http://globalguerrillas.typepad.com/globalguerrillas/2011/06/the-bitcoin-bubble.html

THE BITCOIN BUBBLE

If you haven't already heard about bitcoin, the first popular cypto-currency, you soon will. The idea for the currency is simple. It's a software system that makes it possible to manufacture and trade (P2P), in a public and decentralized way, a limited digital resource. That's it.

So why the interest in bitcoin?

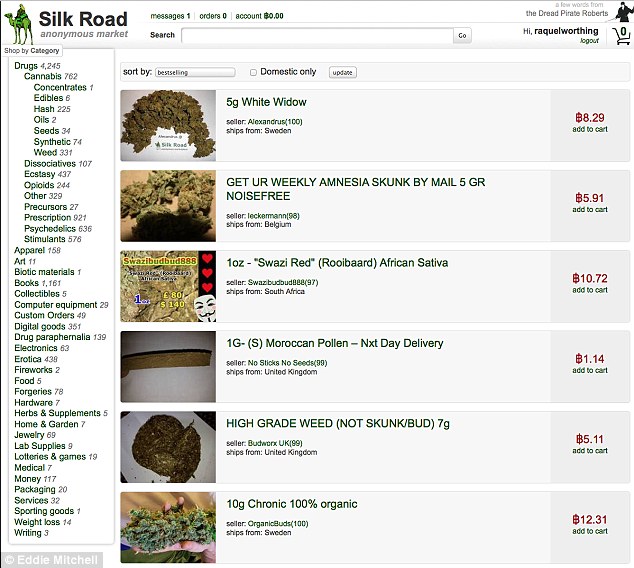

Simple. It appears to be gaining critical mass as a transactional currency that operates outside of the traditional monetary conduits (banks, SWIFT, etc.). That fact alone has attracted lots of people to the system, despite the fact that it's not built to allow completely anonymous transactions (it can't be, given that it requires network broadcasts of every transaction to maintain the integrity of the system and prevent counterfeiting).

As a transactional currency that operates outside of traditional systems, it's actually a pretty good medium of exchange (particularly if those transactions are small and quick). The problems arise when people confuse bitcoin's role as a transactional medium and its role as a store of value (as in: holding it as an asset).

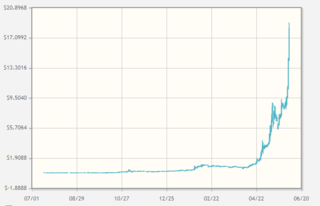

As a store of value or an asset it's shady. Here's why: since the supply of bitcoin is limited and knowledge/use of it is growing (potentially virally) it's the perfect breeding ground for a speculative bubble. In a world awash with scams and financial speculation (a defining characteristic of our time), it was only a matter of time before the pump and dump mobsters moved in. Spamming message boards everywhere. Generating buzz. Taking speculative positions. The rapid rise in bitcoin's value relative to the dollar can be seen below (on thin trading) demonstrates that this is already going on:

Bitcoin Trading History

So, for those of you with the stomach to take bets with eastern european mobsters and US financial boiler rooms or if your willing to bet on the fickleness of viral adoption, you might be interested in taking a look at bitcoin as an asset. Of course, a dollar's worth of bitcoins may be worth nothing or $100 in a month, who knows?

As far as I know this could become the first P2P bubble. If you know of others, let me know.

THE BITCOIN BUBBLE

If you haven't already heard about bitcoin, the first popular cypto-currency, you soon will. The idea for the currency is simple. It's a software system that makes it possible to manufacture and trade (P2P), in a public and decentralized way, a limited digital resource. That's it.

So why the interest in bitcoin?

Simple. It appears to be gaining critical mass as a transactional currency that operates outside of the traditional monetary conduits (banks, SWIFT, etc.). That fact alone has attracted lots of people to the system, despite the fact that it's not built to allow completely anonymous transactions (it can't be, given that it requires network broadcasts of every transaction to maintain the integrity of the system and prevent counterfeiting).

As a transactional currency that operates outside of traditional systems, it's actually a pretty good medium of exchange (particularly if those transactions are small and quick). The problems arise when people confuse bitcoin's role as a transactional medium and its role as a store of value (as in: holding it as an asset).

As a store of value or an asset it's shady. Here's why: since the supply of bitcoin is limited and knowledge/use of it is growing (potentially virally) it's the perfect breeding ground for a speculative bubble. In a world awash with scams and financial speculation (a defining characteristic of our time), it was only a matter of time before the pump and dump mobsters moved in. Spamming message boards everywhere. Generating buzz. Taking speculative positions. The rapid rise in bitcoin's value relative to the dollar can be seen below (on thin trading) demonstrates that this is already going on:

Bitcoin Trading History

So, for those of you with the stomach to take bets with eastern european mobsters and US financial boiler rooms or if your willing to bet on the fickleness of viral adoption, you might be interested in taking a look at bitcoin as an asset. Of course, a dollar's worth of bitcoins may be worth nothing or $100 in a month, who knows?

As far as I know this could become the first P2P bubble. If you know of others, let me know.