Economy badly disappoints with just 210,000 jobs in November

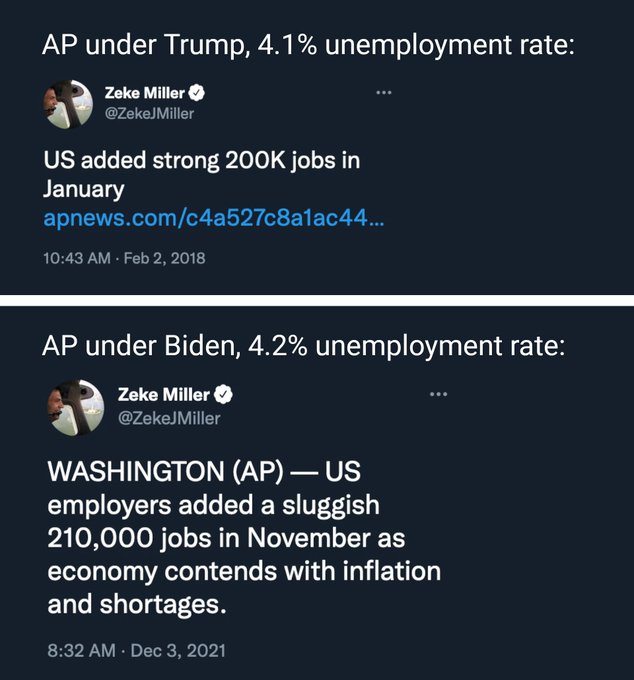

The economy added just 210,000 new jobs in November, far fewer than the half-million expected.

The disappointing news from the survey of establishments published by the Bureau of Labor Statistics Friday showed a loss of momentum in job gains, which had been strong the previous two months.

Still, the news from the separate household survey published in Friday's jobs report was more favorable. It showed the unemployment rate dropping by 0.4 percentage points to 4.2%, where it was in mid-2017.

Otherwise, the economic news in recent weeks has been relatively encouraging. Jobless claims, which are a proxy for layoffs, are running atextremely low levels.

POWELL SAYS FEDERAL RESERVE COULD MOVE FASTER TOWARD RATE HIKES AMID HIGH INFLATION

The economy continues to claw its way out of a pandemic-induced slump, but it is still millions of jobs short of its pre-pandemic level. Before COVID-19 hit, the unemployment rate was at an ultra-low 3.5%.

The gradual rebound of the economy ran into a speed bump over the summer when the delta variant of COVID-19 emerged and sent hospitalizations and deaths spiking. The omicron variant of the virus was recently discovered, which the World Health Organization quickly branded a “variant of concern.”

The stock market responded to the omicron variant with its worst single-day decline of 2021, although there has not yet been any evidence that the new strain is more dangerous than previous iterations of COVID-19.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Still, the country is suffering from rising prices, with inflation clocking in at 6.2% for the year ending in October, nearly 0.5% above predictions and the highest level in three decades. There are also concerns with worker shortages as some businesses struggle to find workers. The price pressures have led Federal Reserve Chairman Jerome Powell to say that the central bank will move more quickly toward raising its interest rate target.

Consumer confidence is also down, with the University of Michigan Consumer Sentiment Index falling to 67.4 in early November, from 71.7 in October — a 10-year low.

Tags: News, Jobs, Unemployment, Department of Labor, Inflation, Coronavirus

Original Author: Zachary Halaschak

Original Location: Economy badly disappoints with just 210,000 jobs in November

The economy added just 210,000 new jobs in November, far fewer than the half-million expected.

The disappointing news from the survey of establishments published by the Bureau of Labor Statistics Friday showed a loss of momentum in job gains, which had been strong the previous two months.

Still, the news from the separate household survey published in Friday's jobs report was more favorable. It showed the unemployment rate dropping by 0.4 percentage points to 4.2%, where it was in mid-2017.

Otherwise, the economic news in recent weeks has been relatively encouraging. Jobless claims, which are a proxy for layoffs, are running atextremely low levels.

POWELL SAYS FEDERAL RESERVE COULD MOVE FASTER TOWARD RATE HIKES AMID HIGH INFLATION

The economy continues to claw its way out of a pandemic-induced slump, but it is still millions of jobs short of its pre-pandemic level. Before COVID-19 hit, the unemployment rate was at an ultra-low 3.5%.

The gradual rebound of the economy ran into a speed bump over the summer when the delta variant of COVID-19 emerged and sent hospitalizations and deaths spiking. The omicron variant of the virus was recently discovered, which the World Health Organization quickly branded a “variant of concern.”

The stock market responded to the omicron variant with its worst single-day decline of 2021, although there has not yet been any evidence that the new strain is more dangerous than previous iterations of COVID-19.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Still, the country is suffering from rising prices, with inflation clocking in at 6.2% for the year ending in October, nearly 0.5% above predictions and the highest level in three decades. There are also concerns with worker shortages as some businesses struggle to find workers. The price pressures have led Federal Reserve Chairman Jerome Powell to say that the central bank will move more quickly toward raising its interest rate target.

Consumer confidence is also down, with the University of Michigan Consumer Sentiment Index falling to 67.4 in early November, from 71.7 in October — a 10-year low.

Tags: News, Jobs, Unemployment, Department of Labor, Inflation, Coronavirus

Original Author: Zachary Halaschak

Original Location: Economy badly disappoints with just 210,000 jobs in November

I'm dead.

I'm dead.