My shares were assigned after I sold a covered call on them. That was a great day.HYLN posting earnings in after-hours.

If these fuckers don't report positive earnings, imma run up in their office and start letting off.

I have $8k with these bastards and my shit has been declining for months.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anyone investing heavily this year??

- Thread starter rph2005

- Start date

So, I'm sitting on some cash at the moment based on some winning trades...But i'm hungry as hell.

Should i hold onto that cash and see what happens to the market tomorrow etc or continue to take advantage of the sales?

i am holding to buy when it inevitably dips again tomorrow

i am holding to buy when it inevitably dips again tomorrow

Thank you! I think i'll take my win into tomorrow and shut it down today.

This is where your accounting 101 and finance 101 classes come into play. What do you believe in? You know what I don’t believe in? Some dickhead spending his companies money on buying imaginary money.

Elon and BTC I presume..?

Dude should learn to make a car with a decent interior but he gets paid off of stock prices soElon and BTC I presume..?

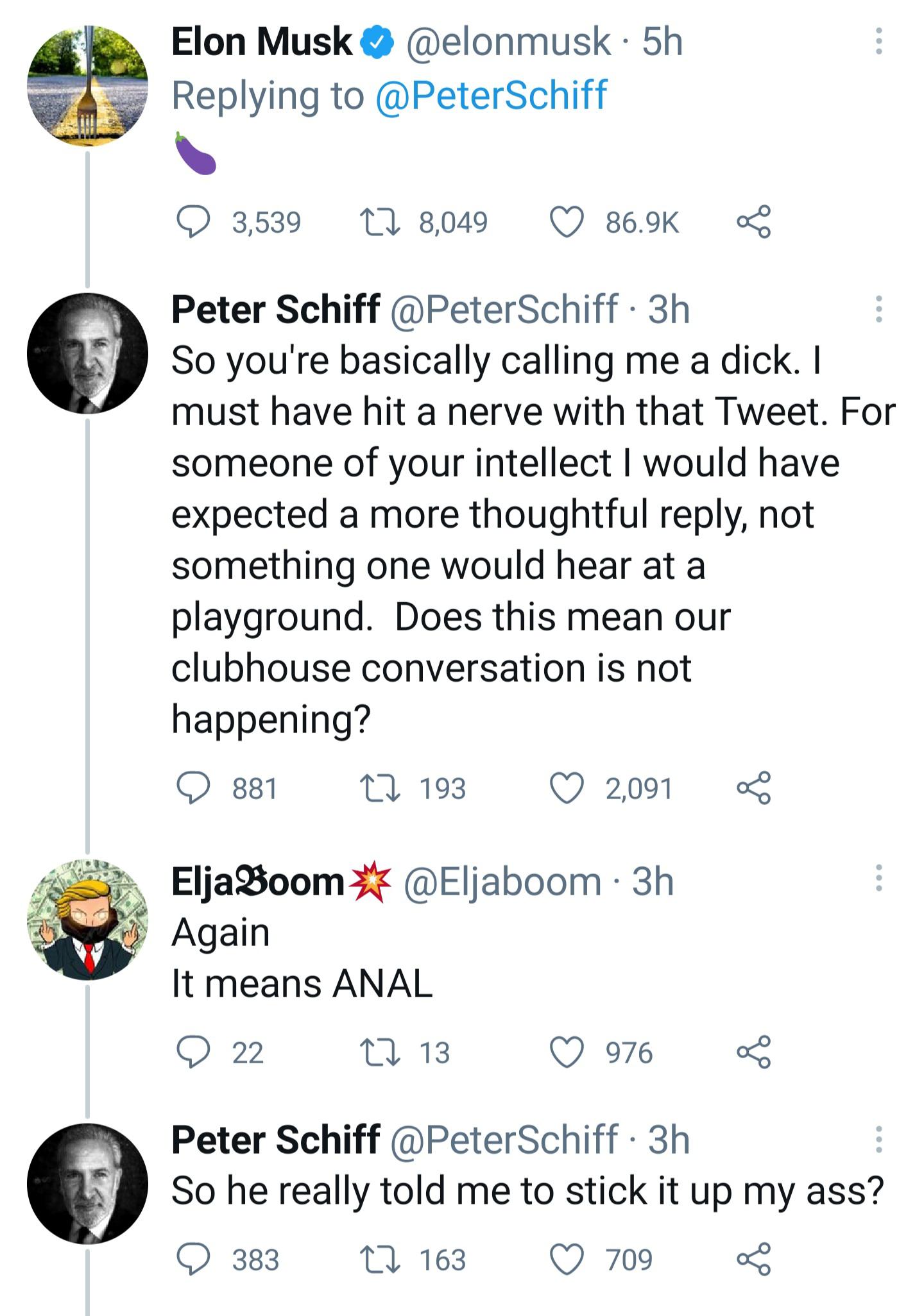

Twitter is the greatest thing ever.

We got CEOs using eggplant emojis as a diss

WORD!Dude should learn to make a car with a decent interior but he gets paid off of stock prices so

So, I'm sitting on some cash at the moment based on some winning trades...But i'm hungry as hell.

Should i hold onto that cash and see what happens to the market tomorrow etc or continue to take advantage of the sales?

Hold that shit! At least wait for the fed to talk his shit around 2pm today. I watched and missed out on a lot of moves, because I'm out of day trades, and I'm not getting caught out there. Didn't pay attention to the fed back in 2017-18 and got wipe out because of him, and fucking CAC Trump with his China tweets!

Can you break down a covered call? I'm about to go research YT for it also.My shares were assigned after I sold a covered call on them. That was a great day.

Twitter is the greatest thing ever.

We got CEOs using eggplant emojis as a diss

and peter schiff confuse about the interpretation. lol

Check this video from the main board that was posted.

I find this very Interesting, that a Chinese company owns AMC, and their government is pressuring them to sell off assets. We got Amazon looking at maybe buying AMC.

I find this very Interesting, that a Chinese company owns AMC, and their government is pressuring them to sell off assets. We got Amazon looking at maybe buying AMC.

if the market wasn't down I think it would be back to $60cciv looks to be settling in at about 38-39

My shares were assigned after I sold a covered call on them. That was a great day.

How much did you make off the premium?

and peter schiff confuse about the interpretation. lol

Old ass pop culture challenged dummy.

[/QUOTE]

BAC, JPM, and even bitch ass Wells Fargo are good long term buys.

$BAC is perfoming well has been for a while

BAC, JPM, and even bitch ass Wells Fargo are good long term buys.

spoke too sooncciv looks to be settling in at about 38-39

Check this video from the main board that was posted.

I find this very Interesting, that a Chinese company owns AMC, and their government is pressuring them to sell off assets. We got Amazon looking at maybe buying AMC.

You must’ve thought I was kidding when I said “Beijing” Biden is selling us out.

the U.S. been bought and sold.. this ain't on bidenYou must’ve thought I was kidding when I said “Beijing” Biden is selling us out.

Basically, when you own 100 shares of a stock, you get paid to list them for sale (as an option). The amount you are paid is called the "premium". If the stock price is below the strike you chose, you keep your shares and do it all over again. If the stock price is at or above the strike you chose, they give (assign) your shares to the person who bought the option.Can you break down a covered call? I'm about to go research YT for it also.

Right here. Had too. Bears were gnawing on my soul.I hope somebody got puts on $RIOT

Yo I saw this shit this morning and was cracking tf up!! What a hot mess! These muggs is fuckng with the market for sure!!Damn...so now we got wall street tweeter beefs???

Hold that shit! At least wait for the fed to talk his shit around 2pm today. I watched and missed out on a lot of moves, because I'm out of day trades, and I'm not getting caught out there. Didn't pay attention to the fed back in 2017-18 and got wipe out because of him, and fucking CAC Trump with his China tweets!

Was away! Did it happen yet? If so what they say?

Nah, playa. Check the market since he has been sworn in, spoke to, and got bitched at by Xi, and the Chinese stocks’ correlation has been like clockwork. Check the top gainer today. Shit is unbelievable.the U.S. been bought and sold.. this ain't on biden

HYLN posting earnings in after-hours.

If these fuckers don't report positive earnings, imma run up in their office and start letting off.

I have $8k with these bastards and my shit has been declining for months.

I know the feeling. I have a larger position than that in CLOV, had it when it was a spac. I feel like I'm bag holding a ton of bricks

Basically, when you own 100 shares of a stock, you get paid to list them for sale (as an option). The amount you are paid is called the "premium". If the stock price is below the strike you chose, you keep your shares and do it all over again. If the stock price is at or above the strike you chose, they give (assign) your shares to the person who bought the option.

Good looking out man. That's what I was thinking, but wanted to be sure. So if I have a 100 shares of $SNDL at 1.28. I can sell a covered call at a $3 strike price, at 14 day period. If the stock stays under $3 at the end of the contact, I keep the premium and the stock. If the stock hits $3 and above, the buyer has the right to exercise the option at the strike price for $3 and gets the 100 shares.

You sure about that, playa?cciv looks to be settling in at about 38-39

let me do some more research

Good looking out man. That's what I was thinking, but wanted to be sure. So if I have a 100 shares of $SNDL at 1.28. I can sell a covered call at a $3 strike price, at 14 day period. If the stock stays under $3 at the end of the contact, I keep the premium and the stock. If the stock hits $3 and above, the buyer has the right to exercise the option at the strike price for $3 and gets the 100 shares.

Yes, you keep the premium but the other party would have the right to exercise the option. Covered calls also limit your profit, if the stock went to $4 you would lose out on all that profit because you would have sold it at $3

Good looking out man. That's what I was thinking, but wanted to be sure. So if I have a 100 shares of $SNDL at 1.28. I can sell a covered call at a $3 strike price, at 14 day period. If the stock stays under $3 at the end of the contact, I keep the premium and the stock. If the stock hits $3 and above, the buyer has the right to exercise the option at the strike price for $3 and gets the 100 shares.

Yea, they have "the right", but from what I saw on TD and WeBull its pretty much automatic that you will give up the shares.

Yes, you keep the premium but the other party would have the right to exercise the option. Covered calls also limit your profit, if the stock went to $4 you would lose out on all that profit because you would have sold it at $3

Yes, thats what I learned. So the objective is to chip away at the overall cost basis of your 100 shares. Don't try to get a big come up on the premium, because the closer it is to the money, the more likely it is that you will lose them.

Yea, they have "the right", but from what I saw on TD and WeBull its pretty much automatic that you will give up the shares.

I think most brokers will automatically assign the shares unless you call them and tell them not to.

speaking just for today...You sure about that, playa?

let me do some more research

i know people where hoping for a run up this morning

You sure about that, playa?

let me do some more research

Muther Fucker...LOL! Also you need to respond to your messages...I got busniss to discuss.

Similar threads

- Replies

- 14

- Views

- 320

- Replies

- 38

- Views

- 2K

- Replies

- 34

- Views

- 1K