Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anyone investing heavily this year??

- Thread starter rph2005

- Start date

and the move to Texas maybe

Out of all these infrastructure stocks I like $NUE.

$CHPT is making an early morning run. I would only do LEAP with $CHPT now.

I sold that shit month ago

Might be a good time to start a position in AFRM

yep

INTC cant catch a break.Amd!

INTC cant catch a break.

Again, I'm worried about $INTC. Shit has to go perfect for them to get leadership back in 2025. $TSMC, $AMD, and $NVDA won't be sitting still. Will they follow the same fate as IBM?

$AMD on the other hand, they are quickly gaining datacenter market share. They have most of the largest cloud providers as customers and now, they're adding $FB as a customer. Products look damn promising. Pushing $NVDA in AI...sign me up.

There's a rumor that $AAPL is developing an ARM server chip. This makes me think that $AAPL will be $AMD's main competition (along with $NVDA) in datacenter and accelerator technology. Therefore, they're building a design fork in their next server processors to deal with 1. compute workloads (Genoa) and 2. cloud specific workloads (Bergamo). Speculation, but you never know.

There's hopefully another catalyst for $AMD this year and that's the $XLNX merger. I dumped a decent bag into $XLNX @ $130. Shit is over $200 now and will convert into 1.7234 shares of $AMD, which means there is still about a 20% upside (assuming the merger goes through).

Stocksera | AMD-XLNX Ratio

Empowering retailers to take advantage of alternative data

Good info. Thanks.Again, I'm worried about $INTC. Shit has to go perfect for them to get leadership back in 2025. $TSMC, $AMD, and $NVDA won't be sitting still. Will they follow the same fate as IBM?

$AMD on the other hand, they are quickly gaining datacenter market share. They have most of the largest cloud providers as customers and now, they're adding $FB as a customer. Products look damn promising. Pushing $NVDA in AI...sign me up.

There's a rumor that $AAPL is developing an ARM server chip. This makes me think that $AAPL will be $AMD's main competition (along with $NVDA) in datacenter and accelerator technology. Therefore, they're building a design fork in their next server processors to deal with 1. compute workloads (Genoa) and 2. cloud specific workloads (Bergamo). Speculation, but you never know.

There's hopefully another catalyst for $AMD this year and that's the $XLNX merger. I dumped a decent bag into $XLNX @ $130. Shit is over $200 now and will convert into 1.7234 shares of $AMD, which means there is still about a 20% upside (assuming the merger goes through).

Stocksera | AMD-XLNX Ratio

Empowering retailers to take advantage of alternative datastocksera.pythonanywhere.com

$FCEL

24%

24%

I dropped the ball, my 13 yr told me to buy him 5 more shares at $76, I forgot to move his limit order up from $70.$RBLX holy shit!

Robinhood discloses data breach impacting 7 million customers

Stock trading platform Robinhood has disclosed a data breach after their systems were hacked and a threat actor gained access to the personal information of approximately 7 million customers.

Robinhood discloses data breach impacting 7 million customers

Stock trading platform Robinhood has disclosed a data breach after their systems were hacked and a threat actor gained access to the personal information of approximately 7 million customers.www.bleepingcomputer.com

damn robin hood...

Are we going to act like little virgins? Every company gets their shit hacked. These corporations need to do better with legislation.

People can hate on $hood all the want but they have the best mobile app imo.

RH is the easiest/most user friendly but nowhere better than WeBullPeople can hate on $hood all the want but they have the best mobile app imo.

RH is the easiest/most user friendly but nowhere better than WeBull

Webull has more advanced features but Robinhood is all about simplicity. If you want to do deep research on a company you will use third party sites anyways. Webull also lacks in option features, no roll overs or calendar spreads.

RH is the easiest/most user friendly but nowhere better than WeBull

Webull has more advanced features but Robinhood is all about simplicity. If you want to do deep research on a company you will use third party sites anyways. Webull also lacks in option features, no roll overs or calendar spreads.

Not to mention pre market and after hour trades. Webull can trade as early as 4am. Also some stocks are not available on RH.

Robinhood discloses data breach impacting 7 million customers

Stock trading platform Robinhood has disclosed a data breach after their systems were hacked and a threat actor gained access to the personal information of approximately 7 million customers.www.bleepingcomputer.com

Posts up, waits for the class action lawsuit so i can get my cut.

Does anyone here use acorns?

I've been using it since 2017. I initially had it on moderate but switched to moderately aggressive last year. My return since I opened my account is almost 30%

$RBLX holy shit!

I don't hold their stock individually but I got in on the META etf Friday and they hold a large amount of RBLX..

I like RBLX long term but there will be more than one winner in the future of metaverse stocks.

RH is the easiest/most user friendly but nowhere better than WeBull

At the end of the day it's all about execution and making a profit.

I got in before the split, NVDA got my portfolio jumping.

finance.yahoo.com

finance.yahoo.com

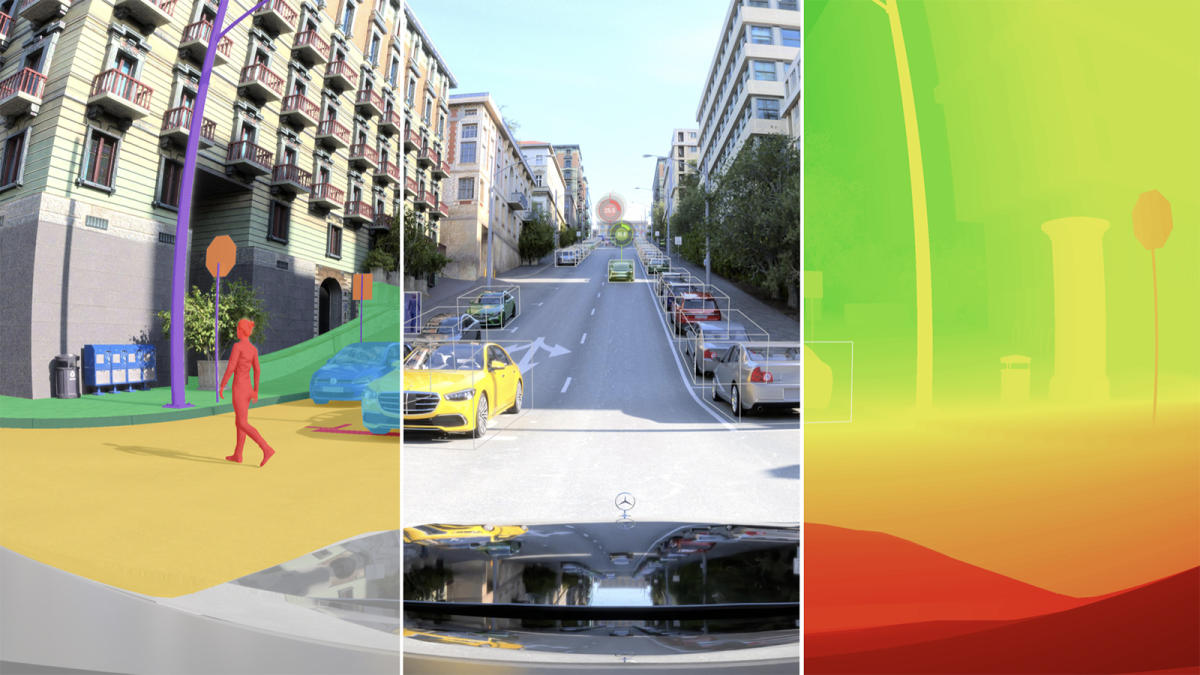

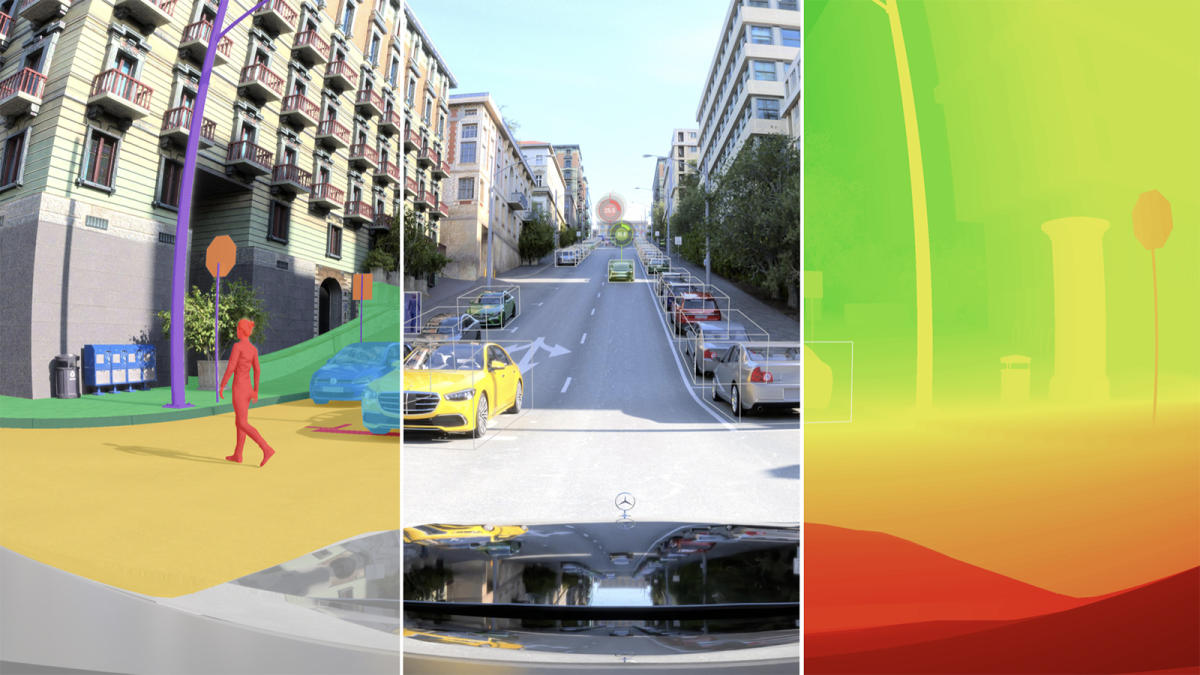

Nvidia promises fully self-driving cars with new Nvidia Drive tech

Nvidia is using AI and its Omniverse technology to develop self-driving cars.

I thought they were going to cool off this week. Nope.I got in before the split, NVDA got my portfolio jumping.

Nvidia promises fully self-driving cars with new Nvidia Drive tech

Nvidia is using AI and its Omniverse technology to develop self-driving cars.finance.yahoo.com

I thought they were going to cool off this week. Nope.

Jensen can't let that happen. Don't they have some sort of showcase today?

****Edit:. Luminar... One of my old SPAC holdovers. This could be interesting. More competition for $INTC Mobileye.

Last edited:

General Electric to break up into 3 independent companies

General Electric announced Tuesday it will break itself into three independent companies focused on aviation, health care and energy.Why it matters: The planned split of the once industrial powerhouse comes after years of seeing its stock underperform and the buildup of high levels of debt.Get...

Similar threads

- Replies

- 14

- Views

- 332

- Replies

- 38

- Views

- 2K

- Replies

- 34

- Views

- 1K