You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

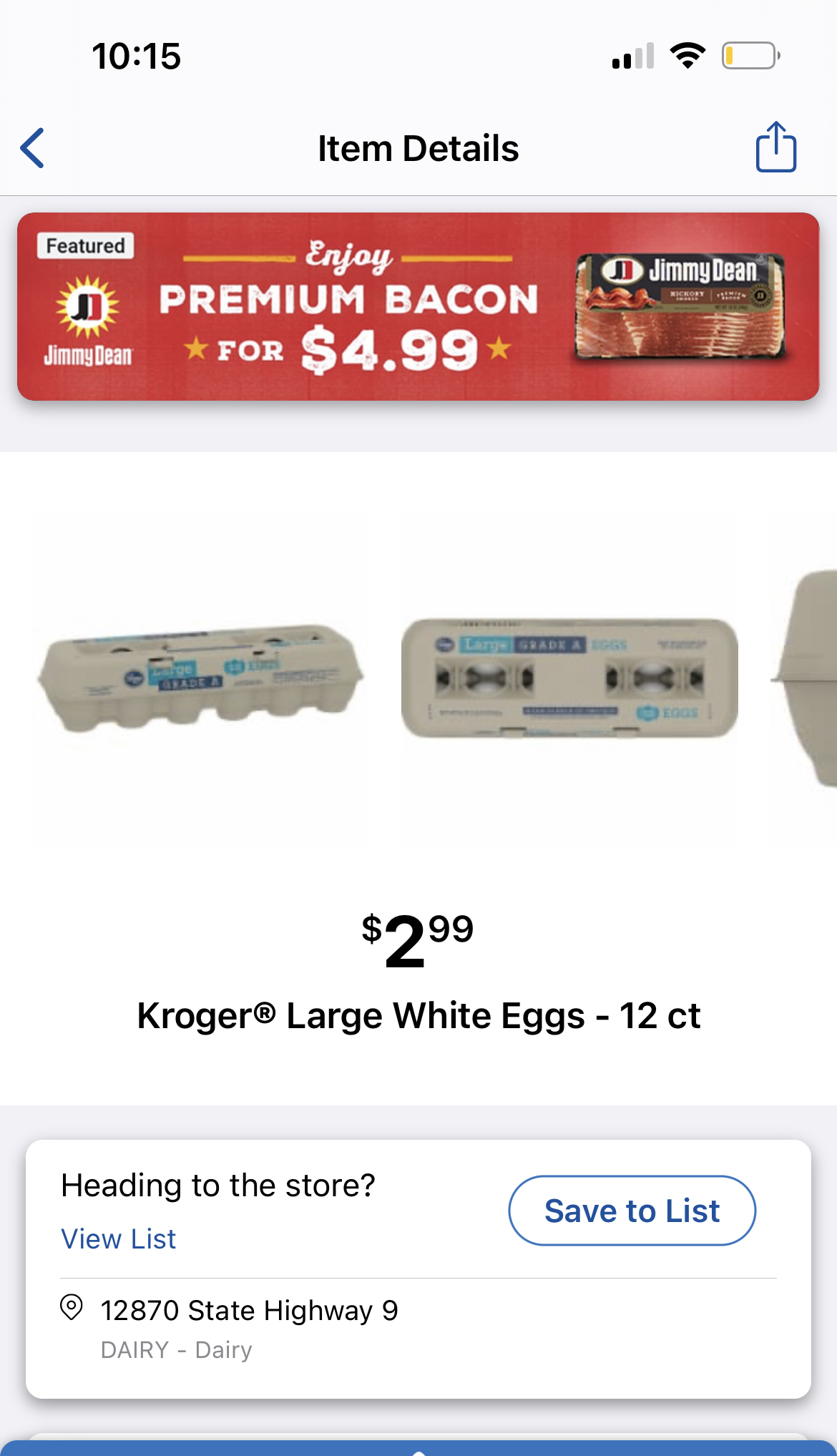

Got eggs for $3 today from Publix

clicking on my name lets u see exactly where i'm located................but yeah....in my head.....Where is here? In your head?

Lady at Costco told me there was an egg shortage... Bird flu or somethingGot eggs for $3 today from Publix

Ain’t doing all that. Never knew you could even see that.

If you think what you wrote was a complete thought then so be it. Peace.

If you think what you wrote was a complete thought then so be it. Peace.

clicking on my name lets u see exactly where i'm located................but yeah....in my head.....

I love eggs. But I have slowed my roll. On going through them bad boys. Ive been picking up a couple of cartons every few weeks. This past year.

I just saw today that the price of eggs will be normalizing as well as there has been a drop in the price of wings..... I picked up some wings about a week and a half ago for $2.99/lb..... down from over $5/lb... jumbo eggs been over $5/dozen for more than a month.... I will see what they are when I go shopping in a couple of daysa dozen eggs are about $3 here.

.

.

You from yonkers stop speaking about a borough you know nothing about… you can go to Costco and get them for cheapAint now Kroger in NYC.

You need about 500k to get by in NYC man. I swear.

I've stopped buying eggs now, and it's better for my health. So thank you high egg prices!

Folks still too embarrassed to shop at Wally World huh. I only Publix for the deli sandwiches and honey crisp apples. EXPENSIVE TASTE HAVING AZZES

This is the time to lose weight and diet.

Not only will you improve your health, but your pockets will love you.

Drop 10-20% bodyweight and save a grip.

Not only will you improve your health, but your pockets will love you.

Drop 10-20% bodyweight and save a grip.

so 2 18 packs is less than 9 dollars

1 18 pack is 4.16.

where the hell is this that 1 18 count is almost 10 dollars

1 18 pack is 4.16.

where the hell is this that 1 18 count is almost 10 dollars

Just logged into my Publix Instacart... says it's also $10.19 here in Va for 18 X-large

I'm about to go to the store tomorrow to get four or five dozen if they are not $4 a piece that is at Aldi

I usually shop at Aldi. Eggs are $3 and some change the last time I went (few nights ago). I like Eggland's Best though and those are about $5 for 12.

I, like other BGOL ballers, can't relate.

Our dozen bald eagle eggs, cost $25k. We wish eggs were only $8.98 foh

#endangerecuisine

#8komelletelife

#bgolballer

Our dozen bald eagle eggs, cost $25k. We wish eggs were only $8.98 foh

#endangerecuisine

#8komelletelife

#bgolballer

Chick on the right doing we going to Costco dance

I've seen the Egg price fluctuations at My Job.

Regular has started to go down in price recently.

Especially from last year..

But I tend to buy (Organic) Pasteurized which tend to be a bit more.

Depending on the Farm/Vendor, anywhere from $4.29 - $5.49 a dozen.

Employee discount helps for sure.

But My Customers are anxiously awaiting that WEGMAN'S to open at the old K-MART spot on Astor Place.

In hopes of getting some more competitive pricing.

Especially on the staples.

Regular has started to go down in price recently.

Especially from last year..

But I tend to buy (Organic) Pasteurized which tend to be a bit more.

Depending on the Farm/Vendor, anywhere from $4.29 - $5.49 a dozen.

Employee discount helps for sure.

But My Customers are anxiously awaiting that WEGMAN'S to open at the old K-MART spot on Astor Place.

In hopes of getting some more competitive pricing.

Especially on the staples.

Man, my dodo bird eggs cost 250k. U gettin' off cheap.I, like other BGOL ballers, can't relate.

Our dozen bald eagle eggs, cost $25k. We wish eggs were only $8.98 foh

#endangerecuisine

#8komelletelife

#bgolballer

From chicken wings to used cars, inflation begins to ease its grip

But there’s still a long way to go before consumers feel much relief or the Federal Reserve hits its goal of a 2 percent annual price target

A shopper looks at Black Friday displays at a Walmart store in Wilmington, Del., on Nov. 25. With inflation at record levels, retailers expect shoppers to be looking for especially good deals as discretionary spending falls.

A shopper looks at Black Friday displays at a Walmart store in Wilmington, Del., on Nov. 25. With inflation at record levels, retailers expect shoppers to be looking for especially good deals as discretionary spending falls.

The price of gasoline is dropping like a rock. Chicken wings are suddenly a bargain. And retailers drowning in excess inventory are looking to make a deal.

After more than a year of high inflation, many consumers are finally starting to catch a break. Even apartment rents and car prices, two items that hammered millions of household budgets this year, are no longer spiraling out of control.

Global supply chains are finally operating normally, as more consumers spend more on in-person services like restaurant meals and less on goods like furniture and computers that come from an ocean away. The cost of sending a standard 40-foot container from China to the U.S. West Coast is $1,935 — down more than 90 percent from its September 2021 peak of $20,586, according to the online freight marketplace Freightos.

Biden’s rescue plan made inflation worse but the economy better

The moderation in inflation is just beginning to appear in government statistics. In October, the Federal Reserve’s preferred price gauge, the personal consumption expenditures index, posted its smallest monthly increase since September of last year, and is up 6 percent over the past 12 months. The better-known consumer price index is rising at an annual rate of 7.7 percent, down from 9.1 percent in June.

“The worst of the inflation is behind us,” said Steven Blitz, chief U.S. economist for TS Lombard in New York. “The question is where does inflation settle?”

The Fed has been raising interest rates sharply since March in a bid to get inflation back to its 2-percent price stability target. Fed Chair Jerome H. Powell on Wednesday noted signs of progress, but said it was far too early to claim victory. Friday’s stronger-than-expected jobs report, which showed wages rising too quickly for policymakers’ tastes, only underscored the point. The central bank does not expect to reach its inflation goal until 2025.

“It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high,” Powell told an audience at the Brookings Institution.

Still, there are clear signs of improvement in merchandise prices, as consumers resume their pre-pandemic spending patterns. Excluding volatile food and energy prices, goods prices rose in October by 5.1 percent, down from a 12.3 percent annual rate in February.

But as goods prices begin cooling, pressure is building on services. Rising demand and limited supply — think short-staffed restaurants — has services inflation running at an annual 6.7 percent rate, more than twice the year-ago figure.

“The expectation is that goods prices will continue to disinflate. But services inflation will more gradually slow and will be much stickier,” said Kathy Bostjancic, chief economist at Nationwide.

Most of what is happening now with prices reflects developments in specific markets or consumers’ return to pre-pandemic routines. The plunge in ocean shipping costs, by itself, has stripped roughly 0.7 percentage points from the inflation rate, Freightos chief executive Zvi Schreiber said.

By making credit more expensive, the Fed has put a major dent in the housing industry. With mortgage rates briefly topping 7 percent recently, pending home sales in October were 37 percent lower than one year earlier, according to the National Association of Realtors. But the full effect on the economy of higher interest rates will take many months to materialize.

Either way, consumers are unimpressed. Less than 1 percent of those responding to a recent Census Bureau survey said they had noticed prices for goods and services declining over the past two months. And 15.7 percent of households said they find it “very difficult” to pay their routine household expenses, a figure that is virtually unchanged from the 15.9 percent who reported affordability woes in June.

To be sure, in a $26 trillion economy, prices on some products are always falling even as many others rise. In June, when inflation reached its highest point in more than 40 years, prices nonetheless dropped that month for bacon, window coverings and men’s sweaters, according to the Bureau of Labor Statistics. So it’s important not to exaggerate the recent improvement.

That said, the global economic backdrop has shifted.

With Europe and the United Kingdom in recession and China hobbled by its restrictive “zero covid” policy, global demand for oil has sagged. A barrel of Brent crude now goes for about $85, one-third less than in early March following Russia’s invasion of Ukraine. As a result, the national average price for a gallon of regular gasoline is $3.47, down almost 8 percent from one month ago, according to AAA.

CONTINUED:

But there’s still a long way to go before consumers feel much relief or the Federal Reserve hits its goal of a 2 percent annual price target

The price of gasoline is dropping like a rock. Chicken wings are suddenly a bargain. And retailers drowning in excess inventory are looking to make a deal.

After more than a year of high inflation, many consumers are finally starting to catch a break. Even apartment rents and car prices, two items that hammered millions of household budgets this year, are no longer spiraling out of control.

Global supply chains are finally operating normally, as more consumers spend more on in-person services like restaurant meals and less on goods like furniture and computers that come from an ocean away. The cost of sending a standard 40-foot container from China to the U.S. West Coast is $1,935 — down more than 90 percent from its September 2021 peak of $20,586, according to the online freight marketplace Freightos.

Biden’s rescue plan made inflation worse but the economy better

The moderation in inflation is just beginning to appear in government statistics. In October, the Federal Reserve’s preferred price gauge, the personal consumption expenditures index, posted its smallest monthly increase since September of last year, and is up 6 percent over the past 12 months. The better-known consumer price index is rising at an annual rate of 7.7 percent, down from 9.1 percent in June.

“The worst of the inflation is behind us,” said Steven Blitz, chief U.S. economist for TS Lombard in New York. “The question is where does inflation settle?”

The Fed has been raising interest rates sharply since March in a bid to get inflation back to its 2-percent price stability target. Fed Chair Jerome H. Powell on Wednesday noted signs of progress, but said it was far too early to claim victory. Friday’s stronger-than-expected jobs report, which showed wages rising too quickly for policymakers’ tastes, only underscored the point. The central bank does not expect to reach its inflation goal until 2025.

“It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high,” Powell told an audience at the Brookings Institution.

Still, there are clear signs of improvement in merchandise prices, as consumers resume their pre-pandemic spending patterns. Excluding volatile food and energy prices, goods prices rose in October by 5.1 percent, down from a 12.3 percent annual rate in February.

But as goods prices begin cooling, pressure is building on services. Rising demand and limited supply — think short-staffed restaurants — has services inflation running at an annual 6.7 percent rate, more than twice the year-ago figure.

“The expectation is that goods prices will continue to disinflate. But services inflation will more gradually slow and will be much stickier,” said Kathy Bostjancic, chief economist at Nationwide.

Most of what is happening now with prices reflects developments in specific markets or consumers’ return to pre-pandemic routines. The plunge in ocean shipping costs, by itself, has stripped roughly 0.7 percentage points from the inflation rate, Freightos chief executive Zvi Schreiber said.

By making credit more expensive, the Fed has put a major dent in the housing industry. With mortgage rates briefly topping 7 percent recently, pending home sales in October were 37 percent lower than one year earlier, according to the National Association of Realtors. But the full effect on the economy of higher interest rates will take many months to materialize.

Either way, consumers are unimpressed. Less than 1 percent of those responding to a recent Census Bureau survey said they had noticed prices for goods and services declining over the past two months. And 15.7 percent of households said they find it “very difficult” to pay their routine household expenses, a figure that is virtually unchanged from the 15.9 percent who reported affordability woes in June.

To be sure, in a $26 trillion economy, prices on some products are always falling even as many others rise. In June, when inflation reached its highest point in more than 40 years, prices nonetheless dropped that month for bacon, window coverings and men’s sweaters, according to the Bureau of Labor Statistics. So it’s important not to exaggerate the recent improvement.

That said, the global economic backdrop has shifted.

With Europe and the United Kingdom in recession and China hobbled by its restrictive “zero covid” policy, global demand for oil has sagged. A barrel of Brent crude now goes for about $85, one-third less than in early March following Russia’s invasion of Ukraine. As a result, the national average price for a gallon of regular gasoline is $3.47, down almost 8 percent from one month ago, according to AAA.

CONTINUED:

Spoke with my moms last week and she told me the Fine Fare she goes to in the Bronx was charging around $7 for a dozen. Meanwhile I just bought a dozen jumbo eggs for about $3.50 in Raleigh

Spoke with my moms last week and she told me the Fine Fare she goes to in the Bronx was charging around $7 for a dozen. Meanwhile I just bought a dozen jumbo eggs for about $3.50 in Raleigh

"FINE FARE" is one of the WORST Supermarkets to go to in this city for anything.

You try convincing an old Jamaican mom to change her normal routine from going to the Fine Fare 5 blocks away to driving out further to a Stop & Shop or BJs on a regular basis"FINE FARE" is one of the WORST Supermarkets to go to in this city for anything.

You try convincing an old Jamaican mom to change her normal routine from going to the Fine Fare 5 blocks away to driving out further to a Stop & Shop or BJs on a regular basis

Bruh,

I Hear Ya.

Similar threads

- Replies

- 3

- Views

- 99

- Replies

- 1

- Views

- 76

- Replies

- 1

- Views

- 209

- Replies

- 1

- Views

- 217