In January 2020, my husband and I decided to splurge and book a suite aboard a Celebrity Cruises springtime voyage on the line’s Apex ship. The cruise fare wasn’t insignificant, so we bought travel insurance — as we usually do for any big trip. We printed out policies from five different companies and carefully reviewed the differences.

We thought about all the things that could go wrong that might stop us from going on this cruise — the death of an elderly relative, a work conflict or a broken leg. At the time, “pandemic” did not make our shortlist. We ultimately purchased a trip insurance package without the pricey “cancel for any reason” add-on (sometimes called CFAR). We thought we’d be just fine.

Of course, the sudden emergence of COVID-19 changed things and, boy, do we wish we’d sprung for the additional CFAR protection.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs — including cancel-for-any reason coverage.

More destinations are reopened to American travelers, and people are booking trips once again. But the coronavirus pandemic isn’t over, and there is still some uncertainty about what the rest of this year and 2022 holds. Cancel-for-any-reason trip protection can save you hundreds or even thousands of dollars in a time when flexibility is paramount when booking travel.

If you’re not sure what cancel-for-any-reason travel protection is and when you should purchase it, here’s everything you need to know.

In This Post

- What you need to know about travel insurance

- What is cancel-for-any-reason protection?

- When am I eligible to add CFAR protection?

- How much does cancel-for-any-reason coverage cost?

- Will you get all your money back if you purchase CFAR coverage?

- Should you buy CFAR coverage?

- A few more words of advice

- Bottom line

What you need to know about travel insurance

Cancel for any reason, also known as CFAR, is a time-sensitive, optional benefit that can be added to some comprehensive travel insurance policies for qualifying travelers. Before we delve into the details, it’s useful to understand trip insurance in general. Here are some resources that explain everything you need to know about travel insurance and its benefits, from trip cancellation and interruption coverage to emergency medical to baggage delay. And, we’ve included some resources that specifically talk about coronavirus as it relates to insurance policies:

- The best travel insurance policies and providers

- When to buy travel insurance versus when to rely on credit card protections

- Will independent travel insurance cover coronavirus? Here’s what you should know

- Best credit cards with travel insurance

- What you should know about the trip cancellation and interruption protection offered by select credit cards

- Be careful: Avoiding outbreaks isn’t covered by most travel insurance

While travel insurance policies can offer a range of inclusions (think: medical evacuation, trip cancellation due to foreign or domestic terrorism or damage to your rental car), not every eventuality is included in all insurance policies. For example, some trip insurance plans may offer coverage in the event of employment layoffs, while others do not. Some policies may have robust emergency medical coverage, while competitors don’t. That’s why it’s so important for you to select a plan that meets your specific needs for each trip.

A commonality among insurance policies is their long list of exclusions. For example, my homeowners’ insurance clearly states I’m not covered for damage caused by an alien invasion. Yes. Seriously.

When it comes to travel insurance, it’s common to see these sorts of incidents excluded from coverage: normal pregnancy, the illness of a pet, suicide (yours or a traveling companion) or any self-inflicted injury, psychological disorders, mountain climbing, bungee-jumping, skydiving, declared (or undeclared) war as well as epidemics and pandemics.

So, under normal circumstances, a travel insurance policy would likely not cover a trip you cancel because you’re worried about contracting coronavirus.

That’s where a cancel-for-any-reason policy comes into play. This is a time-sensitive add-on you can purchase from some providers when buying specific comprehensive travel insurance plans — as long as you meet certain eligibility requirements. By paying extra for this coverage, you can cancel for any reason under the sun as long as you follow the policies’ purchase and cancel stipulations.

When am I eligible to add CFAR protection?

In general, you’re only eligible to add CFAR protection to a comprehensive travel insurance policy at the time of purchase — you typically can’t purchase the policy and then decide (at a later date) to commit to the CFAR add on. In addition, you’ll need to commit to the policy and CFAR protection fairly soon after making your initial trip payment. According to InsureMyTrip.com, typically “a policy must be purchased within 10-21 days of making the initial trip payment to be eligible for CFAR benefits.”

Many providers will also require you to insure the entire value of your trip, and additional requirements may apply. As always, it’s critical to read through all of the terms before committing to purchasing any travel insurance policy — including CFAR coverage.

How much does cancel-for-any-reason coverage cost?

CFAR coverage is sounding pretty good as a way to hedge bets against the continued uncertainty of the coronavirus pandemic. But, how much are you going to have to dig into your wallet to pay for it? The fee for this add-on is typically calculated as a percentage of the price of the standard insurance policy you select.

Standard comprehensive plans can cost about 4-10% of the total cost of the insured trip, and CFAR can be an additional 40-60% on top of the standard plan (not the cost of the trip).

Consider the following illustrative example for a $5,000 trip with two 50-year-old travelers to Aruba:

- A standard, comprehensive plan might cost around $250 — which is 5% of the total trip cost.

- A comprehensive plan with the CFAR upgrade included might cost around $375 — which is the price of the standard plan ($250) plus an additional 50% ($125).

However, please note that all plan costs can differ based on individual quote details.

Will you get all your money back if you purchase CFAR coverage?

No. Generally speaking, CFAR can reimburse up to 75% of your total insured, prepaid, nonrefundable trip cost. In addition, CFAR typically requires you to cancel your trip no less than two days prior to departure to be eligible for reimbursement.

Check the insurance policy terms carefully to find out how much your refund would be if you invoked the CFAR terms and canceled your insured trip — and be sure to know the deadline for doing so.

Whether you’re going to Paris, France or the Paris Las Vegas, CFAR protection may be a good option. (Photo by Nikada/Getty Images)

Should you buy CFAR coverage?

Whether to travel and what level of insurance to purchase — or not — is always a personal decision. But, TPG has consistently received a lot of reader questions over the past year about what they should do if they have a trip booked or were about to book a trip and now don’t know what to do because of the uncertainty of the coronavirus.

“One of the top questions travelers ask is about when to splurge for the CFAR upgrade,” says Meghan Walch, a travel insurance expert for InsureMyTrip. “It’s important to note that a standard comprehensive policy does not cover fear of travel. That’s why we strongly recommend all travelers consider CFAR, if eligible. There is so much uncertainty with the pandemic, travelers are leaning towards maximum flexibility to cancel their trip to receive a percentage of their trip cost back.”

If your total trip cost is low, you may decide to forego insurance — or the additional CFAR coverage — and self-insure (i.e., eat the nonrefundable trip costs if you cancel). But, if your vacation is expensive, the additional fee for CFAR may feel like a bargain instead of potentially losing thousands of dollars if you have to cancel nonrefundable reservations.

A few more words of advice

Coronavirus is adding a layer of complexity to decisions travelers must make about going on planned trips and booking future vacations. Here are a few specific scenarios to consider:

What to do if you’re about to book a trip but are hesitant because of coronavirus

If you’re afraid to commit a large amount of money to a future trip, purchasing a comprehensive travel insurance policy and adding the cancel-for-any-reason coverage option might be the best bet.

“Cancel-for-any-reason is the only way to protect the majority of your trip cost if you would like the flexibility to cancel your trip due to fear of the coronavirus pandemic and variants that are currently spiking,” says Walch.

This could also be a great option for immunocompromised travelers. Even a doctor attesting to your inability to travel may not be enough to qualify for reimbursement under a standard, comprehensive plan — but CFAR coverage could help recoup some of your forfeited costs.

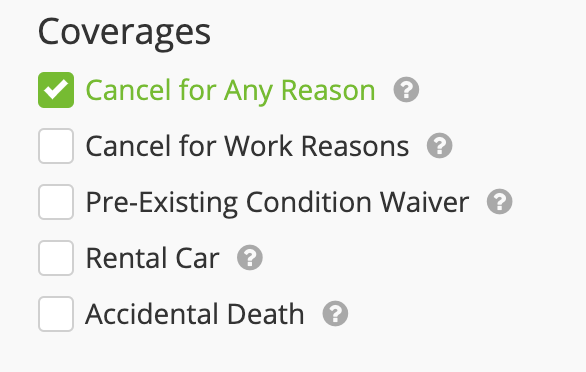

If you’re shopping for CFAR, you can use a site like InsureMyTrip.com, and then check the applicable box under the search results:

Doing so will only return policy results that include that type of coverage.

What to do if you booked a trip and have insurance — but your policy doesn’t include CFAR clause

If you purchased a comprehensive travel insurance plan for an upcoming trip but didn’t add CFAR coverage, just be aware that your options for coronavirus-related cancellations are more limited. While CFAR is the only cancellation option to cover fear of travel due to the coronavirus pandemic, some comprehensive policies still offer coverage for other COVID-19-related concerns. This may include:

- Coverage for common concerns like cancellation due to diagnosed illness before traveling

- Emergency medical care from a doctor or hospital if you become ill while traveling

- Accommodation coverage if quarantined at your destination

Always be sure to review your policy carefully to understand the exclusions — but note that, without CFAR coverage, canceling a trip simply because you’re afraid of contracting COVID-19 will likely not result in a successful claim under standard, comprehensive travel insurance plans.

What to do if you booked a trip and have no travel insurance

First, look at when you actually booked the trip. If it was within the last three weeks, you may still be eligible for a comprehensive travel insurance plan with the cancel-for-any-reason add-on. And if not, there may still be more limited policies that provide some coronavirus-related protection — including emergency medical evacuation.

In short, it’s critical to begin investigating your travel insurance options as soon as you book (and make an initial payment on) a trip, as this will maximize the number of applicable plans. This is particularly important when it comes to time-sensitive benefits — like CFAR protection.

To explore these options, you can enter your trip details to compare available plans on a site like InsureMyTrip.com.

Bottom line

Having the peace of mind of travel insurance is more important than ever as countries reopen to vaccinated U.S. citizens and people start booking trips once again. With the delta variant now the dominant strain in the U.S., there is still uncertainty ahead for travelers hoping to take trips this year and into next.

In the past, you may have shrugged at the idea of trip insurance, especially the more expensive policies that offer a CFAR add-on. If you don’t want the coronavirus pandemic to derail your travel plans but want to be covered if an expensive trip must be postponed or canceled, CFAR may be a great option to consider.

Everything you need to know about cancel for any reason trip insurance - The Points Guy

Some trip insurance policies offer a special "cancel for any reason" add-on. Should you buy it? Here's what you need to know to make a wise choice when shopping for travel insurance.