source:

Daily Kos

Top dogs' corporate profits hit new records. Still hoarding gobs of cash, still barely hiring

The Fortune 500

are raking in the profits as never before. Indeed, corporate profits overall are back to pre-recession levels.

The Fortune 500 generated a total of $824.5 billion in earnings last year, up 16.4% over 2010. That beats the previous record of $785 billion, set in 2006 during a roaring economy. The 2011 profits are outsized based on two key historical metrics. They represent 7% of total sales, vs. an average of 5.14% over the 58-year history of the Fortune 500. Companies are also garnering exceptional returns on their capital. The 500 achieved a return-on-equity of 14.3%, far above the historical norm of 12%.

But business investment? Running about 16.5 percent vs. a pre-recession rate of 20 percent,

according to the International Institute for Labour Studies.

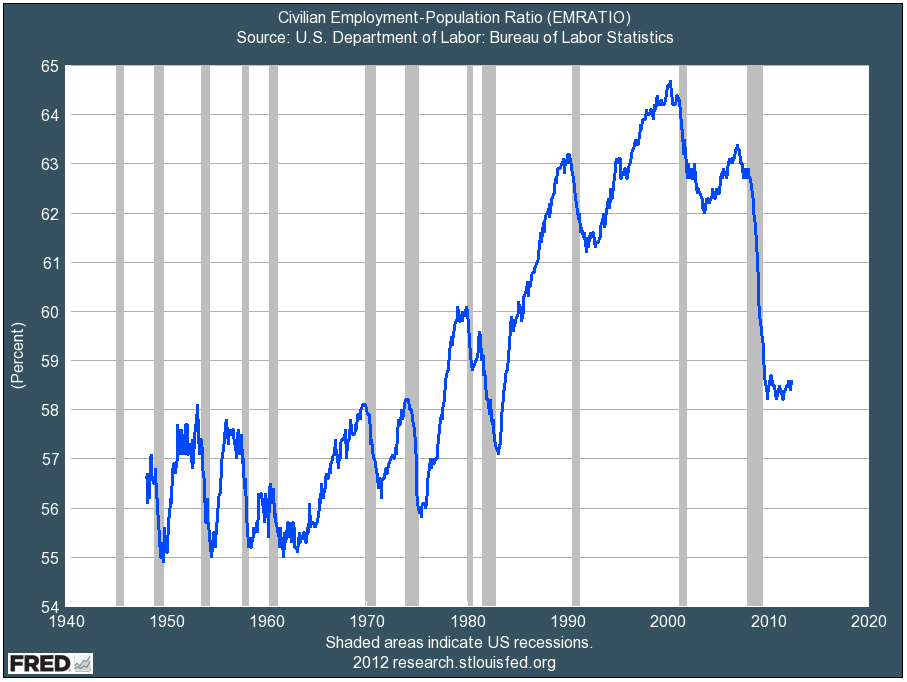

And hiring? Still limping along. Millions of new private sector jobs created over the past three years, but far short of the number required. The

last jobs report, at a seasonally adjusted 115,000 jobs, was just barely above the level required to absorb increases to the working-age population, although the number of new hires will probably be revised upward 10-15 percent when the next report appears in June.

Meanwhile, the biggest U.S. non-financial corporations are sitting on an estimated $2 trillion in cash instead of using the money to hire more workers or invest in new projects.

At present, cash

accounts for more than 6 per cent of the assets on the balance sheets of US non-financial companies. That is the highest in at least six decades, and represents the fruit of record high profit margins. Companies cut costs through redundancies during the post-Lehman economic swoon, while negligible interest rates reduced their borrowing costs. As a result, US corporate profits are higher, as a share of gross domestic product, than at any time since 1950.

But as uncertainty persists, groups are reluctant to repay that cash to shareholders by buying back stock or — particularly — paying dividends. The pay-out ratio (the proportion of earnings that go in dividends) for the S&P 500 index is at its lowest since 1900.

Got that? Corporate profits are higher, percentage-wise, than in more than 60 years. The dividend pay-out ratio is lower than in

more than a century. And the companies are sitting on piles of money that make Scrooge McDuck look like an Occupy activist.

Meanwhile, extensive productivity gains during the recovery have benefited employers and stock prices but not workers. While the profits have rolled in, wages have risen less than two-thirds the level of inflation in the past 12 months.

Forbes notes that this can't last. Employers have squeezed about as much as they can out of their layoff-shrunken work-forces. Soon, it is claimed, they will have to hire more workers to meet growing consumer demand. There is, it is true, evidence in the data that more and more part-time workers who have been hankering for full-time jobs are finally getting them. And that

could be a precursor to vastly more hiring and rehiring. Which, if it isn't just another verse in the siren song we've been hearing for two years straight, would obviously be music to the ears of the 25 or so million Americans who are officially jobless or underemployed, as well as those millions who have fallen off the radar completely.

But, given the actual play of the economy recently, best to believe it when we see it.

Your turn!