The Curse of Econ 101

When it comes to basic policy questions such as the minimum wage,

introductory economics can be more misleading than it is helpful.

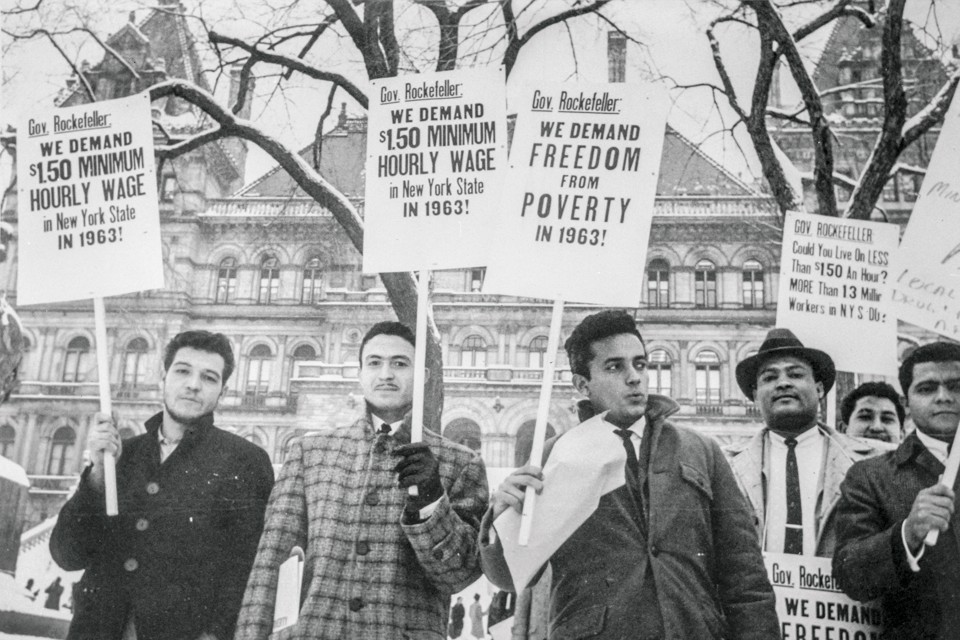

Bettmann / Getty

In a rich, post-industrial society, where most people walk around with supercomputers in their pockets and a person can have virtually anything delivered to his or her doorstep overnight, it seems wrong that people who work should have to live in poverty. Yet in America, there are more than ten million members of the working poor: people in the workforce whose household income is below the poverty line. Looking around, it isn’t hard to understand why.

The two most common occupations in the United States are retail salesperson and cashier. Eight million people have one of those two jobs, which typically pay about $9–$10 per hour. It’s hard to make ends meet on such meager wages. A few years ago, McDonald’s was embarrassed by

the revelation that its internal help line was recommending that even a full-time restaurant employee apply for various forms of public assistance.

Poverty in the midst of plenty exists because many working people simply don’t make very much money. This is possible because

the minimum wage that businesses must pay is low: only $7.25 per hour in the United States in 2016 (although it is higher in some states and cities). At that rate, a person working full-time for a whole year, with no vacations or holidays, earns about $15,000—which is below the poverty line for a family of two, let alone a family of four. A minimum-wage employee is poor enough to qualify for food stamps and, in most states, Medicaid. Adjusted for inflation, the federal minimum is roughly the same as in the 1960s and 1970s, despite significant increases in average living standards over that period. The United States currently has

the lowest minimum wage, as a proportion of its average wage, of any advanced economy, contributing to today’s soaring levels of inequality. At first glance, it seems that raising the minimum wage would be a good way to combat poverty.

The argument against increasing the minimum wage often relies on what I call “economism”—the misleading application of basic lessons from Economics 101 to real-world problems, creating the illusion of consensus and reducing a complex topic to a simple, open-and-shut case. According to economism, a pair of supply and demand curves proves that a minimum wage increases unemployment and hurts exactly the low-wage workers it is supposed to help. The argument goes like this: Low-skilled labor is bought and sold in a market, just like any good or service, and its price should be set by supply and demand. A minimum wage, however, upsets this happy equilibrium because it sets a price floor in the market for labor. If it is below the natural wage rate, then nothing changes. But if the minimum (say, $7.25 an hour) is above the natural wage (say, $6 per hour), it distorts the market. More people want jobs at $7.25 than at $6, but companies want to hire fewer employees. The result: more unemployment. The people who are still employed are better off, because they are being paid more for the same work; their gain is exactly balanced by their employers’ loss. But society as a whole is worse off, as transactions that would have benefited both buyers and suppliers of labor will not occur because of the minimum wage. These are jobs that someone would have been willing to do for less than $6 per hour and for which some company would have been willing to pay more than $6 per hour. Now those jobs are gone, as well as the goods and services that they would have produced.

The minimum wage has been a hobgoblin of economism since its origins. Henry Hazlitt wrote in

Economics in One Lesson, “For a low wage you substitute unemployment. You do harm all around, with no comparable compensation.” In

Capitalism and Freedom, Milton Friedman patronizingly described the minimum wage as “about as clear a case as one can find of a measure the effects of which are precisely the opposite of those intended by the men of good will who support it.” Because employers will not pay people more money than their work is worth, he continued, “insofar as minimum-wage laws have any effect at all, their effect is clearly to increase poverty.” Jude Wanniski similarly concluded in

The Way the World Works, “Every increase in the minimum wage induces a decline in real output and a decline in employment.” On the campaign trail in 1980,

Ronald Reagan said, “The minimum wage has caused more misery and unemployment than anything since the Great Depression.” Think tanks including

Cato,

Heritage, and

the Manhattan Institute have reliably attacked the minimum wage for decades, all the while emphasizing the key lesson from Economics 101: Higher wages cause employers to cut jobs.

In today’s environment of increasing economic inequality, the minimum wage is a centerpiece of political debate.

California,

New York City, and

Seattle are all raising their minimums to $15, and President Barack Obama

called for a federal minimum of $10.10. An army of commentators has responded by reminding us of what we should have learned in Economics 101. In

The Wall Street Journal, the economist Richard Vedder explained, “If the price of something rises, people buy less of it—including labor. Thus governmental interferences such as minimum-wage laws lower the quantity of labor demanded.” Writing for

Forbes, Tim Worstall offered a mathematical proof: “A reduction in wage costs of some few thousand dollars increases employment. Obviously therefore a rise in wage costs of four or five times that is going to have significant unemployment effects. QED: A $15 minimum wage is going to destroy many jobs.” (Of theoretical arguments in favor of a higher minimum wage, he continued, “I’m afraid I really just don’t believe those arguments.”) Jonah Goldberg of the American Enterprise Institute and

National Review chimed in, “A minimum wage is no different from a tax on firms that use low-wage and unskilled labor. And if there’s anything that economists agree upon, it’s that if you tax something you get less of it.”

______________________________

The supply-and-demand diagram is a

good conceptual starting point for

thinking about the minimum wage.

But on its own, it has limited

predictive value in the much more

complex real world.

_____________________________

The real impact of the minimum wage, however, is much less clear than these talking points might indicate. Looking at historical experience, there is no obvious relationship between the minimum wage and unemployment: adjusted for inflation,

the federal minimum was highest from 1967 through 1969, when the unemployment rate was below 4 percent—a historically low level. When economists try to tackle this question, they come up with all sorts of results. In 1994, David Card and Alan Krueger

evaluated an increase in New Jersey’s minimum wage by comparing fast-food restaurants on both sides of the New Jersey-Pennsylvania border. They concluded, “Contrary to the central prediction of the textbook model ... we find no evidence that the rise in New Jersey’s minimum wage reduced employment at fast-food restaurants in the state.”

Card and Krueger’s findings have been vigorously contested across dozens of empirical studies. Today, people on both sides of the debate can cite papers supporting their position, and reviews of the academic research disagree on what conclusions to draw. David Neumark and William Wascher, economists who have long argued against the minimum wage,

reviewed more than one hundred empirical papers in 2006. Although the studies had a wide range of results, they concluded that the “preponderance of the evidence” indicated that a higher minimum wage does increase unemployment. On the other hand, two

recent meta-studies (which pool together the results of multiple analyses) have found that increasing the minimum wage does not have a significant impact on employment. In the past several years,

a new round of sophisticated analyses comparing changes in employment levels between neighboring counties also found “strong earnings effects and no employment effects of minimum wage increases.” (That is, the number of jobs stays the same and workers make more money.) Not surprisingly, Neumark and Wascher have contested this approach. The profession as a whole is divided on the topic: When the University of Chicago Booth School of Business

asked a panel of prominent economists in 2013 whether increasing the minimum wage to $9 would “make it noticeably harder for low-skilled workers to find employment,” the responses were split down the middle.

The idea that a higher minimum wage might not increase unemployment runs directly counter to the lessons of Economics 101. According to the textbook, if labor becomes more expensive, companies buy less of it. But there are several reasons why the real world does not behave so predictably. Although the standard model predicts that employers will replace workers with machines if wages increase, additional labor-saving technologies are not available to every company at a reasonable cost. Small employers in particular have limited flexibility; at their scale, they may not be able to maintain their operations with fewer workers. (Imagine a local copy shop: No matter how fast the copy machine is, there still needs to be one person to deal with customers.) Therefore, some companies can’t lay off employees if the minimum wage is increased. At the other extreme, very large employers may have enough market power that the usual supply-and-demand model doesn’t apply to them. They can reduce the wage level by hiring fewer workers (only those willing to work for low pay), just as a monopolist can boost prices by cutting production (think of an oil cartel, for example). A minimum wage forces them to pay more, which eliminates the incentive to minimize their workforce.

In the above examples, a higher minimum wage will raise labor costs. But many companies can recoup cost increases in the form of higher prices; because most of their customers are not poor, the net effect is to transfer money from higher-income to lower-income families. In addition, companies that pay more often benefit from higher employee productivity, offsetting the growth in labor costs. Justin Wolfers and Jan Zilinsky

identified several reasons why higher wages boost productivity: They motivate people to work harder, they attract higher-skilled workers, and they reduce employee turnover, lowering hiring and training costs, among other things. If fewer people quit their jobs, that also reduces the number of people who are out of work at any one time because they’re looking for something better. A higher minimum wage motivates more people to enter the labor force, raising both employment and output. Finally, higher pay increases workers’ buying power. Because poor people spend a relatively large proportion of their income, a higher minimum wage can boost overall economic activity and stimulate economic growth, creating more jobs.

All of these factors vastly complicate the two-dimensional diagram taught in Economics 101 and help explain why a higher minimum wage does not necessarily throw people out of work. The supply-and-demand diagram is a good conceptual starting point for thinking about the minimum wage. But on its own, it has limited predictive value in the much more complex real world.

Even if a higher minimum wage does cause some people to lose their jobs, that cost has to be balanced against the benefit of greater earnings for other low-income workers.

A study by the Congressional Budget Office (CBO) estimated that a $10.10 minimum would reduce employment by 500,000 jobs but would increase incomes for most poor families, moving 900,000 people above the poverty line. Similarly,

a recent paper by the economist Arindrajit Dube finds that a 10 percent raise in the minimum wage should reduce the number of families living in poverty by around 2 percent to 3 percent.

The economists polled in the 2013 Chicago Booth study thought that increasing the minimum wage would be a good idea because its potential impact on employment would be outweighed by the benefits to people who were still able to find jobs. Raising the minimum wage would also reduce inequality by

narrowing the pay gap between low-income and higher-income workers.

In short, whether the minimum wage should be increased (or eliminated) is a complicated question. The economic research is difficult to parse, and arguments often turn on sophisticated econometric details. Any change in the minimum wage would have different effects on different groups of people, and should also be compared with other policies that could help the working poor—such as the negative income tax (a cash grant to low-income households, similar to today’s Earned Income Tax Credit)

favored by Milton Friedman, or the guaranteed minimum income that

Friedrich Hayek assumed would exist.

________________________________

Instead of greedily demanding higher

profits, industry executives can

invoke Economics 101, which

provides a simple explanation of the

world that serves their interests.

________________________________

Nevertheless, when the topic reaches the national stage, it is economism’s facile punch line that gets delivered, along with its all-purpose dismissal: people who want a higher minimum wage just don’t understand economics (although, by that standard,

several Nobel Prize winners don’t understand economics). Many leading political figures largely repeat the central theses of economism, claiming that they have only the best interests of the poor at heart. In the 2016 presidential campaign,

Senator Marco Rubio opposed increasing the minimum wage because companies would then substitute capital for labor: “I’m worried about the people whose wage is going to go down to zero because you’ve made them more expensive than a machine.”

Senator Ted Cruz also chimed in on behalf of the poor, saying, “the minimum wage consistently hurts the most vulnerable.”

Senator Rand Paul explained, “when the [minimum wage] is above the market wage it causes unemployment” because it reduces the number of employees whom companies can afford to hire.

The former governor Jeb Bush also invoked Economics 101, saying that wages should be left “to the private sector,” meaning companies like Walmart, which “raised wages because of supply and demand.”

For Congressman Paul Ryan, raising the minimum wage is “bad economics” and “will hurt the economy because it raises the price of labor.”

This conviction that the minimum wage hurts the poor is an example of economism in action. Economists have many different opinions on the subject, based on different theories and research studies, but when it comes to public debate, one particular result of one particular model is presented as an unassailable economic theorem. (Politicians advocating for a higher minimum wage, by contrast, tend to avoid economic models altogether, instead arguing in terms of fairness or helping the poor.) This happens partly because the competitive market model taught in introductory economics classes is simple, clear, and memorable. But it also happens because there is a large interest group that wants to keep the minimum wage low: businesses that rely heavily on cheap labor.

The restaurant industry has been a major force behind the advertising and public relations campaigns opposing the minimum wage,

including many of the op-ed articles repeating the basic lesson of supply and demand. For example, Andy Puzder, the CEO of a restaurant company (and President-elect Trump’s nominee to lead the Labor Department),

explained in The Wall Street Journal, “Every retailer has locations that are profitable, but only marginally. Increased labor costs can push these stores over the line and into the loss column. When that happens, companies that want to stay competitive will close them.” As a result, “broad increases in the minimum wage destroy jobs and hurt the working-class Americans that they are supposed to help.”

A recent study by researchers at the Cornell School of Hotel Administration, however, found that higher minimum wages have not affected either the number of restaurants or the number of people that they employ, contrary to the industry’s dire predictions, while they have modestly increased workers’ pay. Because restaurant closings do not seem to increase, the implication is that paying employees more cuts into excess profits—profits beyond those necessary to stay in business. Or,

as the financial commentator Barry Ritholtz put it, “raising the minimum wage works as a wealth transfer, from shareholders and franchisees, to minimum wage workers.” But instead of greedily demanding higher profits, industry executives can invoke Economics 101, which provides a simple explanation of the world that serves their interests.

The fact that this is the debate already demonstrates the historical influence of economism. Once upon a time, the major issue affecting workers’ wages and income inequality was unionization.

In the 1950s, about one in every three wage and salary employees was a union member. Unions, of course, were an early and frequent target of economism.

Hayek argued that unions are bad both for workers, because “they cannot in the long run increase real wages for all wishing to work above the level that would establish itself in a free market,” and for society as a whole, because “by establishing effective monopolies in the supply of the different kinds of labor, the unions will prevent competition from acting as an effective regulator of the allocation of all resources.”

For Friedman, unions “harmed the public at large and workers as a whole by distorting the use of labor” while increasing inequality even within the working class. The changing composition of the U.S. workforce, state right-to-work laws, and aggressive anti-unionization tactics by employers—increasingly tolerated by the National Labor Relations Board, beginning with the Reagan administration—all contributed to a long, slow fall in unionization levels.

By 2015, only 12 percent of wage and salary employees were union members—fewer than 7 percent in the private sector. Low- and middle-income workers’ reduced bargaining power is a major reason why their wages have not kept pace with the overall growth of the economy. According to

an analysis by the sociologists Bruce Western and Jake Rosenfeld, one-fifth to one-third of the increase in inequality between 1973 and 2007 results from the decline of unions.

With unions only a distant memory for many people, federal minimum-wage legislation has become the best hope for propping up wages for low-income workers. And again, the worldview of economism comes to the aid of employers by abstracting away from the reality of low-wage work to a pristine world ruled by the “law” of supply and demand.

This article has been adapted from James Kwak’s book,

Economism: Bad Economics and the Rise of Inequality.

SOURCE:

https://www.theatlantic.com/business/archive/2017/01/economism-and-the-minimum-wage/513155/

.