You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A Blueprint for Reparations

- Thread starter VAiz4hustlaz

- Start date

“Hochul said that by signing the bill, a commission will be created to study what reparations may look like in New York, but she clarified it’s not about fixing the past, but about doing more for African Americans and “bending the arc of justice.”

Excuse me but WTF is there to study? Economists, Sociologists and Psychologists have already done numerous “studies” and research on the damage of Slavery, Jim Crow and Racism in America.

This has been repeated thousands of times over the years. It’s seen with your own eyes the disinfranchisment of Black people due to this evil ass country. GET THE FUCK OUT OF HERE WITH THESE DUMB ASS STUDIES!!!!!!

“Hochul said that by signing the bill, a commission will be created to study what reparations may look like in New York, but she clarified it’s not about fixing the past, but about doing more for African Americans and “bending the arc of justice.”

Excuse me but WTF is there to study? Economists, Sociologists and Psychologists have already done numerous “studies” and research on the damage of Slavery, Jim Crow and Racism in America.

This has been repeated thousands of times over the years. It’s seen with your own eyes the disinfranchisment of Black people due to this evil ass country. GET THE FUCK OUT OF HERE WITH THESE DUMB ASS STUDIES!!!!!!

NONE of these CAC politicians truly support meaningful financial Reparations for Black folks. They just tell us just enough to get our support without actually committing to anything. This is what we have continued to receive when we vote for "the least evil".

Yeah bitch that’s right , all you non voting fuck niggas shouldn’t get shit!!

California Gov. Newsom Signs Reparations Bill Into Law - Inland Valley News

Antonio Ray Harvey, California Black Media Statewide -- California Gov. Gavin Newsom has signed the state’s historic reparations bill into law. Assembly Bill (AB) 3121 moves descendants of enslaved Americans one step closer to getting restitution for centuries of free labor and legal...inlandvalleynews.com

He got cacs and coons big mad

California in crisis, Newsom focused on slavery reparations | Fox News

California's reparations for slavery program is Gov. Newsom's strategy instead of addressing crises that dominate the state -- from homelessness to wildfires.www.foxnews.com

LETS GO

California advances goal of reparations for Black residents: Activist calls for $350,000 per person

A new report out of California shows that the state is advancing a plan to give reparations to certain Black residents in order to compensate for years of discrimination.www.foxnews.com

“After a Fox News report indicated that Newsom would not support the cash payment aspect of the recommendations, a spokesperson for the governor told Newsweek that it was not accurate and he would make up his mind about cash payments after the task force submits its final report.”

Gavin Newsom hits back at claims he's dismissed reparations payments

"The Governor looks forward to reviewing the final report— and all recommendations—when complete," a spokesperson for Newsom told Newsweek.www.newsweek.com

Gov. Gavin Newsom may regret pledges to Black Californians

The governor's promises to Black Californians about filling U.S. Senate seat and providing reparations created a political trap for himself.

Gavin Newsom :

While praising the commission’s work as “a milestone in our bipartisan effort to advance justice and promote healing,” he said, “Dealing with that legacy is about much more than cash payments.”

Racial and Ethnic Wealth Inequality in the Post‑Pandemic Era

By Rajashri Chakrabarti, Natalia Emanuel, and Ben Lahey

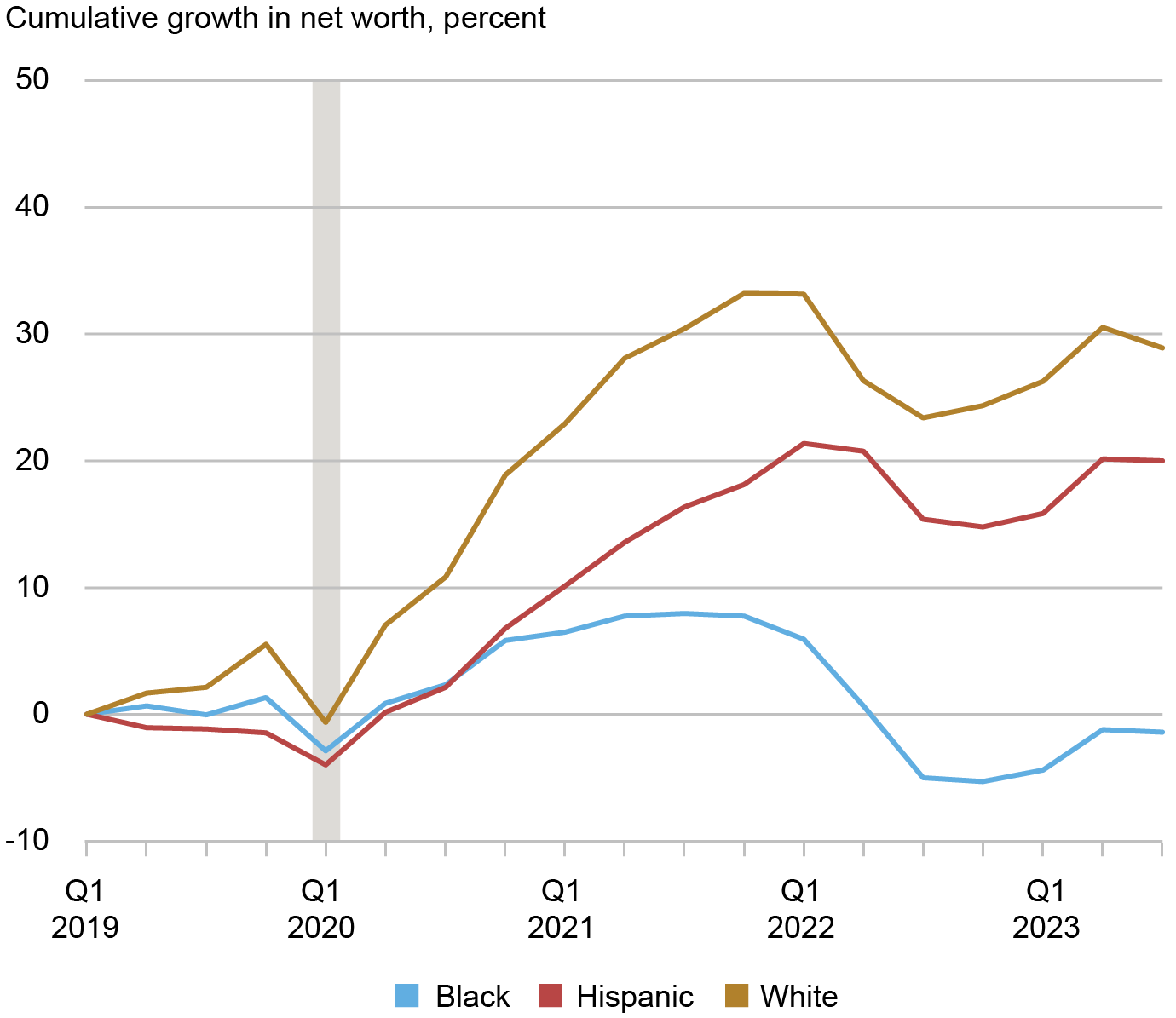

Wealth is unevenly distributed across racial and ethnic groups in the United States. In this first post in a two-part series on wealth inequality, we use the Distributional Financial Accounts (DFA) to document these disparities between Black, Hispanic, and white households from the first quarter of 2019 to the third quarter of 2023 for wealth and a variety of asset and liability categories. We find that these disparities have been exacerbated since the pandemic, likely due to rapid growth in the financial assets more often held by white individuals.

The quarterly demographic wealth distributions published in the DFA by the Board of Governors of the Federal Reserve System are estimated using microdata from the Survey of Consumer Finances and aggregate financial data from the Fed’s Financial Accounts series. Sample size concerns lead us to omit Asians, Pacific Islanders, and other smaller groups from this analysis, so references hereafter to the “study population” refer to Hispanic, non-Hispanic Black and non-Hispanic white adults. We refer to non-Hispanic Blacks and non-Hispanic whites as Blacks and whites below respectively. We define wealth as net worth (assets less liabilities).

At the beginning of 2019, Hispanic and Black individuals constituted 18 percent and 13 percent of the study population, respectively, yet they held just 2.7 percent and 4.9 percent of total net worth of this population. Meanwhile, 69 percent of the population was white and held 92.4 percent of U.S. net worth.

Racial and Ethnic Wealth Inequalities Have Deepened since the Pandemic

We find that 2019-2023 growth in real net worth was greater for white individuals than for Black and Hispanic individuals. We calculate real wealth growth using the race and ethnicity specific price indices presented in the inflation inequality section of the Equitable Growth Indicators series. The chart above shows that growth in the real net worth of white individuals since 2019 outpaced growth in the real net worth of Black and Hispanic individuals. The cumulative growth by 2023:Q3 relative to 2019:Q1 for white individuals exceeded that for Black and Hispanic individuals by 30 and 9 percentage points, respectively. Real Black wealth fell below its 2019:Q1 level in 2022:Q3 and remains below its 2019 level despite some recovery.

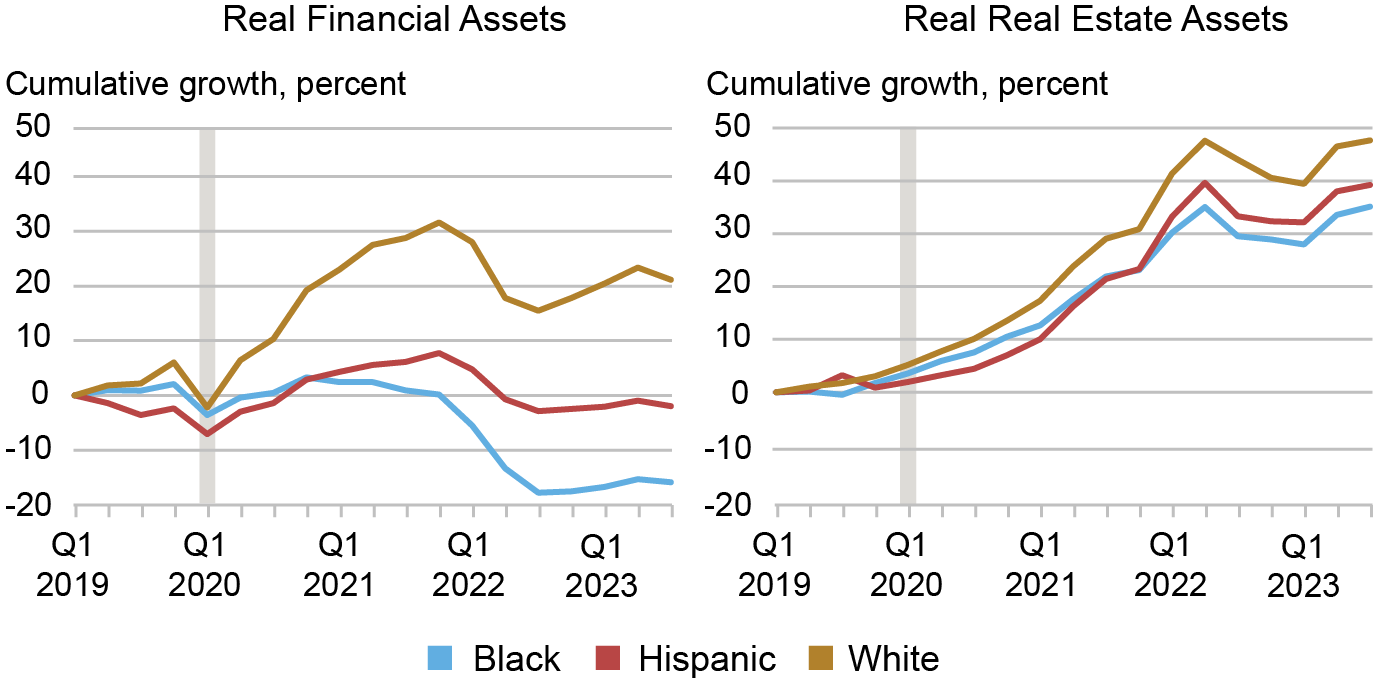

Non-White Financial Wealth Faltered While Real Estate Kept Pace

Next, we explore to what extent the differential growth in wealth during this period is owing to differences in the growth of its components—financial assets and real estate assets. White, Black, and Hispanic households invest their total assets in financial and real estate assets at different rates: total white assets in 2019:Q1 were about 70 percent finanical and 20 percent real estate assets, total Black assets were about 65 percent financial and 25 percent real estate, and total Hispanic assets were 50 percent financial and 40 percent real estate. We find much of the divergence in net worth by race and ethnicity since 2019 can be attributed to divergence in the real values of financial asset holdings (left panel above). It is worth noting here that our data do not allow us to separate changes in investments from changes in returns. So the results we identify here are a combination of both.

As the official sector moved to provide accommodation to combat the COVID recession, financial asset prices rose with the reopening of the economy through 2021. While financial asset prices fell notably alongside the rapid policy rate hikes in 2022, those declines did not fully offset the earlier rises. White-held real financial assets grew by 21 percent from 2019:Q1 to 2023:Q3, outpacing Black and Hispanic real finanical growth by 23 and 37 percentage points, respectively. The real value of Black-held financial assets dropped below its 2019:Q1 level after 2022:Q1 and continued to decline steadily, while the real value of Hispanic-held financial assets dipped below its 2019:Q1 level in 2022:Q2 and stagnated. Neither group’s real financial assets have recovered to their 2019:Q1 values as of 2023:Q3.

In contrast, there is minimal dispersion in the demographic growth rates of real liabilities and real real estate assets, even though white individuals experienced sharper increases in the value of real estate assets between 2023:Q3 and 2019:Q1 (right panel above). Additionally, the growth in the real net worth gap and real asset gap by race and ethnicity above are mostly contributed by growth in the gap of the corresponding nominal values rather than differences in inflationary experiences faced by these groups during this period. Below we try to understand the reasons behind the markedly sharper growth in financial assets of white individuals.

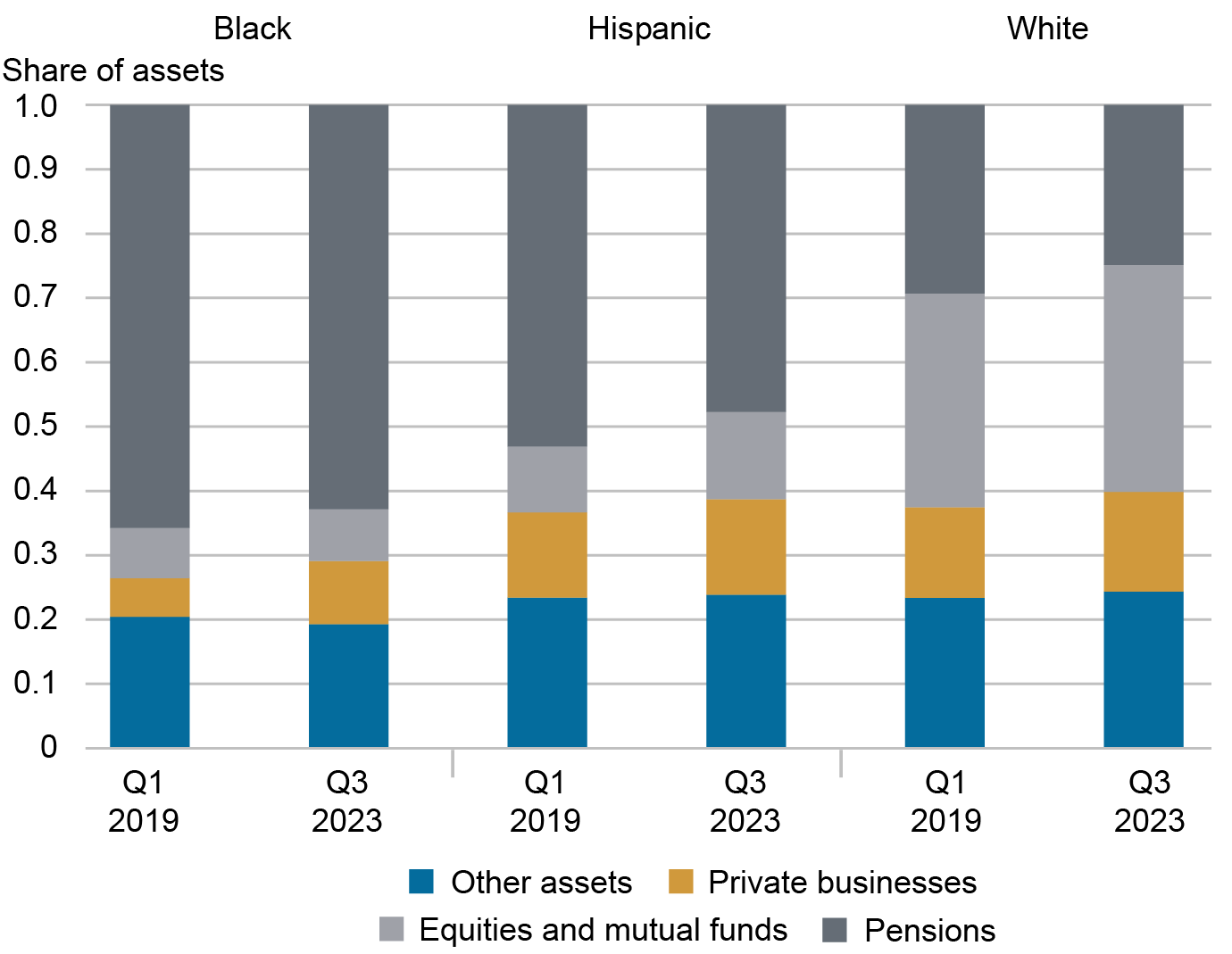

Financial Asset Porfolios Differ Starkly By Race and Ethnicity

The chart above depicts the asset classes each racial and ethnic group held in 2019:Q1 and 2023:Q3. All three groups allocate similar shares of their financial asset portfolios to “other assets”—composed of insurance payouts, mortgage assets, and other small, miscellaneous assets—but exhibit differences across the other categories. More than 50 percent of Black financial wealth is in pensions (which includes both defined benefit and defined contribution pensions) and less than 20 percent is stored in private businesses, corporate equities, and mutual funds while less than 30 percent of white finanical wealth is invested in pensions and about 50 percent is in businesses, equities, and mutual funds. Hispanic financial asset allocations are similar to those of Black individuals but with slightly more investment in businesses, equities, and mutual funds and slightly less in pensions.

The groups with more exposure to businesses, equities, and mutual funds experienced much faster financial asset growth since the first quarter of 2019 as much of the period was associated with substantive appreciation of these specific asset values. In the next post in this two-part series on wealth inequality, we present differences in wealth growth by age groups during the 2019:Q1 to 2023:Q3 period.

Chart data

Net Worth by Race and Age data

Pension data

Racial and Ethnic Wealth Inequality in the Post-Pandemic Era - Liberty Street Economics

Wealth disparities between Black, Hispanic, and white households have been exacerbated since the pandemic, likely due to rapid growth in financial assets more often held by white individuals.

libertystreeteconomics.newyorkfed.org

We need to hold off the talk on Reparations until we can accurately assess how much money we have left after the Billions we give to Isreal and Ukraine first.

Joe "You ain't Black" Biden is currently arguing for a 95.3 Billion dollar aid package for Ukraine and Israel. He backed a "study" to assess whether Black folks should get Reparations 3 years ago.

Joe "You ain't Black" Biden is currently arguing for a 95.3 Billion dollar aid package for Ukraine and Israel. He backed a "study" to assess whether Black folks should get Reparations 3 years ago.

So Nikole-Hannah Jones has embraced the ADOS point-of-view.....without giving credit, of course.

"...Yet progressives, too, have unwittingly helped to maintain the corrupt colorblind argument that Blum has employed so powerfully, in part because the meaning of affirmative action was warped nearly from its beginning by the Supreme Court’s legal reasoning in Bakke. When the court determined that affirmative-action programs could stand only for “diversity” and not for redress, many advocates and institutions, in order to preserve these programs, embraced the idea that the goal of affirmative action was diversity and inclusiveness and not racial justice. Progressive organizations adopted the lexicon of “people of color” when discussing affirmative-action programs and also flattened all African-descended people into a single category, regardless of their particular lineage or experience in the United States.

Campuses certainly became more “diverse” as admissions offices focused broadly on recruiting students who were not white. But the descendants of slavery, for whom affirmative action originated, remain underrepresented among college students, especially at selective colleges and universities. At elite universities, research shows, the Black population consists disproportionately of immigrants and children of immigrants rather than students whose ancestors were enslaved here."

www.nytimes.com

www.nytimes.com

"...Yet progressives, too, have unwittingly helped to maintain the corrupt colorblind argument that Blum has employed so powerfully, in part because the meaning of affirmative action was warped nearly from its beginning by the Supreme Court’s legal reasoning in Bakke. When the court determined that affirmative-action programs could stand only for “diversity” and not for redress, many advocates and institutions, in order to preserve these programs, embraced the idea that the goal of affirmative action was diversity and inclusiveness and not racial justice. Progressive organizations adopted the lexicon of “people of color” when discussing affirmative-action programs and also flattened all African-descended people into a single category, regardless of their particular lineage or experience in the United States.

Campuses certainly became more “diverse” as admissions offices focused broadly on recruiting students who were not white. But the descendants of slavery, for whom affirmative action originated, remain underrepresented among college students, especially at selective colleges and universities. At elite universities, research shows, the Black population consists disproportionately of immigrants and children of immigrants rather than students whose ancestors were enslaved here."

The ‘Colorblindness’ Trap: How a Civil Rights Ideal Got Hijacked

The fall of affirmative action is part of a 50-year campaign to roll back racial progress.

Tennessee Legislation Fights Identity-Group Policy

National Association of Scholars- Statement

- March 13, 2024

- Legislation, State

- Identity Politics

The National Association of Scholars and the Civics Alliance strongly endorse Amendment No. 1 to Tennessee House Bill 474, which is now up for consideration in the Tennessee state legislature. The Amendment prevents local governments from spending funds on reparations for slavery. Neither a county, a municipality, nor a metropolitan government would be allowed to “expend funds for the purposes of studying or disbursing reparations. As used in this section, ‘reparations’ mean money or benefits provided to individuals who are the descendants of persons who were enslaved.”Amendment No. 1 is somewhat outside of our organizational focuses of higher education and K-12 civics education. Yet the arguments for reparations, far more intensely than most political ideas, have been nurtured in the ivory tower and disseminated via the K-12 school system. Disciplines that actively dedicate themselves to activism rather than to the search for knowledge, such as African American Studies and Ethnic Studies, have devoted themselves to enacting reparations policies. The push for reparations has entered the K-12 system via such mechanisms as the College Board’s AP African American Studies course. Indeed, the California reparations task force called for adding African American Studies to primary education, presumably as itself a form of reparation. When a political issue is so inextricably intertwined with education policy, it enters our organizations’ remits.

Reparations is terrible policy. It replaces a republic of individuals with a republic of identity-groups and restores as tax policy “corruption of the blood”—the constitutionally prohibited punishment of relatives of individuals convicted of crimes. Morally, it ignores the terrible blood tithe during the Civil War that Americans already have paid for slavery—and it ignores the extension of citizenship to America’s former slaves, a gift more valuable than any sum of money. On those grounds alone, Tennessee’s policymakers should prohibit reparations; so too should policymakers in all the states.

Policymakers also should prohibit all “diversity, equity, and inclusion” (DEI) and Critical Race Theory (CRT) policies, which are the education policy equivalents of reparations. DEI and CRT both assume the primary importance of identity-groups. Their assumption of a permanent division of oppressor and oppressed is “corruption of the blood” translated into academic theory. Their assumption of a continuing, ineradicable debt owed to particular identity groups ignores every action in the past that a reasonable observer would take to have paid moral debts. DEI and CRT cripple the moral and intellectual foundations of higher education and K-12 education as reparations would cripple the moral and intellectual foundations of the republic.

Practically speaking, these ills rise and fall together. To get rid of the movement for reparations, you must remove DEI and CRT from our education systems. Likewise, DEI and CRT will not be eradicable if reparations become the law of the land. Practical necessity, as well as intellectual consistency, calls for jointly removing reparations policy, DEI, and CRT.

We strongly endorse Amendment No. 1—as a beginning of a wider campaign to remove identity-group policy, oppressor/oppressed distinctions, and permanent and unjustified assertions of moral debt from all aspects of American policy. These iniquitous beliefs should have no place in our colleges and universities, our K-12 schools, or in the republic as a whole.