (growth), the labor market is tightening quickly. Wage growth has yet to pick-up, but that's coming soon.”

Average hourly earnings ticked up just a tenth of a percentage point, suggesting workers still aren’t yet taking more pay home even as more people are finding work. And the labor force participation rate also ticked down a tenth of a percentage point to a historically low 62.8 percent, suggesting workers who exited the labor force aren’t yet coming back.

That may be soon changing, suggested Zandi.

“With the number of job openings at record highs, prospects are good for continued strong gains,” he said. “The gains will moderate from the torrid pace of recent months, but we should see another year of 3 million jobs. This is about as good as it ever gets.”

In a good sign, the so-called unofficial unemployment rate fell sharply from 11.3 percent to 11 percent. This alternative measure of unemployment includes the unemployed as well as people working part-time but wanting full-time jobs and workers who haven’t looked for work recently but want to come back.

The White House welcomed the strong February report.

“With another strong employment report, we have now seen twelve straight months of private-sector job gains above 200,000 -- the first time that has happened since 1977,” said Jason Furman, head of the White House Council of Economic Advisers. “Moreover, 2014 was the best year for job growth since the late 1990s and 2015 has continued at this pace.”

Job gains were broad, across all sectors of economy. Leisure and hospitality jobs led the pack, adding 66,000 positions, suggesting that Americans are opening their wallets to eat out and stay at hotels. The white-collar, higher-paying business and professional services sector added a solid 51,000 jobs.

The hard-hit construction sector continues its steady rebound, adding another 29,000 jobs last month.

“Despite challenging weather conditions in much of the country, both the number of workers and their average weekly hours rose last month to the highest levels since the recession," said Ken Simonson, chief economist of Associated General Contractors of America. "There are lots of good-paying, full-time jobs available in construction, with more work on the way.”

Retailers added a robust 32,000 positions last month, even as the holidays are in the rear-view mirror.

“The strength in the February jobs report bodes well for the next few months in terms of expectations for retail sales and even more job growth in the industry,” said Jack Kleinhenz, chief economist for the National Retail Federation. “As we approach spring there's good reason to believe that the optimism that we've seen thus far from businesses will continue, though wage growth remains a big question mark, potentially impacting how Americans will continue to spend their discretionary budgets.”

Manufacturers continued to add jobs, although a modest 8,000 last month month.

“Overall, these jobs numbers were mostly positive, with the labor market continuing to see progress in the right direction,” Chad Moutray, chief economist for the National Association of Manufacturers, wrote in his blog Shopfloor.org. “Still, the February employment data also show softness in the manufacturing sector as we begin 2015. There have been several headwinds that have negatively impacted demand and output, and this has led to an easing in hiring in February in the sector.”

Private-sector job growth was 288,000 last month, with 7,000 government jobs pushing up the overall number to 295,000 last month. Labor Department statisticians revised downwards January’s hiring number of 257,000, determining that with more complete incoming data the number was actually 239,000.

NOTE: An earlier version of this story incorrectly said January’s numbers were revised up. They were revised down.

Email: khall@mcclatchydc.com; Twitter: @KevinGHall.

Read more here: http://www.mcclatchydc.com/2015/03/06/258897/feb-hiring-scorches-jobless-rate.html#storylink=cpy

Re: The Most Encouraging, Least Noticed Economic News of 2014

FEBRUARY 2015 BY THE NUMBERS:

Read more here: http://www.mcclatchydc.com/2015/03/06/258897/feb-hiring-scorches-jobless-rate.html#storylink=cpy

FEBRUARY 2015 BY THE NUMBERS:

- Professional and business services, up 51,000.

- Manufacturing, up 8,000.

- Retail, up 32,000.

- Leisure and hospitality up 66,000.

- Health care, up 23,800.

- Finance, up 10,000.

- Construction, up 29,000.

- Temporary help services, down 7,800.

- Transportation and warehousing up 18,500.

- Government, up 7,000.

Read more here: http://www.mcclatchydc.com/2015/03/06/258897/feb-hiring-scorches-jobless-rate.html#storylink=cpy

Wal-Mart wage hike hides deeper problem for US economy

Wal-Mart wage hike hides deeper problem for US economy

Wal-Mart won wide praise for raising employee wages. But many employees remain underemployed, working less than a full workweek. It's a problem across the US.

By Daniel Wood

March 18, 2015 4:12 PM

Starting in April, Wal-Mart will be giving Lisa Pietro a raise, thanks to the retailer's decision last month to increase minimum wages for 500,000 employees to $9 per hour – $1.75 more than the federal minimum wage.

It was a much-lauded move coming after protests and pressure. But for Ms. Pietro, it won't mean much.

That's partly because her $8.95-an-hour salary will go up only 5 cents. But ther's another, perhaps bigger reason, too: She simply doesn't work enough hours. What's more, the hours she does work are so erratic that she can't plan around them.

Some days she leaves the Winter Haven, Fla., Wal-Mart at 10 p.m., walks 1-1/2 miles home and catches a few hours of sleep before turning around to work the 5 a.m. shift. She doesn't have a car because she never knows how many hours a week she will work, so she can’t guarantee to any car dealer that she can make regular payments.

Pietro is one of the nation’s 6.6 million involuntary part-time workers, people who want full-time employment but work fewer than 35 hours per week due to slack business conditions. Some piece together second and third jobs to make ends meet. Others, like Pietro, just make do.

Pietro’s plight is emblematic of a problem felt by many low-wage workers in the United States. They want full-time work, but have to settle for 25 to 28 hours per week. While the pay increases instituted by Wal-Mart and immediately copied by TJX, which owns T.J. Maxx, Marshalls, and Home Goods, are a welcome and an overdue sign of the economy's improvement, employees need to work 40 hours per week or they will not see meaningful improvement for themselves or their families, economists and the workers themselves say.

That's important, because an increasing number of typically middle-income workers have settled for hourly positions to escape the ranks of the long-term unemployed. That’s the less-told side of the nation’s celebrated reduction in unemployment in recent months.

Companies like Wal-Mart once employed people at "the margins of the labor force" – those seeking part-time employment to supplement a spouse’s income or reentering the labor force after many years, Gary Chaison, an industrial relations professor at Clark University in Worcester, Mass., told The New York Times.

“What you’re increasingly finding is that it’s the primary wage earners who work at Wal-Mart, because a lot of workers have more or less given up on getting middle-class jobs,” said Professor Chaison.

The number of workers who involuntarily work part time ballooned following the Great Recession, as workers, desperate for any work they could get, took on positions with fewer hours rather than hold out for full-time employment.

By November 2009, the number of involuntary part-time workers – or part-time for economic reasons as the Bureau of Labor Statistics refers to them – swelled to more than 9 million, double the number seen in years leading up to the recession. That figure has declined considerably in recent years, but in February 2015 remained 54 percent higher than the pre-recession average.

While hourly positions that offer less than 40 hours a week save people from the street and unemployment, they leave many workers like Pietro struggling to make ends meet.

For its part, Wal-Mart views hourly positions as entry level steppingstones to management positions.

“We have different roles at different times in our career, and every one of them is important. Today’s cashiers will be tomorrow’s store or club managers," Doug McMillon, Wal-Mart's chief executive officer, wrote in a letter announcing the wage increase to employees.

“In fact, our statistics show that about 75% of our US management teams began in an hourly role,” added Mr. McMillion, who started at the company as an hourly summer associate himself.

The company plans to roll out a new six-month training program dubbed Pathways, beginning this summer and to be fully deployed by next February, company spokesman Kory Lundburg said in a statement. The goal is to offer employees more-targeted training that will allow them to move more easily into higher paying jobs within the company.

Pietro herself may qualify for another boost to $10 per hour in February if she qualifies for and completes the additional training.

The company's decision to boost the wages of its lowest-paid employees has garnered considerable praise from fair-wage advocates. President Obama reportedly called McMillion following the announcement to applaud the increase. And the move was seen by many economists as precedent-setting, likely leading to increased wages for low-income earners throughout the industry.

But advocates for low-wage workers, while supporting the wage boost, say the pay increases will have minimal effect on workers' lives without a full workweek.

Companies like Wal-Mart have turned the scheduling of part-time workers into a science, says Tsedeye Gebreselassie, senior staff attorney with the National Employment Law Project. Computer programs used by Wal-Mart and other large retail outlets piece together employee schedules and are frequently programmed to keep employees' hours below the threshold where benefits kick in, she says.

“These are super-sophisticated programs that work in real time calculating to the minute based on customer traffic, calling people in to work and sending them home accordingly,” she says. “Working there makes it nearly impossible to plan a stable budget, have another job, or go to schools.”

The use of computer scheduling programs is standard practice across the industry, says Susan Lambert, a professor at the University of Chicago School of Social Service Administration.

She also mentions that these programs can be set to produce the most optimal work schedules for workers as well – such as avoiding early morning shifts directly after a late night shift.

Finding ways to better serve employees can translate to increased profits for a company, Ms. Gebreselassie and others say.

A 2006 study of Costco and Wal-Mart-owned Sam’s Club showed that what’s good for employees can be good for the business in the long run.

“In return for its generous wages and benefits, Costco gets one of the most loyal and productive workforces in all of retailing, and, probably not coincidentally, the lowest shrinkage (employee theft) figures in the industry,” study author Wayne Cascio, professor of management at the University of Colorado, Denver, wrote in the Harvard Business Review.

What’s more, the study found that Costco generated $10,000 more in profit per hourly employee than Sam’s Club, leading Professor Cascio to conclude, “Costco’s stable, productive workforce more than offset its higher costs.”

That business model has served other retailers well, from national chains such as Trader Joe's and Whole Foods to local stores such as New England’s Market Basket, where devoted employees went on a six-week strike in support of a management team that held out for worker-friendly practices during a bitter feud between owners last summer.

https://news.yahoo.com/wal-mart-wage-hike-hides-deeper-problem-us-201258351.html

Wal-Mart wage hike hides deeper problem for US economy

Wal-Mart won wide praise for raising employee wages. But many employees remain underemployed, working less than a full workweek. It's a problem across the US.

By Daniel Wood

March 18, 2015 4:12 PM

Starting in April, Wal-Mart will be giving Lisa Pietro a raise, thanks to the retailer's decision last month to increase minimum wages for 500,000 employees to $9 per hour – $1.75 more than the federal minimum wage.

It was a much-lauded move coming after protests and pressure. But for Ms. Pietro, it won't mean much.

That's partly because her $8.95-an-hour salary will go up only 5 cents. But ther's another, perhaps bigger reason, too: She simply doesn't work enough hours. What's more, the hours she does work are so erratic that she can't plan around them.

Some days she leaves the Winter Haven, Fla., Wal-Mart at 10 p.m., walks 1-1/2 miles home and catches a few hours of sleep before turning around to work the 5 a.m. shift. She doesn't have a car because she never knows how many hours a week she will work, so she can’t guarantee to any car dealer that she can make regular payments.

Pietro is one of the nation’s 6.6 million involuntary part-time workers, people who want full-time employment but work fewer than 35 hours per week due to slack business conditions. Some piece together second and third jobs to make ends meet. Others, like Pietro, just make do.

Pietro’s plight is emblematic of a problem felt by many low-wage workers in the United States. They want full-time work, but have to settle for 25 to 28 hours per week. While the pay increases instituted by Wal-Mart and immediately copied by TJX, which owns T.J. Maxx, Marshalls, and Home Goods, are a welcome and an overdue sign of the economy's improvement, employees need to work 40 hours per week or they will not see meaningful improvement for themselves or their families, economists and the workers themselves say.

That's important, because an increasing number of typically middle-income workers have settled for hourly positions to escape the ranks of the long-term unemployed. That’s the less-told side of the nation’s celebrated reduction in unemployment in recent months.

Companies like Wal-Mart once employed people at "the margins of the labor force" – those seeking part-time employment to supplement a spouse’s income or reentering the labor force after many years, Gary Chaison, an industrial relations professor at Clark University in Worcester, Mass., told The New York Times.

“What you’re increasingly finding is that it’s the primary wage earners who work at Wal-Mart, because a lot of workers have more or less given up on getting middle-class jobs,” said Professor Chaison.

The number of workers who involuntarily work part time ballooned following the Great Recession, as workers, desperate for any work they could get, took on positions with fewer hours rather than hold out for full-time employment.

By November 2009, the number of involuntary part-time workers – or part-time for economic reasons as the Bureau of Labor Statistics refers to them – swelled to more than 9 million, double the number seen in years leading up to the recession. That figure has declined considerably in recent years, but in February 2015 remained 54 percent higher than the pre-recession average.

While hourly positions that offer less than 40 hours a week save people from the street and unemployment, they leave many workers like Pietro struggling to make ends meet.

For its part, Wal-Mart views hourly positions as entry level steppingstones to management positions.

“We have different roles at different times in our career, and every one of them is important. Today’s cashiers will be tomorrow’s store or club managers," Doug McMillon, Wal-Mart's chief executive officer, wrote in a letter announcing the wage increase to employees.

“In fact, our statistics show that about 75% of our US management teams began in an hourly role,” added Mr. McMillion, who started at the company as an hourly summer associate himself.

The company plans to roll out a new six-month training program dubbed Pathways, beginning this summer and to be fully deployed by next February, company spokesman Kory Lundburg said in a statement. The goal is to offer employees more-targeted training that will allow them to move more easily into higher paying jobs within the company.

Pietro herself may qualify for another boost to $10 per hour in February if she qualifies for and completes the additional training.

The company's decision to boost the wages of its lowest-paid employees has garnered considerable praise from fair-wage advocates. President Obama reportedly called McMillion following the announcement to applaud the increase. And the move was seen by many economists as precedent-setting, likely leading to increased wages for low-income earners throughout the industry.

But advocates for low-wage workers, while supporting the wage boost, say the pay increases will have minimal effect on workers' lives without a full workweek.

Companies like Wal-Mart have turned the scheduling of part-time workers into a science, says Tsedeye Gebreselassie, senior staff attorney with the National Employment Law Project. Computer programs used by Wal-Mart and other large retail outlets piece together employee schedules and are frequently programmed to keep employees' hours below the threshold where benefits kick in, she says.

“These are super-sophisticated programs that work in real time calculating to the minute based on customer traffic, calling people in to work and sending them home accordingly,” she says. “Working there makes it nearly impossible to plan a stable budget, have another job, or go to schools.”

The use of computer scheduling programs is standard practice across the industry, says Susan Lambert, a professor at the University of Chicago School of Social Service Administration.

She also mentions that these programs can be set to produce the most optimal work schedules for workers as well – such as avoiding early morning shifts directly after a late night shift.

Finding ways to better serve employees can translate to increased profits for a company, Ms. Gebreselassie and others say.

A 2006 study of Costco and Wal-Mart-owned Sam’s Club showed that what’s good for employees can be good for the business in the long run.

“In return for its generous wages and benefits, Costco gets one of the most loyal and productive workforces in all of retailing, and, probably not coincidentally, the lowest shrinkage (employee theft) figures in the industry,” study author Wayne Cascio, professor of management at the University of Colorado, Denver, wrote in the Harvard Business Review.

What’s more, the study found that Costco generated $10,000 more in profit per hourly employee than Sam’s Club, leading Professor Cascio to conclude, “Costco’s stable, productive workforce more than offset its higher costs.”

That business model has served other retailers well, from national chains such as Trader Joe's and Whole Foods to local stores such as New England’s Market Basket, where devoted employees went on a six-week strike in support of a management team that held out for worker-friendly practices during a bitter feud between owners last summer.

https://news.yahoo.com/wal-mart-wage-hike-hides-deeper-problem-us-201258351.html

Payrolls in U.S. Rise; Jobless Rate Falls to 4.6%

U.S. hiring picked up in November, while the unemployment rate tumbled to a nine-year low on a drop in the number of people in the workforce and wages unexpectedly declined, providing a mixed picture of the labor market.

The 178,000 gain followed a 142,000 rise in October that was less than previously estimated, a Labor Department report showed Friday. The median forecast in a Bloomberg survey called for a 180,000 advance. The jobless rate fell 0.3 percentage point to 4.6 percent as labor participation dropped for a second month.

A steady job market signals employers were willing to keep hiring in the days before and after the Nov. 8 presidential election. At the same time, while the Federal Reserve is almost certain to raise borrowing costs this month, sustained weakness in wages or participation would weigh on the economic outlook.

“The labor market is still healthy, and perhaps operating at or beyond capacity,” said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York. “Wages can be volatile month to month. I’d tend to put a little more weight on the unemployment rate when thinking about future developments and wage inflation.”

Revisions to prior reports subtracted a total of 2,000 jobs from payrolls in the previous two months.

November payroll estimates ranged from gains of 140,000 to 250,000. October was initially reported as a 161,000 increase.

Jobless Rate

The unemployment rate, which is derived from a separate Labor Department survey of households, was projected to hold at an eight-year low of 4.9 percent, according to the survey median.

Even with the tight labor market, the news on wages was disappointing. Average hourly earnings fell by 0.1 percent from the prior month to $25.89, the first decline since December 2014. They climbed 2.5 percent over the 12 months ended in November, following a 2.8 percent year-over-year gain in October. The average work week for all workers was unchanged at 34.4 hours.

FULL STORY: https://www.bloomberg.com/news/arti...ise-jobless-rate-falls-on-lower-participation

.

U.S. hiring picked up in November, while the unemployment rate tumbled to a nine-year low on a drop in the number of people in the workforce and wages unexpectedly declined, providing a mixed picture of the labor market.

The 178,000 gain followed a 142,000 rise in October that was less than previously estimated, a Labor Department report showed Friday. The median forecast in a Bloomberg survey called for a 180,000 advance. The jobless rate fell 0.3 percentage point to 4.6 percent as labor participation dropped for a second month.

A steady job market signals employers were willing to keep hiring in the days before and after the Nov. 8 presidential election. At the same time, while the Federal Reserve is almost certain to raise borrowing costs this month, sustained weakness in wages or participation would weigh on the economic outlook.

“The labor market is still healthy, and perhaps operating at or beyond capacity,” said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York. “Wages can be volatile month to month. I’d tend to put a little more weight on the unemployment rate when thinking about future developments and wage inflation.”

Revisions to prior reports subtracted a total of 2,000 jobs from payrolls in the previous two months.

November payroll estimates ranged from gains of 140,000 to 250,000. October was initially reported as a 161,000 increase.

Jobless Rate

The unemployment rate, which is derived from a separate Labor Department survey of households, was projected to hold at an eight-year low of 4.9 percent, according to the survey median.

Even with the tight labor market, the news on wages was disappointing. Average hourly earnings fell by 0.1 percent from the prior month to $25.89, the first decline since December 2014. They climbed 2.5 percent over the 12 months ended in November, following a 2.8 percent year-over-year gain in October. The average work week for all workers was unchanged at 34.4 hours.

FULL STORY: https://www.bloomberg.com/news/arti...ise-jobless-rate-falls-on-lower-participation

.