Tax code was written by elites to allow them to cheat through loop holes to avoid payin their fair share, if any and...place all tax burden on the masses..

Word, but this clown flat out lying on his taxes.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Tax code was written by elites to allow them to cheat through loop holes to avoid payin their fair share, if any and...place all tax burden on the masses..

Slurp, slurp..... gurgle, gurgle..... have some decency..... get a room and slob his knob

Yeah that's pretty much what I was getting at. We have middle class folks raging against the wrong machine, and voting to hurt themselves in the process. They don't make enough to skirt the law, so they have to blame someone, and it's easier to blame an underpaid immigrant for skipping out on $1000 of taxes.The dirty secret is that the tax code will never penalize those who create economic activity. There will always be loopholes for tax avoidance which isn't the same thing as under-the-table tax evasion. Fucked up that the middle class citizens get hurt the most because it sure as shit ain't illegals.

The people in this country are trained to hate the poor.

Word, but this clown flat out lying on his taxes.

Is that illegal? I hope there’s some governmental organization that police that sort of stuff.

"SOI keep picking on me. Can you talk to him please, my fweelings are hurt "Slurp, slurp..... gurgle, gurgle..... have some decency..... get a room andf slob his knob

.

Maybe if someone cares they can look into that.I think when you report that many losses you can use them to reduce your future gains. If it is all legit he is either losing tons of cash or he has it hidden in one of his kid's names.

The people in this country are trained to hate the poor.

Not as much as your ass hurts on any Saturday/Sunday morning"SOI keep picking on me. Can you talk to him please, my fweelings are hurt "

when he gets arrested there will be no footage of it.

let me know when this nigga at a minimum gets perp walked in cuffs.

until then this is nothing but click bait.

See this is the part I don't understand.

The president is technically a government employee that draws a salary of $400,000 a year. Why wasn't Trump being taxed on that?

Normally if you have a job and a side hustle the IRS treats both separately. They're still going to take a cut of your paycheck no matter how much you lose on your business.

I’m not quite sure I understand the fascination with getting Trump’s tax returns.

Are they hoping to show that he’s ‘broke’?

Its a typical return by a rich person, showing as little income as possible and taking advantage of every loophole possible.

And this changes exactly WHAT?

Trumps paid $0 in taxes in 2020, reported negative income 4 times in 6 years, returns reveal

By

Mark Moore

December 21, 2022 9:48am

Updated

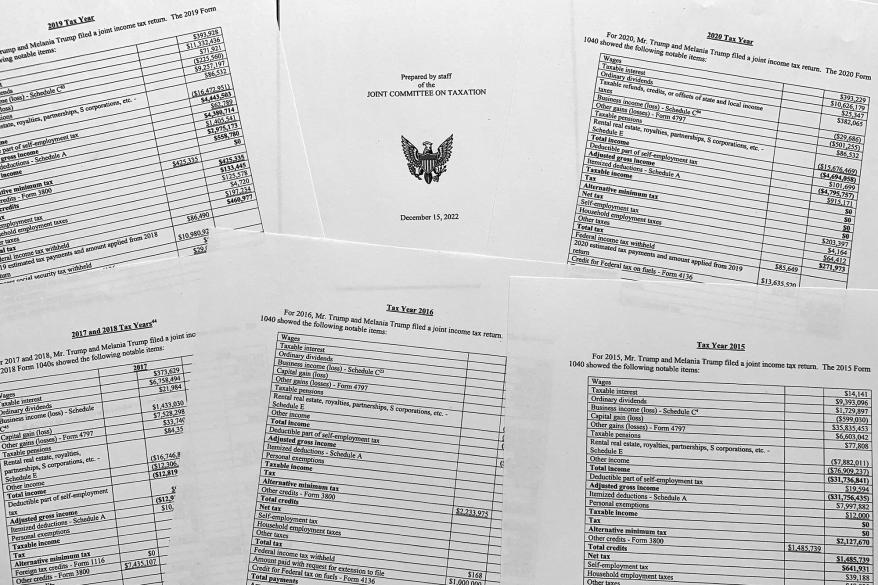

The tax returns of former President Donald Trump and his wife Melania show they reported negative income in four of the six years between 2015 and 2020.

In three of those years — 2015, 2016 and 2017 –the Trumps reported income tax liability of just $750 or less, a report from the House Ways and Means Committee revealed.

The Democrat-controlled panel voted 24-16 along party lines Tuesday evening to release the Trumps’ tax returns following a legal battle that began in 2016.

The full release of the returns is expected in the coming days after all personal information is redacted from them.

In the six-year period covered by the returns, the Trumps’ adjusted gross income totaled negative $53.2 million, and their total federal tax liability, including self-employment and household employment taxes, was $4.4 million.

PREVIOUS

1of3

NEXT

The report from the House Ways and Means Committee, regarding the IRS and former President Donald Trump’s tax returns.AP

Information on former President Donald Trump’s tax returns, released in a staff report by the Joint Committee on Taxation are seen on Wednesday.AP

Advertisement

The Trumps reported positive adjusted gross income in only two of those six years — $24.3 million in 2018 and $4.4 million in 2019.

After 2017, the then-first couple’s tax bill increased, the report found, with the Trumps paying almost $1 million in taxes in 2018 and $133,445 in 2019.

In 2020, as the coronavirus pandemic raged across the country, the Trumps reported a loss of $4.8 million and paid $0 in federal taxes.

The panel voted 24-16 to release the Trumps’ tax returns following a legal battle that began in 2016.AP

The tax returns of former President Donald Trump and his wife Melania show negative income in four of the six years between 2015 and 2020. Getty Images

The release of the returns follows a protracted legal fight that began in April 2019 and went all the way to the Supreme Court.

The panel’s 29-page executive summary also shows that the IRS failed to conduct a mandatory audit of Donald Trump’s tax returns during the 45th president’s first two years in office — a requirement dating back to 1977 following a controversy over former President Richard Nixon’s taxes.

The IRS only began examining the former president’s individual tax return for 2015 — the year he announced his presidential run — when committee Chairman Richard Neal (D-Mass.) sent a letter to the federal agency on April 3, 2019, seeking information about the returns.

Former President Donald Trump and his wife, Melania Trump, reported negative income on four of six years of tax returns between 2015 and 2020.Corbis via Getty Images

More than five months later, the report says, the agency selected Trump’s 2016 return for a mandatory audit. The individual returns for 2017, 2018 and 2019 were not selected for examination until after the former president had left office.

“The Committee expected that these mandatory audits were being conducted promptly and in accordance with IRS policies,” Neal said in a statement Tuesday. “We anticipated the IRS would expand the mandatory audit program to account for the complex nature of the former president’s financial situation yet found no evidence of that. This is a major failure of the IRS under the prior administration, and certainly not what we had hoped to find.

“But the evidence is clear,” said Neal. “Congress must step in.”

Former President Donald Trump speaks at a political rally in Georgia on Dec. 5, 2020.Anadolu Agency via Getty Images

PREVIOUS

1of3

NEXT

The Trumps reported positive adjusted gross income in only two of those six years — $24.3 million in 2018 and $4.4 million in 2019. Getty Images

During the pandemic in 2020, the Trumps reported a loss of $4.8 million and paid $0 in federal taxes.Getty Images

Advertisement

In response to the committee’s probe, Neal has proposed legislation requiring the IRS to conduct an annual audit of each president’s finances. The bill is unlikely to go anywhere, with mere days to go before the end of the congressional session and Republicans taking control of the House on Jan. 3.

Trump, 76, who announced last month that he is running for president in 2024, has refused to release his tax returns, saying they were under IRS audit.

A spokesman for the former president characterized the release of the returns as an “unprecedented leak by lame duck Democrats” in a statement to the Wall Street Journal.

Donald and Melania Trump in August 2015.AFP via Getty Images

“If this injustice can happen to President Trump, it can happen to all Americans without cause,” Steven Cheung told the newspaper, adding that the full release of the returns will reflect Trump’s success as a businessman.

Democratic members of the committee said the release of the returns was necessary for transparency.

“I voted to reinforce this critical principle: No person is above the law, not even a president of the United States,” committee member Rep. Brendan Boyle (D-Pa.) said.

But Republicans warned that it could set a dangerous precedent.

Former President Donald Trump and his wife, Melania Trump, depart the White House on Dec. 5, 2020.Bloomberg via Getty Images

“Over our objections in opposition, Democrats in the Ways and Means Committee have unleashed a dangerous new political weapon that overturns decades of privacy protections,” Rep. Kevin Brady (R-Texas), the top GOPer on the panel, told reporters.

“The era of political targeting, and of Congress’ enemies list, is back and every American, every American taxpayer, who may get on the wrong side of the majority in Congress is now at risk,” the Texas lawmaker said.

806

What do you think? Post a comment.

Earlier this month, a Manhattan trial jury found the Trump Organization guilty of criminal tax fraud.

Prosecutors said the company helped top executives evade income taxes by providing them off-the-book perks like rent, private school tuition and luxury cars.

he had no obligation to turn over anything.It doesn't change anything, but it holds him to the same standard that other presidents in the modern era have been held to and makes information public that he fought tooth and nail to keep private after initially saying he would make it public.

he had no obligation to turn over anything.

It doesn't change anything, but it holds him to the same standard that other presidents in the modern era have been held to and makes information public that he fought tooth and nail to keep private after initially saying he would make it public.

Your hero.You have no knowledge of anything.... ur world's falling apart cause of the Ukraine war and Putin falling down the steps and shitting himself.... shouldn't you be in DC to try and troll Zelensky when he arrives?

I think the bigger story is why his taxes were made public in the first place.

His "charitable" organization was already punished for undervaluing their holdings so the feds decided to look at Donnie's personal books as well.

This would be similar to the feds finding bricks of cocaine in a shipment of Tesla batteries and deciding to raid Elon Musk's houses. Even if they don't find a single flake in any of them, the fact remains that dude was using his business to commit crimes and rip off the government.

It doesn't change anything, but it holds him to the same standard that other presidents in the modern era have been held to and makes information public that he fought tooth and nail to keep private after initially saying he would make it public.

See this is the part I don't understand.

The president is technically a government employee that draws a salary of $400,000 a year. Why wasn't Trump being taxed on that?

Normally if you have a job and a side hustle the IRS treats both separately. They're still going to take a cut of your paycheck no matter how much you lose on your business.