Many who have left U.S. labor force say they would like to return

Many who have left U.S. labor force say they would like to return

By Howard Schneider

August 20, 2014 1:22 AM

WASHINGTON (Reuters) - Mike Yack has left the workforce twice in the last eight years and calls himself retired, yet at age 62 the former General Motors employee does not consider his working life over.

"I'd be open to anything - learning a new trade or something. I don't expect top wages. But I am not going to work for ten dollars an hour," said Yack, who accepted a buyout from GM in 2006 and was then laid off earlier this year by a GM contractor.

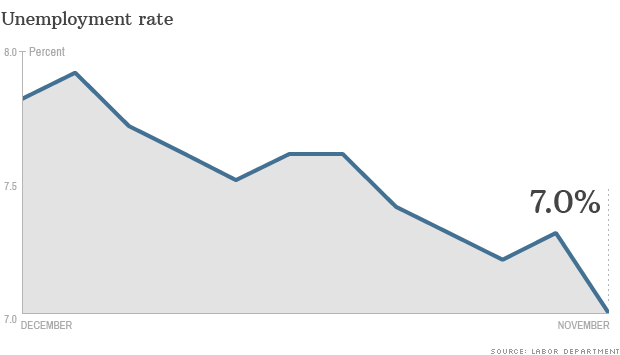

Yack, who says he can get by on Social Security and his GM pension, is among millions of Americans who could re-enter the U.S. labor force if the economy improves. They don’t show up in the U.S. jobless rate, currently at 6.2 percent.

For U.S. Federal Reserve Chair Janet Yellen, the willingness of people like Yack to return to the workforce contributes to the "slack" she sees in the labor force that could keep wages growth and inflation under control even as the economy picks up. Yellen and other Fed policymakers will be studying the labor market overhang carefully as they gather for their annual retreat in Jackson Hole, Wyoming this week.

Heading into that event, an exclusive Reuters/Ipsos poll - which was conducted between June 6 and Aug. 8 - shows there are many retired, and other jobless people who have stopped looking for employment, declaring they are ready to re-enter the labor force if the right opportunity came along.

The poll of 7,727 individuals aged 18 and older who said they were unemployed, retired, or declined to provide their employment status, found that 34 percent said they had stopped looking for work because the job market was so bad. Despite the falling unemployment rate, 40 percent said they were no more optimistic about their job search today than when they initially stopped working.

Among those who said they had halted a job search, many were ready to resume the hunt if they received the right signals from the market – those signals included more job postings that match their qualifications, evidence of a stronger economic recovery, and word that friends or relatives had landed jobs.

For people who identified themselves as retired, 40 percent said they would have preferred to keep working and 30 percent said they would go back to work if the right job came along.

Of the poll respondents, 44 percent had not worked in the past five years, though nearly two thirds of those people were close to or had reached retirement age when they stopped working.

Large numbers of discouraged workers are key to why the U.S. labor participation rate lingers at 62.9 percent, down from 66.4 percent in January 2007, just before the recession and the financial crisis was about to roll over the economy.

And this is in addition to the 7.5 million Americans who are currently working part-time but want to work full-time, often referred to as involuntary part-time workers. Most want a full-time job but can't find it or their employers have cut back on their hours for business reasons. The number is still about 3 million more than before the financial crisis.

PHYSICALLY ABLE

For Yack, the equation is quite simple. If wages start moving up at the auto parts suppliers and other companies near his home in Howell, Michigan, he says he would be ready to return to the workforce.

“I am physically able. The opportunity is not there,” he said.

In the U.S., the Fed's mandate is to maintain full employment consistent with stable prices, giving it a direct interest in knowing not only how many people are working, but in how many might want to work but have been discouraged from looking.

But the extent of the changes under way in the U.S. job market are not fully known, nor is the ability of the Fed or other government officials to address them. Some trends seem inexorable: perhaps half the recent decline in labor force participation, for example, can be explained by the aging of the U.S. workforce, a number of studies have concluded.

Six years into the recovery, U.S. policymakers confront a few problems. Wages are hardly keeping up with inflation, productivity is in the doldrums, and the churn between jobs – an indicator of economic dynamism – has slowed.

In addition, the labor force participation rate for people aged 25-54 – considered the prime working years – has dropped from 84 percent at the turn of the century to just 81.4 percent now, a fact economists have found difficult to explain. And the number of people unemployed for six months or more has been dropping, but still stands at 3.2 million – nearly triple the number in the months before the last recession hit.

Those and other factors have convinced Yellen the U.S. still has room to grow before inflation becomes a concern, and has made her reluctant to raise interest rates before employment and wage growth recover.

What she, academic researchers, Obama administration officials, and others are trying to understand is whether those trends have become a permanent part of the U.S. labor landscape.

They have plenty of recent research, much of it containing worrying findings, to comb through.

Studies by economists like Robert Litan at Brookings Institution and John Haltiwanger at the University of Maryland have documented the growing importance of larger and older firms in the U.S. economy -- and noted how those tend to be less dynamic job creators than new companies.

Other research, noted with concern at the Fed and elsewhere, has found a decline in demand for higher skilled and better educated workers. That means college graduates may be competing for positions further down the "job ladder," pushing the less skilled to the margins.

"A year or so ago many labor economists would have said this was just a really bad recession and we have seen a huge cyclical impact and it takes a while to reverse," said Paul Swaim, senior labor economist at the Organization for Economic Cooperation and Development. "It looks like the longer-run trends are more and more the story ... It is not just declining employment participation. It is a whole sort of ebbing of vitality."

The Fed's response to the problem is necessarily blunt: keeping interest rates lower than might otherwise be warranted in hopes of encouraging growth, investment, job creation and higher wages.

Some of the forces at work in the U.S., however, may be of a more subtle sort that require changes in government policy and not simply stronger economic growth.

The fact that labor force participation among women has declined in the U.S. while it continues rising in much of Europe, for example, may be related to European policies that provide better family leave and care for aging parents.

There is evidence as well that the jobs which are being created are those that pay less, perhaps adding to the level of income inequality in the U.S. and undermining the spending power of households. A higher federally mandated minimum wage could help to address this, though critics say that could hurt jobs growth and risk a much higher inflation rate.

AILING WIFE

Conversations with the unemployed, meanwhile, show that there are many reasons why they may stay out of the workforce.

For some, like Bill Young of suburban Atlanta, a simple bump in the overall economy might help. The 41-year-old landscaper said his last full time job was a decade ago, before the housing boom turned to a bust. The sector has yet to recover.

"It is almost impossible to get a full-time job," said Young, who gets by on "a lot of little part-time jobs."

April Phelps, 40, of Sycamore, Illinois., has been making do on her disability payment since she left the Army. She got a master's degree in psychology in 2011, but has yet to land a job and is only intermittently searching because of the frustration.

Donald Oremus, 63, left his job two years ago to care for his ailing wife. After that long out of the workforce he feels his skills as an architectural draftsman are out of date in a profession driven by fast advances in software.

The Veterans Benefits Administration recently agreed to provide home nursing care for his wife. Both served in the Navy during the Vietnam War.

He's now weighing whether to invest the necessary time and money to learn the latest tools and return to work. "I would love to get back," Oremus said by phone from his home in Boise, Idaho. "Suddenly I have fallen far behind."

https://news.yahoo.com/many-left-u-labor-force-return-050511935.html