This peaked my interest because I don't want my SS being offset with this garbage living overseas.

1. The Lack of Information (Fraud, Inducement)

Let say the government issues misleading information to a large portion of the population by claiming the infection rate from AIDS and Monkeypox is extremely low. We know that AIDS and Monkeypox affect the LGBTQ+ community mainly.

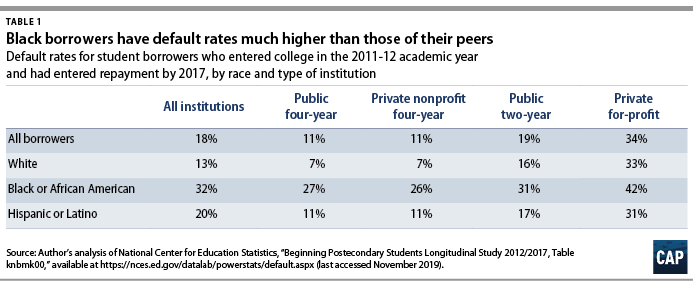

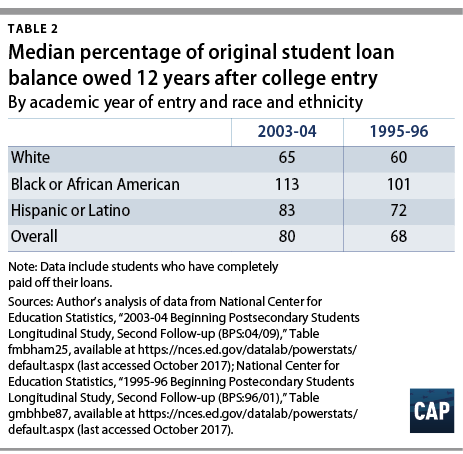

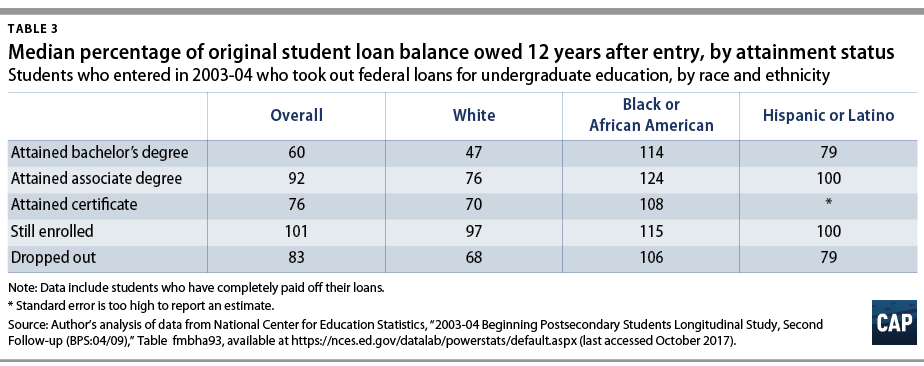

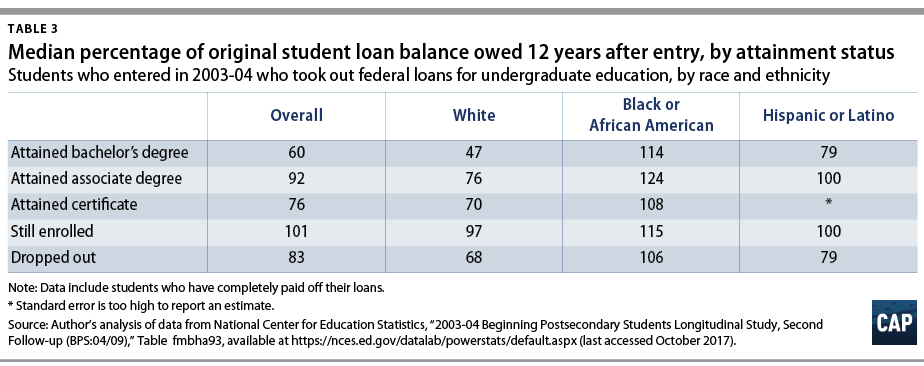

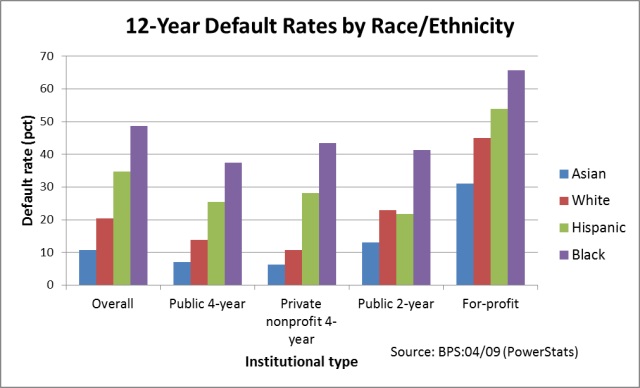

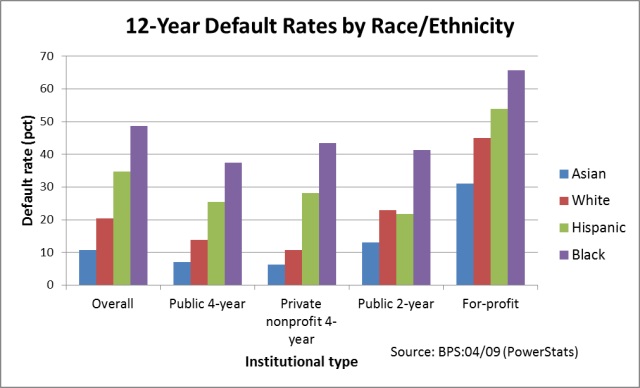

The same thing happened to us by the federal government, not providing relevant data regarding the default rates on student loans until the Obama administration. Aggregating the data to hide the truth, which would have deter many from seeking college.

Hiding that although you went to college, like your white peers, your job prospects were deem and your ability to repay your student was bleak. It wasn't until the President Obama administration that this data was finally compiled and released.

It is no different than drinking contaminated water from Camp Lejeune, and receiving a payout for damages.

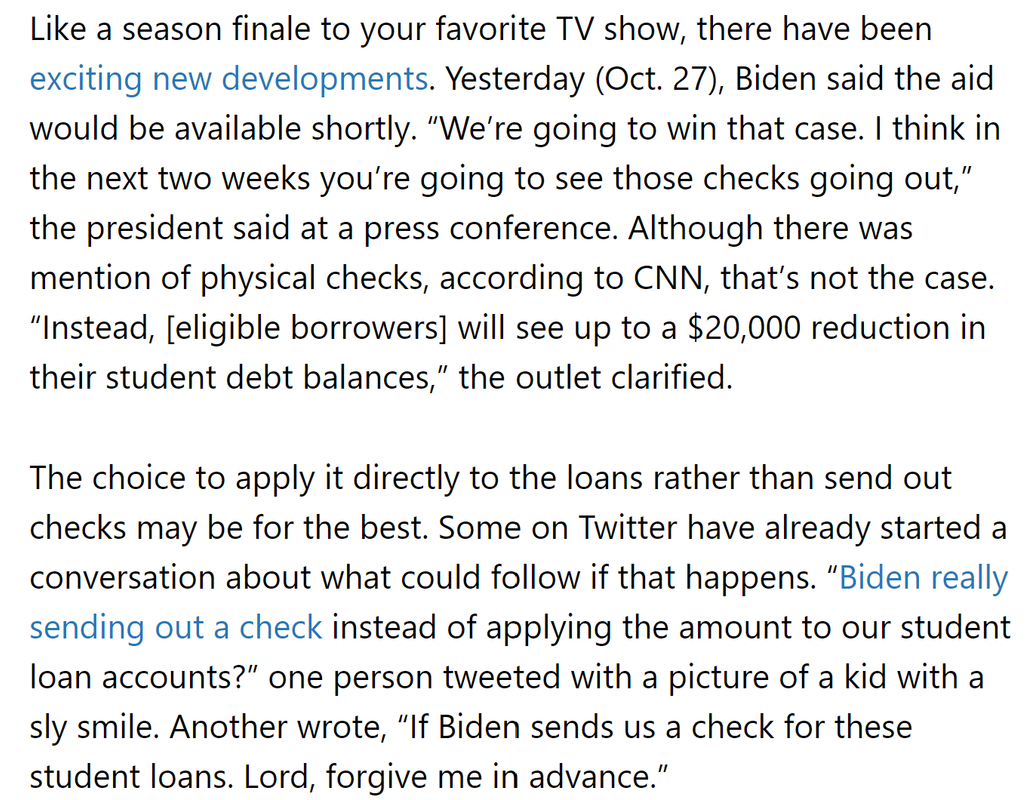

One of the few positive things about this clown was his insight on this matter.

2. Income Based Repayment

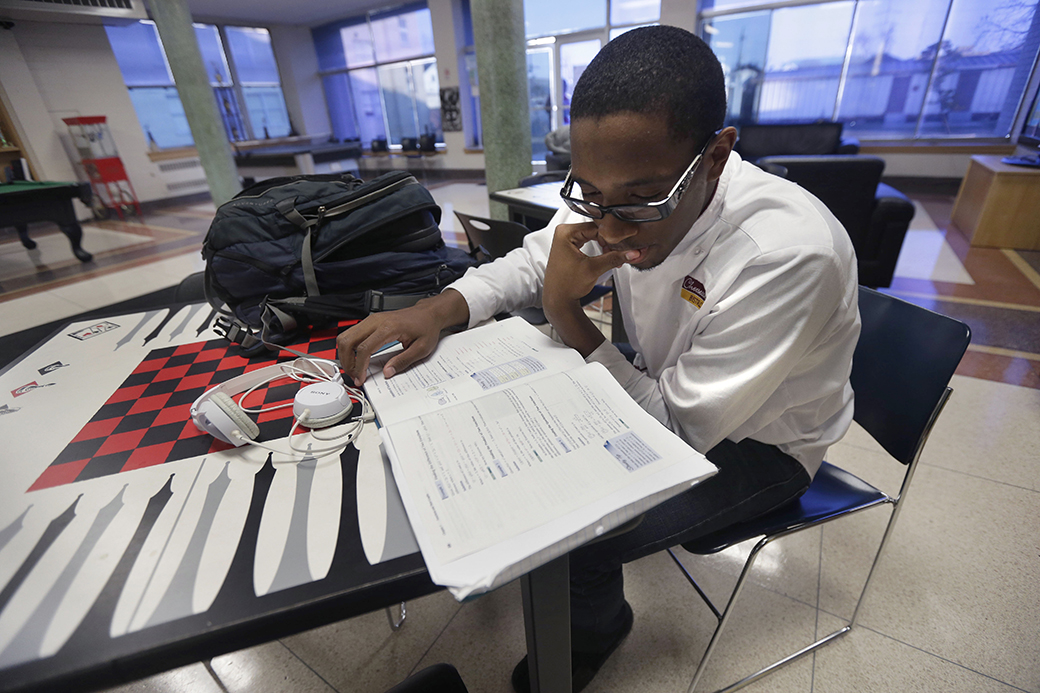

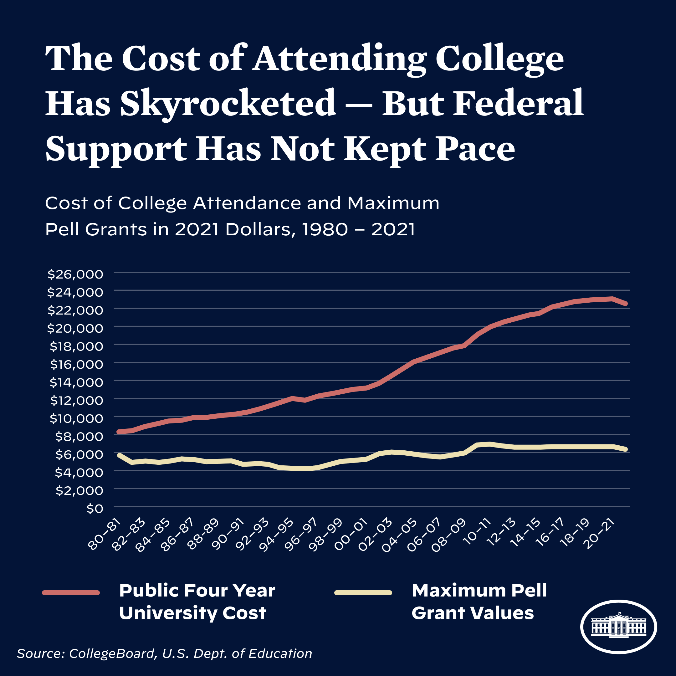

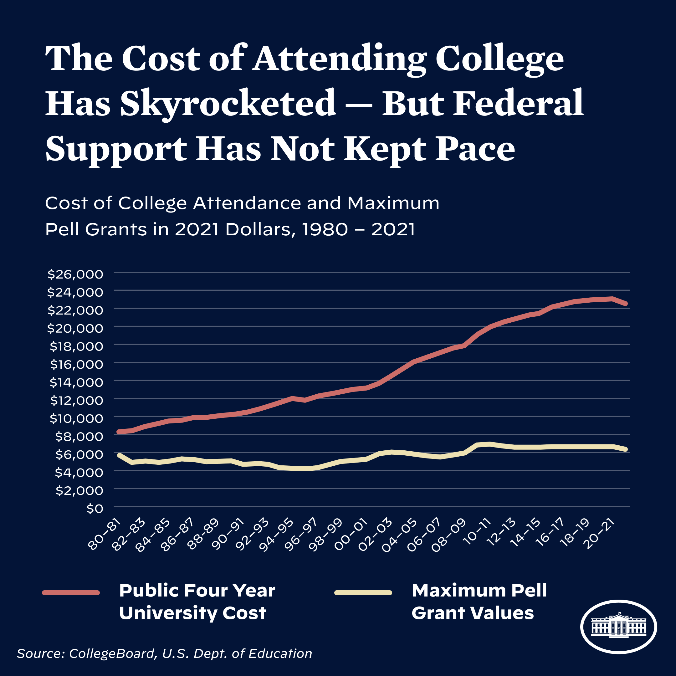

The big thing this executive order will change is setting up an income based repayment plan that is extremely affordable. You basically pay 5% for 10 years. I was the first to advise parents to buy real estate, stock, or other investment assets in lieu of paying fully for a degree. This is a huge wealth transfer out of the black community. We can transfer the risk back to the federal government if you end up earning like me 25% of what your white peers earn or deal with intellectual property theft that prevents you from starting a business, the federal government will pick up the costs.

www.whitehouse.gov

www.whitehouse.gov

3. Loan Forgiveness is Small

Loan forgiveness is actually a tiny part of this package that many people attack as being unfair. Unfair is earning a degree with the same GPA and still not getting the same job prospects. Going forward, students that do not get this loan forgiveness will benefit tremendously which can be many times more. I done some rough calculation, it is a huge benefit that if you are affected by discriminatory hiring practices, you are looking at $80,000 to $200,000 of loan 'forgiveness'.

4. You might have paid off your loans, but the really affordable income repayment plan will benefit greatly your children and your wallet. Instead of saving up to fully pay their $100,000 tuition, you can pocket the money giving you a huge benefit. Again you can set aside investment in real estate or the stock market to help them, meanwhile let them test out the job market to see if they can earn the income to fully pay the loan.

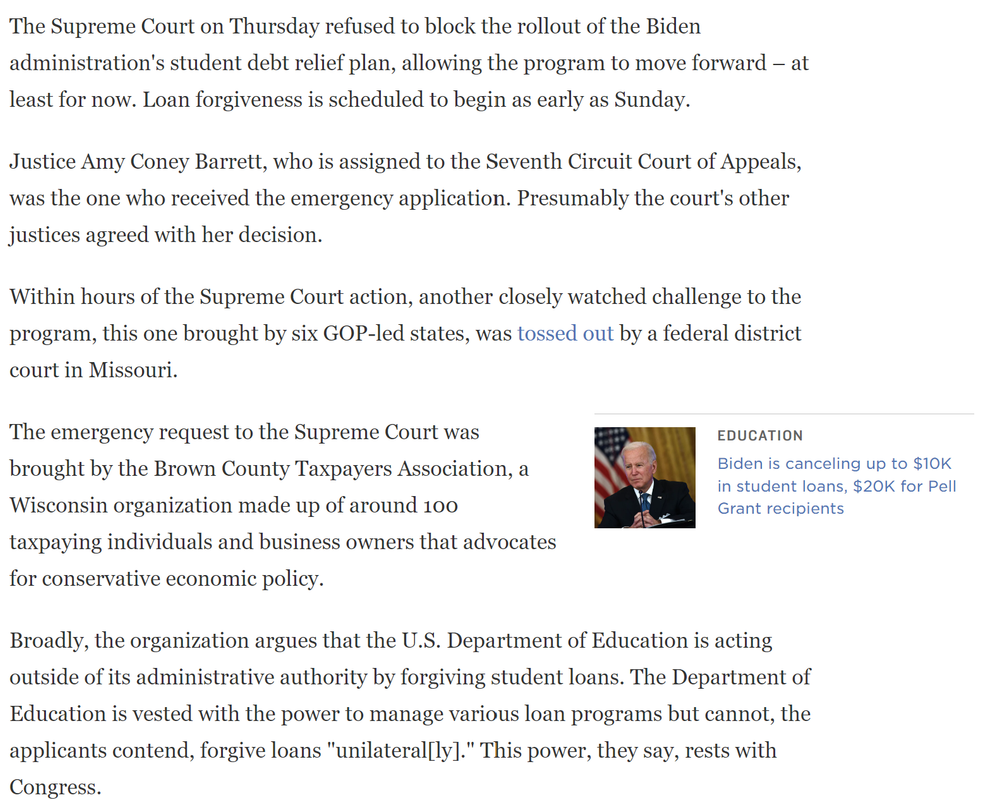

If the federal government mislead us into taking out student loans either to hide discrimination by the private sector, this could be grounds for a class action lawsuit. I believe this plan remedies this problem, although the basis/authority is due to the pandemic.

1. The Lack of Information (Fraud, Inducement)

Let say the government issues misleading information to a large portion of the population by claiming the infection rate from AIDS and Monkeypox is extremely low. We know that AIDS and Monkeypox affect the LGBTQ+ community mainly.

The same thing happened to us by the federal government, not providing relevant data regarding the default rates on student loans until the Obama administration. Aggregating the data to hide the truth, which would have deter many from seeking college.

Hiding that although you went to college, like your white peers, your job prospects were deem and your ability to repay your student was bleak. It wasn't until the President Obama administration that this data was finally compiled and released.

It is no different than drinking contaminated water from Camp Lejeune, and receiving a payout for damages.

One of the few positive things about this clown was his insight on this matter.

2. Income Based Repayment

The big thing this executive order will change is setting up an income based repayment plan that is extremely affordable. You basically pay 5% for 10 years. I was the first to advise parents to buy real estate, stock, or other investment assets in lieu of paying fully for a degree. This is a huge wealth transfer out of the black community. We can transfer the risk back to the federal government if you end up earning like me 25% of what your white peers earn or deal with intellectual property theft that prevents you from starting a business, the federal government will pick up the costs.

FACT SHEET: President Biden Announces Student Loan Relief for Borrowers Who Need It Most | The White House

A three-part plan delivers on President Biden’s promise to cancel $10,000 of student debt for low- to middle-income borrowers President Biden believes that a post-high school education should be a ticket to a middle-class life, but for too many, the cost of borrowing for college is a lifelong...

Forgive loan balances after 10 years of payments, instead of 20 years, for borrowers with original loan balances of $12,000 or less. The Department of Education estimates that this reform will allow nearly all community college borrowers to be debt-free within 10 years.

3. Loan Forgiveness is Small

Loan forgiveness is actually a tiny part of this package that many people attack as being unfair. Unfair is earning a degree with the same GPA and still not getting the same job prospects. Going forward, students that do not get this loan forgiveness will benefit tremendously which can be many times more. I done some rough calculation, it is a huge benefit that if you are affected by discriminatory hiring practices, you are looking at $80,000 to $200,000 of loan 'forgiveness'.

4. You might have paid off your loans, but the really affordable income repayment plan will benefit greatly your children and your wallet. Instead of saving up to fully pay their $100,000 tuition, you can pocket the money giving you a huge benefit. Again you can set aside investment in real estate or the stock market to help them, meanwhile let them test out the job market to see if they can earn the income to fully pay the loan.

If the federal government mislead us into taking out student loans either to hide discrimination by the private sector, this could be grounds for a class action lawsuit. I believe this plan remedies this problem, although the basis/authority is due to the pandemic.

Last edited: