Living paycheck-to-paycheck affects all income levels

Contrary to popular belief, “this is not just an issue for people at the lower end of the income spectrum,” Dan Macklin, Salary Finance’s U.S. CEO and co-founder of SoFi, tells CNBC Make It. About 31% of respondents earning over $100,000 also regularly experience a budget shortfall before payday.

For many, it’s the rising cost of living — including food, housing, education and medical expenses — that creates the squeeze. Over the past year, basic costs increased by 2.3%, according to the Bureau of Labor Statistics’s Consumer Price Index. The cost of medical care rose 4.6% in 2019, the largest year-over-year increase since 2007, the BLS reports. Housing also jumped 3.2% last year, while education expenses rose 2.1% and food prices increased about 1.8%.

For others, it’s stagnant wages. Real wages effectively remained stalled last year, showing only a 0.2% year-over-year increase, according to the PayScale Index. But looking longer term, Payscale found median wages, when adjusted for inflation, actually declined 9% since 2006.

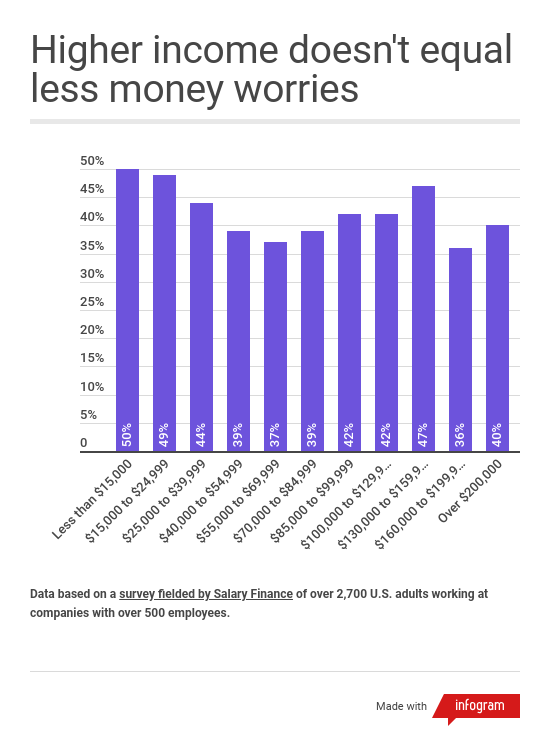

Salary Finance compared the percentage of respondents who say they have money worries among different income levels.

No matter the underlying reason, the struggle to pay bills and put food on the table when you’re short on cash leads to a lot of stress, the survey finds. Financial stress is very prevalent today, with 42% of working Americans experiencing it. It’s a percentage that Macklin finds “extremely worrying.”

That’s because that financial stress can have lasting effects on your mental and physical health, he says. Those with financial worries are six times more likely to suffer from anxiety and seven times more prone to depression, Salary Finance’s survey found.

Nearly 1 in 3 American workers run out of money before payday—even those earning over $100,000

Almost a third of Americans across all income levels are regularly running out of money before their next paycheck hits, according to a new survey from Salary Finance.